Question

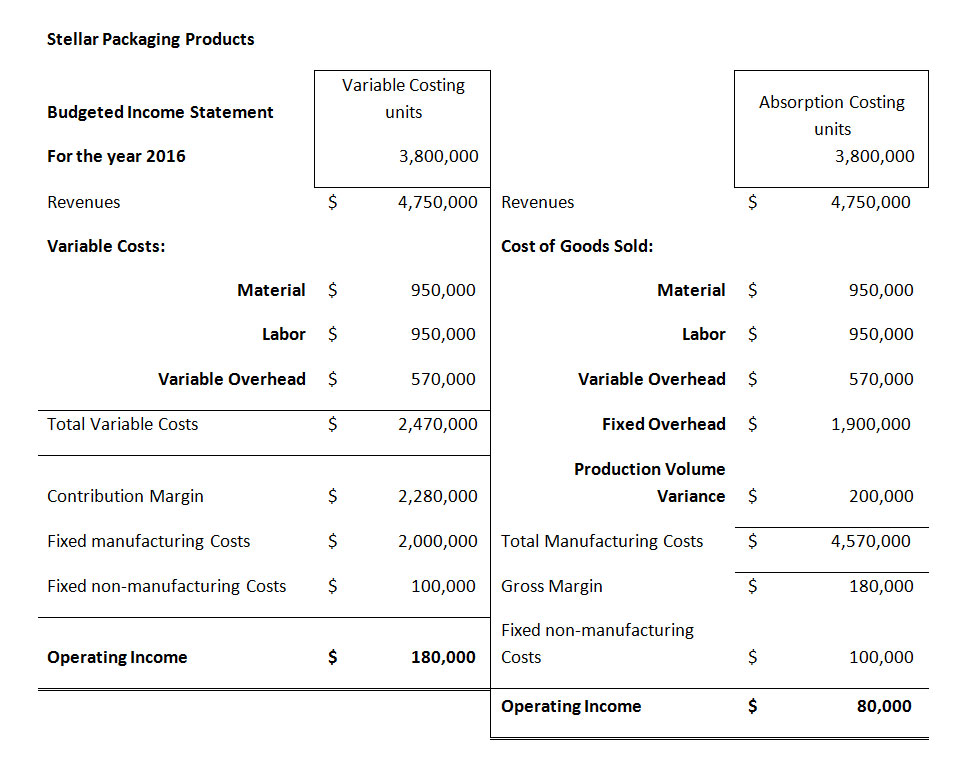

Stellar Packaging Products Company notes the following results for 2016 for variable versus absorption costing. The companys base volume is 4,000,000. The company presently uses

Stellar Packaging Products Company notes the following results for 2016 for variable versus absorption costing. The companys base volume is 4,000,000.

The company presently uses absorption costing to provide additional compensation and incentivize managers to achieve their production goals. The compensation formula is 10% of operating income.

Instructions:

Calculate the amount of the difference of additional compensation between the two income statement methods. If the decline in volume continues and Stellar makes 3.6 million units in 2017, should the company switch to variable costing as the basis of compensation? Why or why not? What might be the reaction of the production managers if this occurs?

Stellar Packaging Products Budgeted Income Statement For the year 2016 Revenues Variable Costs: Material Labor Variable Overhead Total Variable Costs Contribution Margin Fixed manufacturing Costs Fixed non-manufacturing Costs Operating Income Variable Costing units 3,800,000 4,750,000 Revenues Cost of Goods Sold: Material 950,000 Labor 950,000 Variable Overhead 570,000 Fixed overhead 2,470,000 Production Volume 2,280,000 Variance 2,000,000 Total Manufacturing Costs 100,000 Gross Margin Fixed non-manufacturing 180,000 Costs Operating Income Absorption Costing units 3,800,000 4,750,000 950,000 950,000 570,000 1,900,000 200,000 4,570,000 180,000 100,000 80,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started