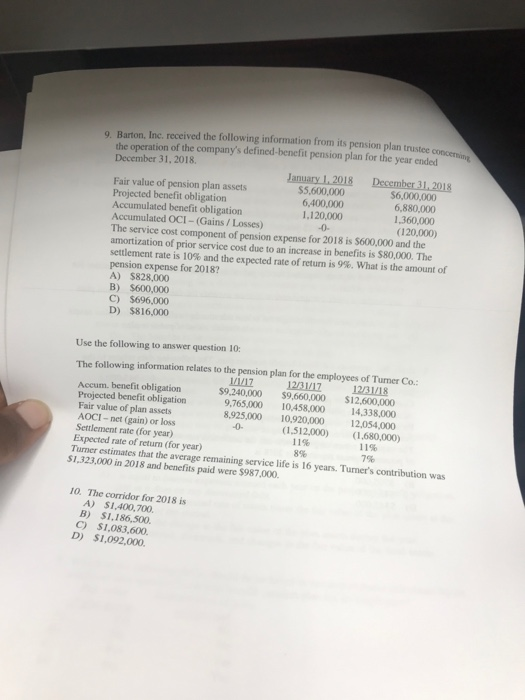

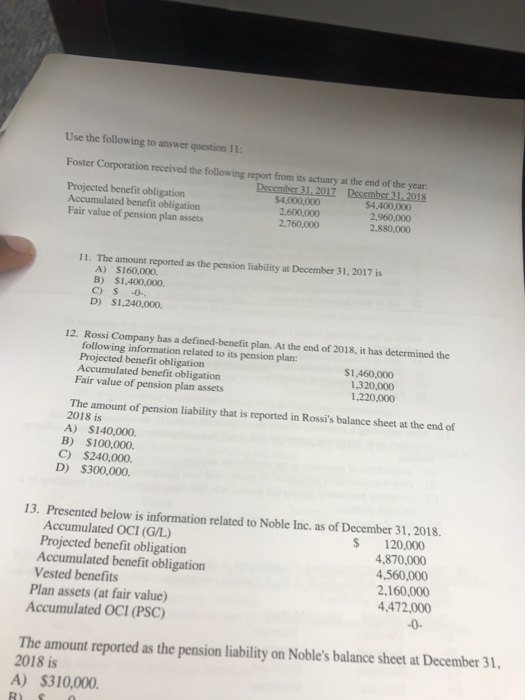

ste conce o Barton, Inc. received the following information from its pension plan trustee conce the operation of the company's defined benefit pension plan for the year ended December 31, 2018 January 1, 2018 December 31, 2018 Fair value of pension plan assets $5,600,000 $6,000,000 Projected benefit obligation 6,400,000 6,880,000 Accumulated benefit obligation 1.120,000 1.360,000 Accumulated OCI-(Gains/Losses) (120.000) The service cost component of pension expense for 2018 is $600,000 and the amortization of prior service cost due to an increase in benefits is $80,000. The settlement rate is 10% and the expected rate of return is 9%. What is the amount of pension expense for 2018? A) $828.000 B) S600,000 C) $696,000 D) $816,000 Use the following to answer question 10 The following information relates to the pension plan for the employees of Turner Co. 12112 1 231/17 12/31/18 Accum benefit obligation 59.240,000 59,660,000 $12,600,000 Projected benefit obligation 9,765.000 10,458,000 14.338.000 Fair value of plan assets 8.925,000 10.920,000 12,054,000 AOCI-net(gain) or loss (1,512,000) (1.680,000) Settlement rate (for year) Expected rate of return (for year) Turner estimates that the average remaining service life is 16 years. Tumer's contribution was $1,323,000 in 2018 and benefits paid were $987.000. 11% 8% 11% 790 10. The corridor for 2018 is A) $1,400,700 B) S1.186,500 C) $1,083,600 D) $1,092,000 Use the following to answer question 11: Foster Corporation received the following report from its actuary at the end of the year December 31, 2017 December 31, 2018 Projected benefit obligation $4,000,000 $4,400,000 Accumulated benefit obligation 2.600.000 2.960.000 Fair value of pension plan assets 2,760.000 2.880,000 11. The amount reported as the pension liability at December 31, 2017 is A) S160,000 B) $1,400,000 C) SD- D) $1.240,000 12. Rossi Company has a defined benefit plan. At the end of 2018, it has determined the following information related to its pension plan: Projected benefit obligation 51.460.000 Accumulated benefit obligation 1.320.000 Fair value of pension plan assets 1.220,000 The amount of pension liability that is reported in Rossi's balance sheet at the end of 2018 is A) $140,000 B) S100,000 $240,000 D) $300,000 C) 13. Presented below is information related to Noble Inc. as of December 31, 2018. Accumulated OCI (G/L) $ 120,000 Projected benefit obligation 4,870,000 Accumulated benefit obligation 4,560,000 Vested benefits 2,160,000 Plan assets (at fair value) 4.472.000 Accumulated OCI (PSC) The amount reported as the pension liability on Noble's balance sheet at December 31, 2018 is A) $310,000