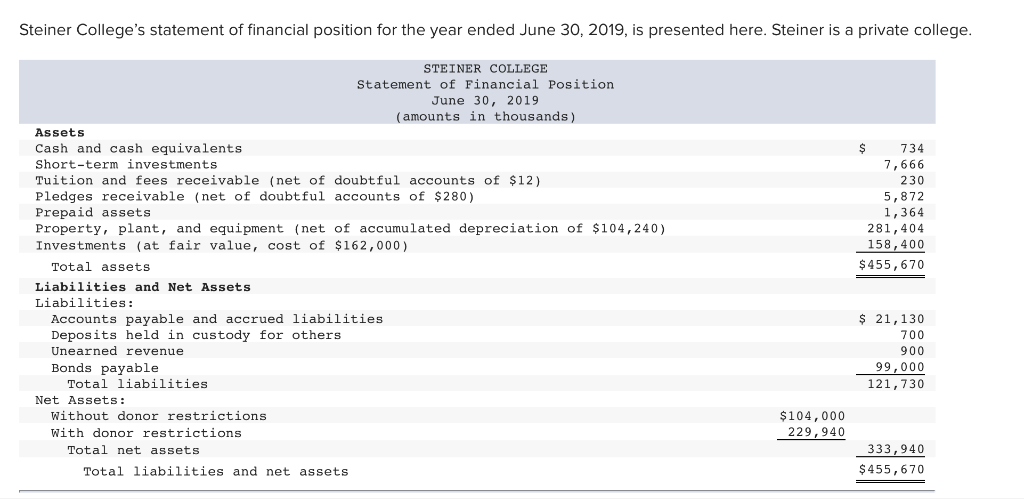

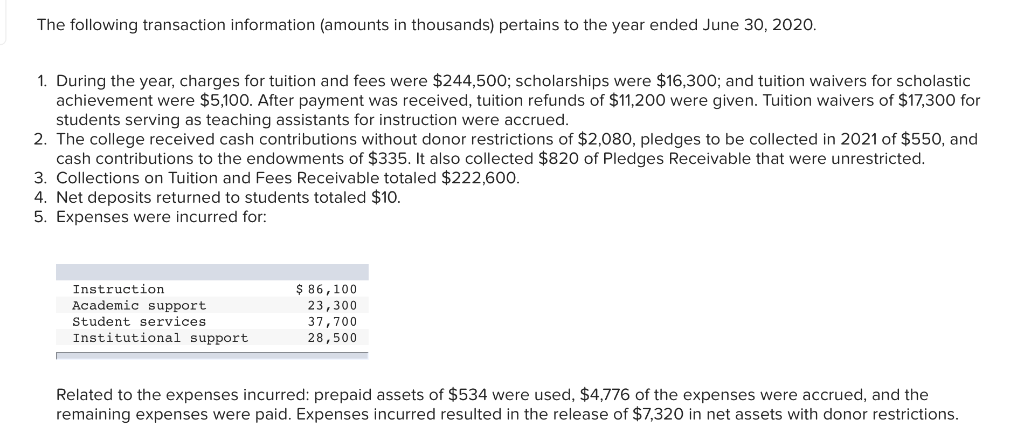

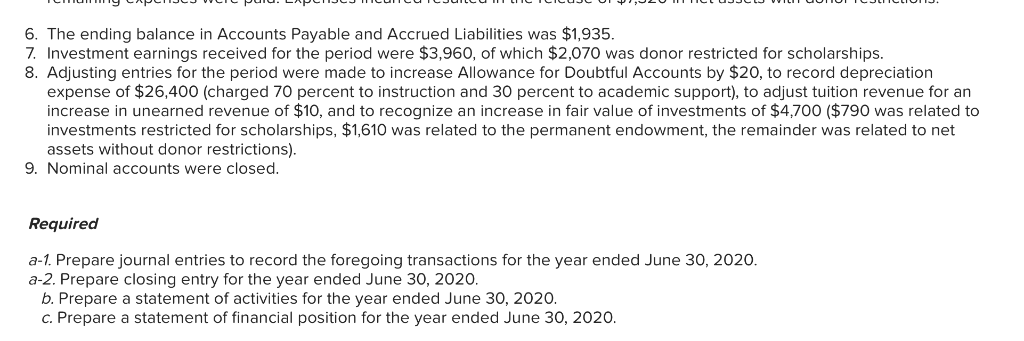

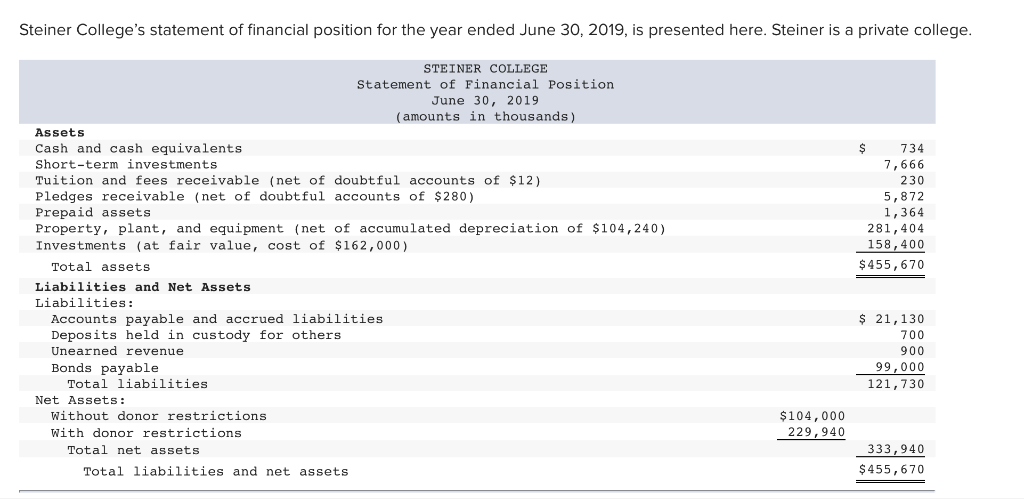

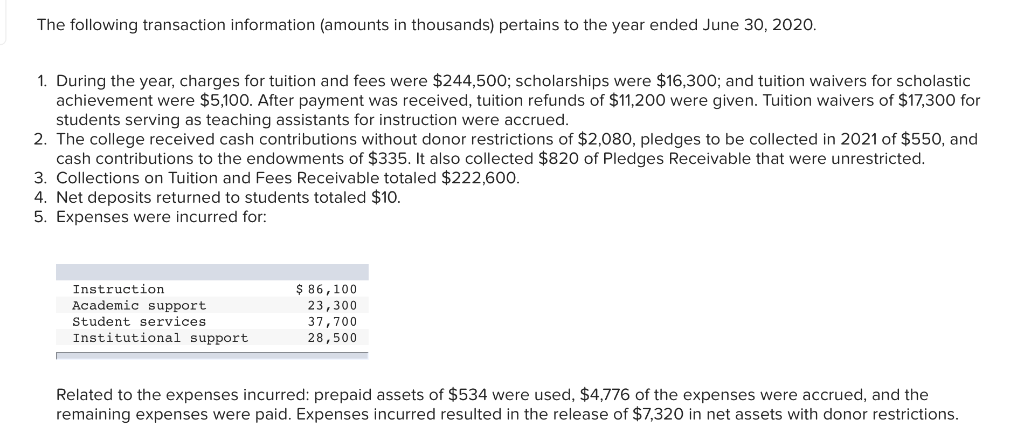

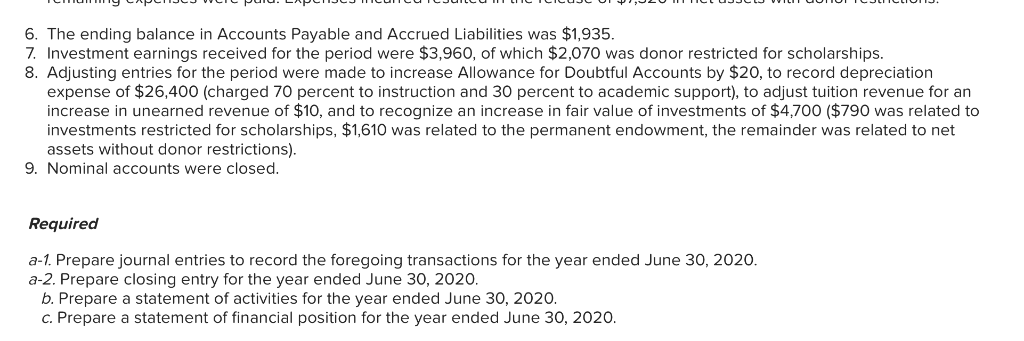

Steiner College's statement of financial position for the year ended June 30, 2019, is presented here. Steiner is a private college STEINER COLLEGE Statement of Financial Position June 30, 2019 (amounts in thousands) Assets Cash and cash equivalents Short-term investments Tuition and fees receivable (net of doubtful accounts of $12) Pledges receivable (net of doubtful accounts of $280) Prepaid assets Property, plant, and equipment (net of accumulated depreciation of $104,240) Investments (at fair value, cost of $162,000) 734 7,666 230 5,872 1,364 281,404 158,400 $455,670 Total assets Liabilities and Net Assets Liabilities: Accounts payable and accrued liabilities Deposits held in custody for others Unearned revenue Bonds payable 21,130 700 900 99,000 121,730 Total liabilities Net Assets: Without donor restrictions With donor restrictions $104,000 229,940 333,940 $455,670 Total net assets Total liabilities and net assets The following transaction information (amounts in thousands) pertains to the year ended June 30, 2020. 1. During the year, charges for tuition and fees were $244,500; scholarships were $16,300; and tuition waivers for scholastic achievement were $5,100. After payment was received, tuition refunds of $11,200 were given. Tuition waivers of $17,300 for students serving as teaching assistants for instruction were accrued. 2. The college received cash contributions without donor restrictions of $2,080, pledges to be collected in 2021 of $550, and cash contributions to the endowments of $335. It also collected $820 of Pledges Receivable that were unrestricted 3. Collections on Tuition and Fees Receivable totaled $222,600. 4. Net deposits returned to students totaled $10. 5. Expenses were incurred for: Instruction Academic support Student services Institutional support $ 86,100 23,300 37,700 28,500 Related to the expenses incurred: prepaid assets of $534 were used, $4,776 of the expenses were accrued, and the remaining expenses were paid. Expenses incurred resulted in the release of $7,320 in net assets with donor restrictions 6. The ending balance in Accounts Payable and Accrued Liabilities was $1,935. 7. Investment earnings received for the period were $3,960, of which $2,070 was donor restricted for scholarships. 8. Adjusting entries for the period were made to increase Allowance for Doubtful Accounts by $20, to record depreciation expense of $26,400 (charged 70 percent to instruction and 30 percent to academic support), to adjust tuition revenue for an increase in unearned revenue of $10, and to recognize an increase in fair value of investments of $4,700 ($790 was related to investments restricted for scholarships, $1,610 was related to the permanent endowment, the remainder was related to net assets without donor restrictions) 9. Nominal accounts were closed. Required a-1. Prepare journal entries to record the foregoing transactions for the year ended June 30, 2020 a-2. Prepare closing entry for the year ended June 30, 2020 b. Prepare a statement of activities for the year ended June 30, 2020. c. Prepare a statement of financial position for the year ended June 30, 2020