Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Steel Traders uses a perpetual inventory system on accrual basis to account for stainless steel smart cookers that it sells with one-year warranty and

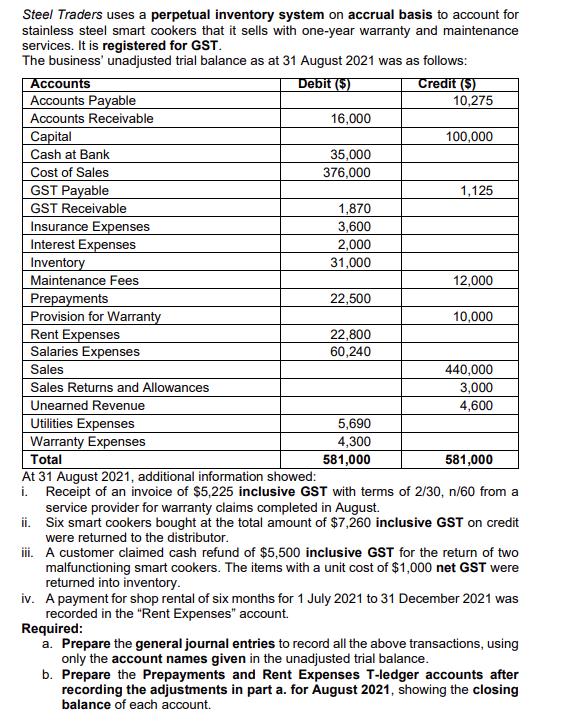

Steel Traders uses a perpetual inventory system on accrual basis to account for stainless steel smart cookers that it sells with one-year warranty and maintenance services. It is registered for GST. The business' unadjusted trial balance as at 31 August 2021 was as follows: Debit (5) Accounts Accounts Payable Accounts Receivable Capital Cash at Bank Cost of Sales GST Payable GST Receivable Insurance Expenses Interest Expenses Inventory Maintenance Fees Prepayments Provision for Warranty Rent Expenses Salaries Expenses Sales Sales Returns and Allowances Unearned Revenue Utilities Expenses Warranty Expenses 16,000 35,000 376,000 1,870 3,600 2,000 31,000 22,500 22,800 60,240 5,690 4,300 581,000 Credit (S) 10,275 100,000 1,125 12,000 10,000 440,000 3,000 4,600 Total 581,000 At 31 August 2021, additional information showed: i. Receipt of an invoice of $5,225 inclusive GST with terms of 2/30, n/60 from a service provider for warranty claims completed in August. ii. Six smart cookers bought at the total amount of $7,260 inclusive GST on credit were returned to the distributor. iii. A customer claimed cash refund of $5,500 inclusive GST for the return of two malfunctioning smart cookers. The items with a unit cost of $1,000 net GST were returned into inventory. iv. A payment for shop rental of six months for 1 July 2021 to 31 December 2021 was recorded in the "Rent Expenses" account. Required: a. Prepare the general journal entries to record all the above transactions, using only the account names given in the unadjusted trial balance. b. Prepare the Prepayments and Rent Expenses T-ledger accounts after recording the adjustments in part a. for August 2021, showing the closing balance of each account.

Step by Step Solution

★★★★★

3.25 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a Compute the current price margin Particulars Cancum Jamaica Cost data Trip cost to cancum Trip ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started