Answered step by step

Verified Expert Solution

Question

1 Approved Answer

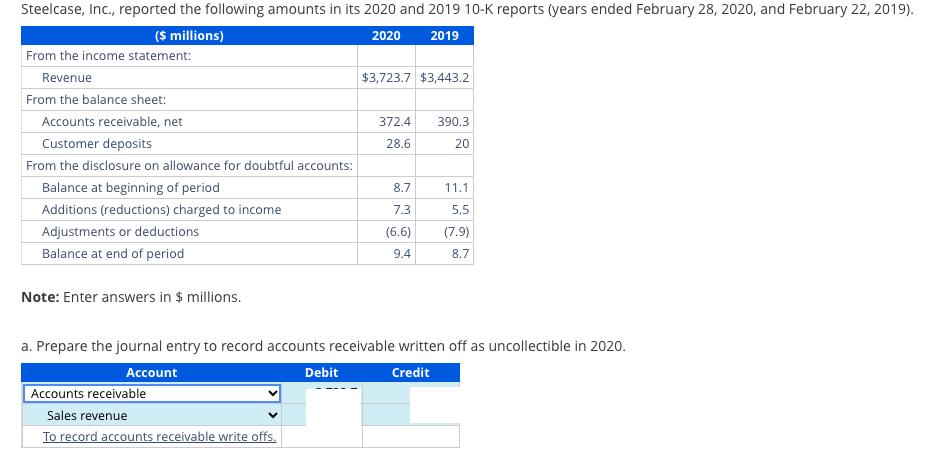

Steelcase, Inc., reported the following amounts in its 2020 and 2019 10-K reports (years ended February 28, 2020, and February 22, 2019). ($ millions)

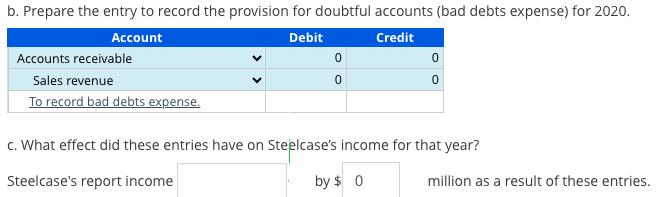

Steelcase, Inc., reported the following amounts in its 2020 and 2019 10-K reports (years ended February 28, 2020, and February 22, 2019). ($ millions) 2020 2019 From the income statement: Revenue From the balance sheet: Accounts receivable, net Customer deposits From the disclosure on allowance for doubtful accounts: Balance at beginning of period Additions (reductions) charged to income Adjustments or deductions Balance at end of period Note: Enter answers in $ millions. Accounts receivable Sales revenue To record accounts receivable write offs. $3,723.7 $3,443.2 Debit 372.4 28.6 8.7 7.3 (6.6) 9.4 390.3 20 a. Prepare the journal entry to record accounts receivable written off as uncollectible in 2020. Account Credit 11.1 5.5 (7.9) 8.7 b. Prepare the entry to record the provision for doubtful accounts (bad debts expense) for 2020. Account Debit Credit Accounts receivable Sales revenue To record bad debts expense. 0 0 0 0 c. What effect did these entries have on Steelcase's income for that year? Steelcase's report income by $ 0 million as a result of these entries.

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a The journal entry to record accounts receivable written off as uncollectible in 2020 would be Ac...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started