Question

Steakhouse Ltd is considering two mutually exclusive investment projects. Details of the two projects and their expected cash flows are as follows: Note that all

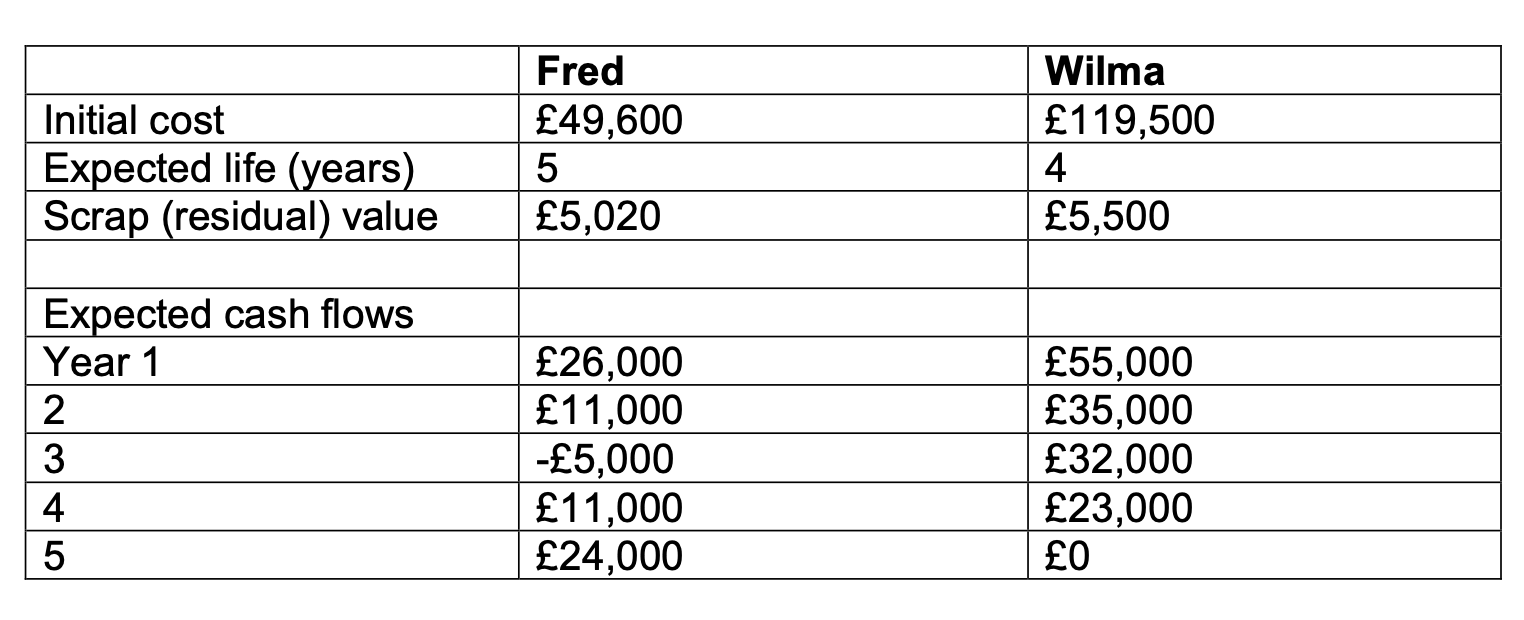

Steakhouse Ltd is considering two mutually exclusive investment projects. Details of the two projects and their expected cash flows are as follows:

Note that all the expected cash flows are positive cash inflows with the exception of year 3 for Fred, which is a negative cash outflow. The company accountant has calculated the Internal Rate of Return (IRR) for the Fred and Wilma projects and found an IRR of 13.7% and 11.2% respectively. Since the IRR for Fred is higher and in excess of Steakhouses 8% cost of capital, the accountant has recommended proceeding with project Fred.

Required:

-

Calculate the payback period for each project to the nearest year and month.

-

Calculate the Accounting Rate of Return(ARR) to the nearest %foreach project using the average profit and average investment.

-

Calculate the Net Present Value(NPV) of each project to the nearest.

-

Which project would you advise Steakhouse to accept? Explain your reasoning and outline any other factors which may be relevant in making your decision.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started