Question

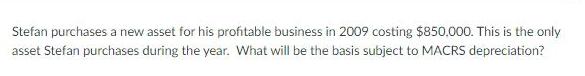

Stefan purchases a new asset for his profitable business in 2009 costing $850,000. This is the only asset Stefan purchases during the year. What

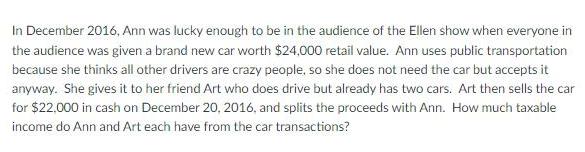

Stefan purchases a new asset for his profitable business in 2009 costing $850,000. This is the only asset Stefan purchases during the year. What will be the basis subject to MACRS depreciation? In December 2016, Ann was lucky enough to be in the audience of the Ellen show when everyone in the audience was given a brand new car worth $24,000 retail value. Ann uses public transportation because she thinks all other drivers are crazy people, so she does not need the car but accepts it anyway. She gives it to her friend Art who does drive but already has two cars. Art then sells the car for $22,000 in cash on December 20, 2016, and splits the proceeds with Ann. How much taxable income do Ann and Art each have from the car transactions?

Step by Step Solution

3.39 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Income Tax Fundamentals 2013

Authors: Gerald E. Whittenburg, Martha Altus Buller, Steven L Gill

31st Edition

1111972516, 978-1285586618, 1285586611, 978-1285613109, 978-1111972516

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App