Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Steadman Company is considering an investment in a new machine for an independent five-year project. The machine's cost $668,750 with no salvage value at the

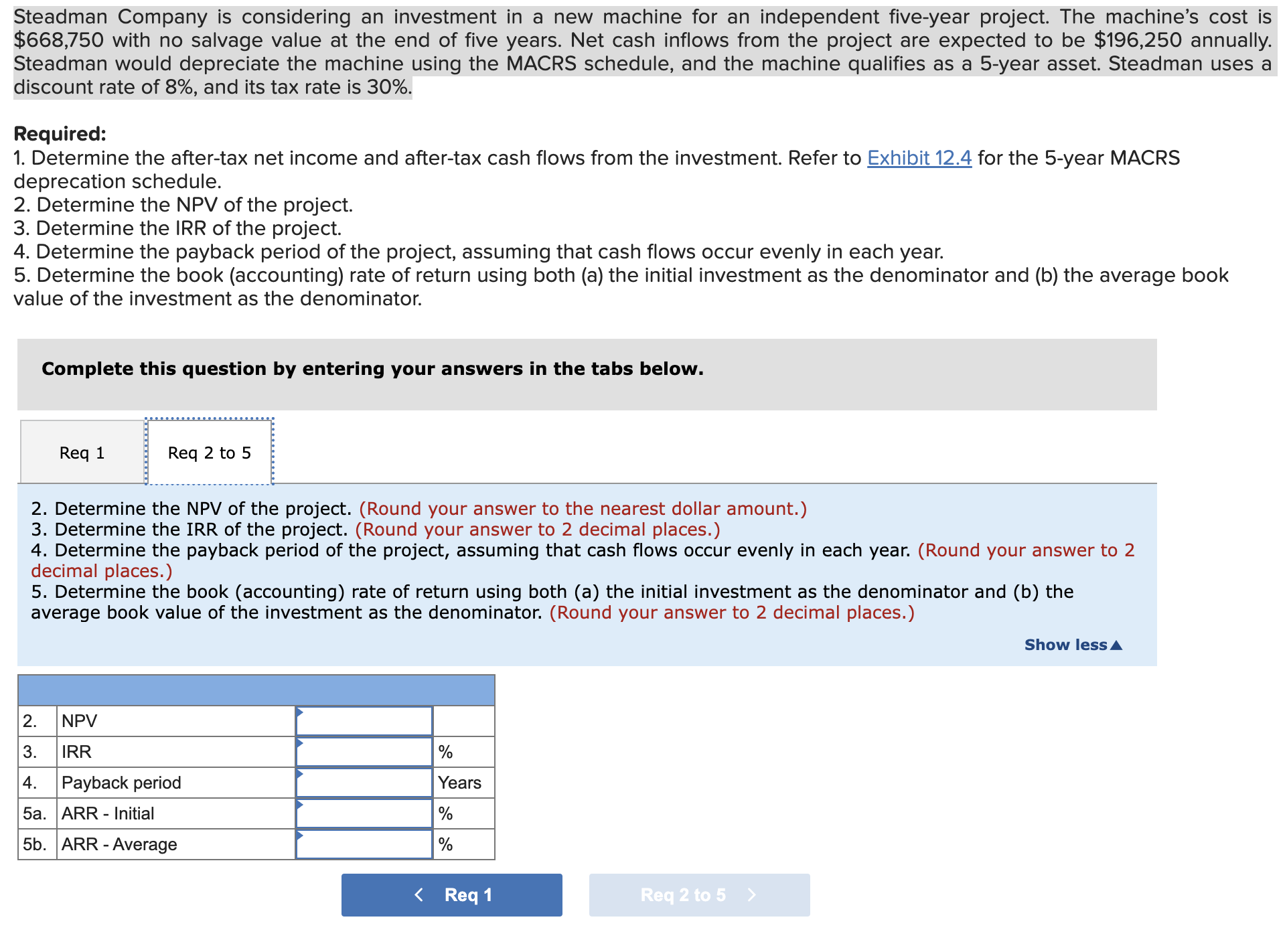

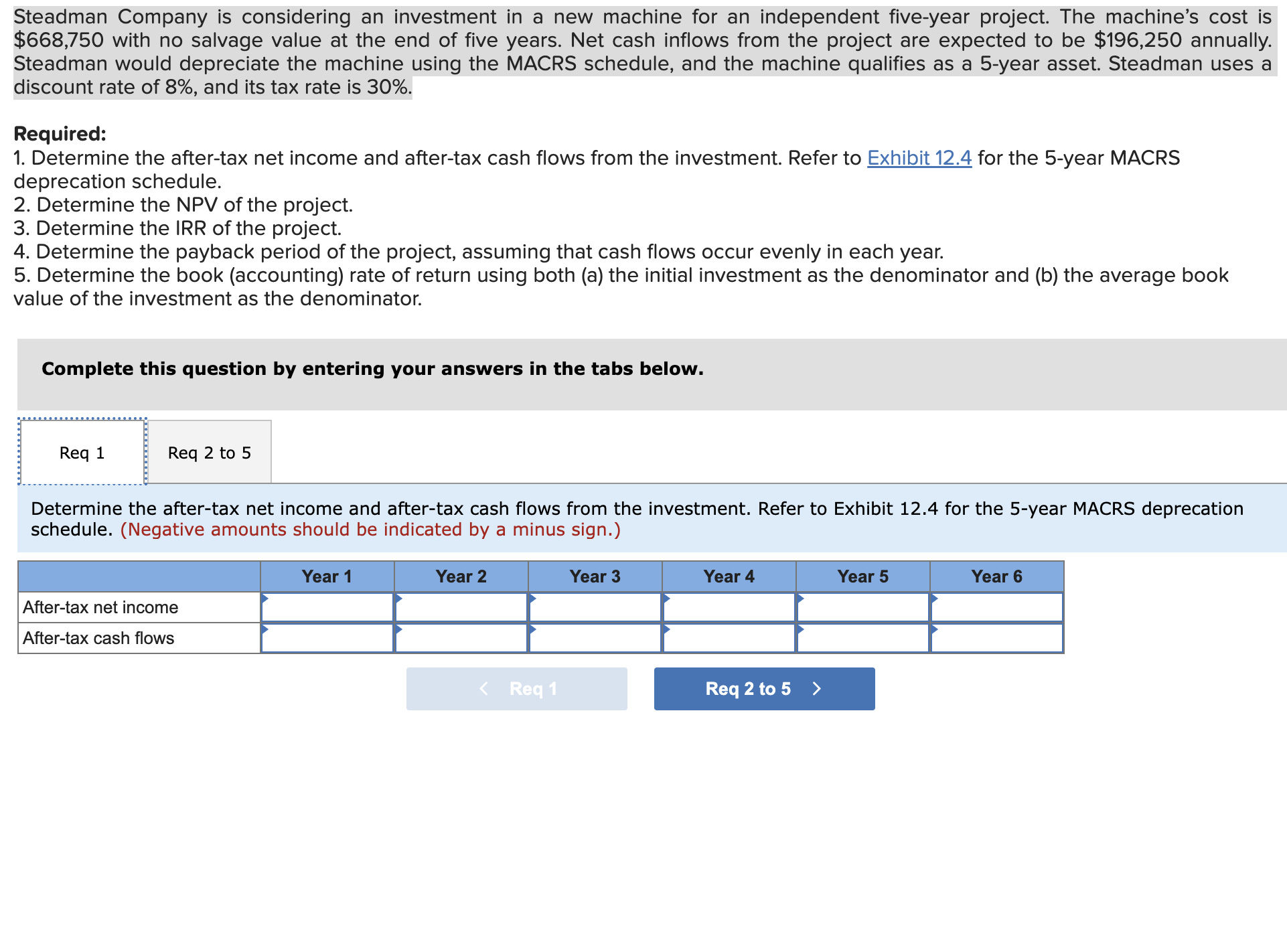

Steadman Company is considering an investment in a new machine for an independent five-year project. The machine's cost $668,750 with no salvage value at the end of five years. Net cash inflows from the project are expected to be $196,250 annually Steadman would depreciate the machine using the MACRS schedule, and the machine qualifies as a 5-year asset. Steadman uses discount rate of 8%, and its tax rate is 30%. Required: 1. Determine the after-tax net income and after-tax cash flows from the investment. Refer to Exhibit 12.4 for the 5-year MACRS deprecation schedule. 2. Determine the NPV of the project. 3. Determine the IRR of the project. 4. Determine the payback period of the project, assuming that cash flows occur evenly in each year. 5. Determine the book (accounting) rate of return using both (a) the initial investment as the denominator and (b) the average book value of the investment as the denominator. Complete this question by entering your answers in the tabs below. 2. Determine the NPV of the project. (Round your answer to the nearest dollar amount.) 3. Determine the IRR of the project. (Round your answer to 2 decimal places.) 4. Determine the payback period of the project, assuming that cash flows occur evenly in each year. (Round your answer to 2 decimal places.) 5. Determine the book (accounting) rate of return using both (a) the initial investment as the denominator and (b) the average book value of the investment as the denominator. (Round your answer to 2 decimal places.) Steadman Company is considering an investment in a new machine for an independent five-year project. The machine's cost is $668,750 with no salvage value at the end of five years. Net cash inflows from the project are expected to be $196,250 annually. Steadman would depreciate the machine using the MACRS schedule, and the machine qualifies as a 5-year asset. Steadman uses a discount rate of 8%, and its tax rate is 30%. Required: 1. Determine the after-tax net income and after-tax cash flows from the investment. Refer to Exhibit 12.4 for the 5-year MACRS deprecation schedule. 2. Determine the NPV of the project. 3. Determine the IRR of the project. 4. Determine the payback period of the project, assuming that cash flows occur evenly in each year. 5. Determine the book (accounting) rate of return using both (a) the initial investment as the denominator and (b) the average book value of the investment as the denominator. Complete this question by entering your answers in the tabs below. Determine the after-tax net income and after-tax cash flows from the investment. Refer to Exhibit 12.4 for the 5-year MACRS deprecation schedule. (Negative amounts should be indicated by a minus sign.)

Steadman Company is considering an investment in a new machine for an independent five-year project. The machine's cost $668,750 with no salvage value at the end of five years. Net cash inflows from the project are expected to be $196,250 annually Steadman would depreciate the machine using the MACRS schedule, and the machine qualifies as a 5-year asset. Steadman uses discount rate of 8%, and its tax rate is 30%. Required: 1. Determine the after-tax net income and after-tax cash flows from the investment. Refer to Exhibit 12.4 for the 5-year MACRS deprecation schedule. 2. Determine the NPV of the project. 3. Determine the IRR of the project. 4. Determine the payback period of the project, assuming that cash flows occur evenly in each year. 5. Determine the book (accounting) rate of return using both (a) the initial investment as the denominator and (b) the average book value of the investment as the denominator. Complete this question by entering your answers in the tabs below. 2. Determine the NPV of the project. (Round your answer to the nearest dollar amount.) 3. Determine the IRR of the project. (Round your answer to 2 decimal places.) 4. Determine the payback period of the project, assuming that cash flows occur evenly in each year. (Round your answer to 2 decimal places.) 5. Determine the book (accounting) rate of return using both (a) the initial investment as the denominator and (b) the average book value of the investment as the denominator. (Round your answer to 2 decimal places.) Steadman Company is considering an investment in a new machine for an independent five-year project. The machine's cost is $668,750 with no salvage value at the end of five years. Net cash inflows from the project are expected to be $196,250 annually. Steadman would depreciate the machine using the MACRS schedule, and the machine qualifies as a 5-year asset. Steadman uses a discount rate of 8%, and its tax rate is 30%. Required: 1. Determine the after-tax net income and after-tax cash flows from the investment. Refer to Exhibit 12.4 for the 5-year MACRS deprecation schedule. 2. Determine the NPV of the project. 3. Determine the IRR of the project. 4. Determine the payback period of the project, assuming that cash flows occur evenly in each year. 5. Determine the book (accounting) rate of return using both (a) the initial investment as the denominator and (b) the average book value of the investment as the denominator. Complete this question by entering your answers in the tabs below. Determine the after-tax net income and after-tax cash flows from the investment. Refer to Exhibit 12.4 for the 5-year MACRS deprecation schedule. (Negative amounts should be indicated by a minus sign.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started