Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Stella plc is a fashion retailer with stores in large cities around the UK. The draft financial statements for the year to 30 April

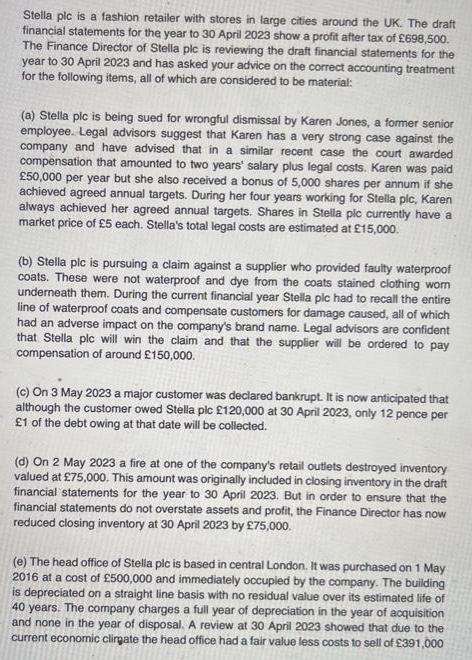

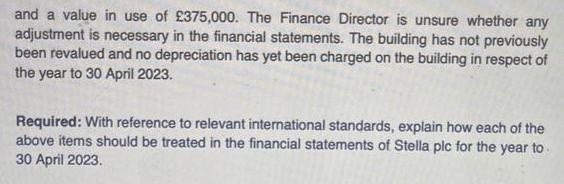

Stella plc is a fashion retailer with stores in large cities around the UK. The draft financial statements for the year to 30 April 2023 show a profit after tax of 698,500. The Finance Director of Stella plc is reviewing the draft financial statements for the year to 30 April 2023 and has asked your advice on the correct accounting treatment for the following items, all of which are considered to be material: (a) Stella pic is being sued for wrongful dismissal by Karen Jones, a former senior employee. Legal advisors suggest that Karen has a very strong case against the company and have advised that in a similar recent case the court awarded compensation that amounted to two years' salary plus legal costs. Karen was paid 50,000 per year but she also received a bonus of 5,000 shares per annum if she achieved agreed annual targets. During her four years working for Stella plc, Karen always achieved her agreed annual targets. Shares in Stella plc currently have a market price of 5 each. Stella's total legal costs are estimated at 15,000. (b) Stella plc is pursuing a claim against a supplier who provided faulty waterproof coats. These were not waterproof and dye from the coats stained clothing wom underneath them. During the current financial year Stella pic had to recall the entire line of waterproof coats and compensate customers for damage caused, all of which had an adverse impact on the company's brand name. Legal advisors are confident that Stella plc will win the claim and that the supplier will be ordered to pay compensation of around 150,000. (c) On 3 May 2023 a major customer was declared bankrupt. It is now anticipated that although the customer owed Stella pic 120,000 at 30 April 2023, only 12 pence per 1 of the debt owing at that date will be collected. (d) On 2 May 2023 a fire at one of the company's retail outlets destroyed inventory valued at 75,000. This amount was originally included in closing inventory in the draft financial statements for the year to 30 April 2023. But in order to ensure that the financial statements do not overstate assets and profit, the Finance Director has now reduced closing inventory at 30 April 2023 by 75,000. (e) The head office of Stella pic is based in central London. It was purchased on 1 May 2016 at a cost of 500,000 and immediately occupied by the company. The building is depreciated on a straight line basis with no residual value over its estimated life of 40 years. The company charges a full year of depreciation in the year of acquisition and none in the year of disposal. A review at 30 April 2023 showed that due to the current economic clirgate the head office had a fair value less costs to sell of 391,000 and a value in use of 375,000. The Finance Director is unsure whether any adjustment is necessary in the financial statements. The building has not previously been revalued and no depreciation has yet been charged on the building in respect of the year to 30 April 2023. Required: With reference to relevant international standards, explain how each of the above items should be treated in the financial statements of Stella plc for the year to 30 April 2023.

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a Stella plc should recognise a liability for the estimated legal costs of 15000 in the financial st...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started