Answered step by step

Verified Expert Solution

Question

1 Approved Answer

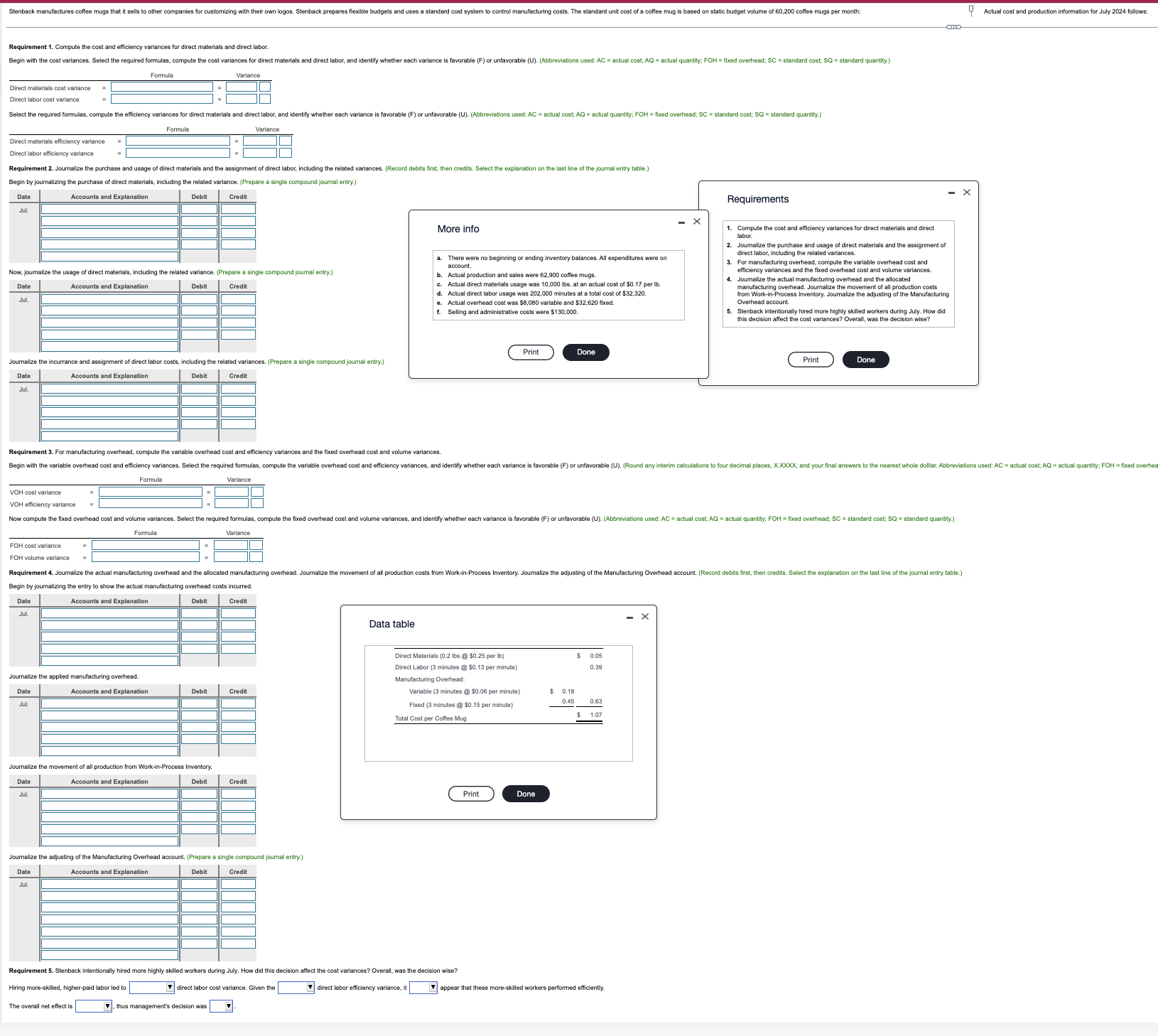

Stenback manufactures coffee mugs that it sells to other companies for customizing with their own logos. Stenback prepares flexible budgets and uses a standard

Stenback manufactures coffee mugs that it sells to other companies for customizing with their own logos. Stenback prepares flexible budgets and uses a standard cost system to control manufacturing costs. The standard unit cost of a coffee mug is based on static budget volume of 60,200 coffee mugs per month: Requirement 1. Compute the cost and efficiency variances for direct materials and direct labor. Begin with the cost variances. Select the required formulas, compute the cost variances for direct materials and direct labor, and identify whether each variance is favorable (F) or unfavorable (U). (Abbreviations used: AC = actual cost; AQ = actual quantity; FOH = fixed overhead; SC standard cost; SQ = standard quantity.) Formula Variance Direct materials cost variance Direct labor cost variance Select the required formulas, compute the efficiency variances for direct materials and direct labor, and identify whether each variance is favorable (F) or unfavorable (U). (Abbreviations used: AC = actual cost; AQ = actual quantity; FOH = fixed overhead; SC = standard cost; SQ = standard quantity.) Formula Variance Direct materials efficiency variance Direct labor efficiency variance Requirement 2. Journalize the purchase and usage of direct materials and the assignment of direct labor, including the related variances. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Begin by journalizing the purchase of direct materials, including the related variance. (Prepare a single compound journal entry.) Date Accounts and Explanation Debit Credit More info Requirements 1. Compute the cost and efficiency variances for direct materials and direct labor. a. There were no beginning or ending inventory balances. account. I expenditures were on Date Now, joumalize the usage of direct materials, including the related variance. (Prepare a single compound journal entry.) Accounts and Explanation Debit Credit Jul b. Actual production and sales were 62,900 coffee mugs. Actual direct materials usage was 10,000 lbs. at an actual cost of $0.17 per lb. d. Actual direct labor usage was 202,000 minutes at a total cost of $32,320. e. Actual overhead cost was $8,080 variable and $32,620 fixed. f. Selling and administrative costs were $130,000. 2. Joumalize the purchase and usage of direct materials and the assignment of direct labor, including the related variances. 3. For manufacturing overhead, compute the variable overhead cost and efficiency variances and the fixed overhead cost and volume variances. 4. Joumalize the actual manufacturing overhead and the allocated manufacturing overhead. Journalize the movement of all production costs from Work-in-Process Inventory. Journalize the adjusting of the Manufacturing Overhead account. 5. Stenback intentionally hired more highly skilled workers during July. How did this decision affect the cost variances? Overall, was the decision wise? Journalize the incurrance and assignment of direct labor costs, including the related variances. (Prepare a single compound journal entry.) Accounts and Explanation Date Debit Credit Jul Print Done Print Done - X Actual cost and production information for July 2024 follows: Requirement 3. For manufacturing overhead, compute the variable overhead cost and efficiency variances and the fixed overhead cost and volume variances. Begin with the variable overhead cost and efficiency variances. Select e required formulas, compute the variable overhead cost and efficiency variances, and identify whether each variance is favorable (F) or unfavorable (U). (Round any interim calculations to four decimal places, X.XXXX, and your final answers to the nearest whole dolllar. Abbreviations used: AC = actual cost; AQ = actual quantity; FOH = fixed overhea VOH cost variance VOH efficiency variance. Formula Variance Now compute the fixed overhead cost and volume variances. Select the required formulas, compute the fixed overhead cost and volume variances, and identify whether each variance is favorable (F) or unfavorable (U). (Abbreviations used: AC = actual cost; AQ = actual quantity; FOH = fixed overhead; SC standard cost; SQ = standard quantity.) Variance Formula FOH cost variance FOH volume variance Requirement 4. Journalize the actual manufacturing overhead and the allocated manufacturing overhead. Journalize the movement of all production costs from Work-in-Process Inventory. Joumalize the adjusting of the Manufacturing Overhead account. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Begin by journalizing the entry to show the actual manufacturing overhead costs incurred. Date Jul. Accounts and Explanation Journalize the applied manufacturing overhead. Date Jul. Debit Credit Accounts and Explanation Debit Credit Journalize the movement of all production from Work-in-Process Inventory. Accounts and Explanation Date Jul Debit Credit Journalize the adjusting of the Manufacturing Overhead account. (Prepare a single compound journal entry.) Date Jul. Accounts and Explanation Debit Credit Data table Direct Materials (0.2 lbs @ $0.25 per lb) Direct Labor (3 minutes @ $0.13 per minute) Manufacturing Overhead: $ 0.05 0.39 Variable (3 minutes Fixed (3 minutes $0.15 per minute) Total Cost per Coffee Mug $0.06 per minute) $ 0.18 0.45 0.63 1.07 Print Done Requirement 5. Stenback intentionally hired more highly skilled workers during July. How did this decision affect the cost variances? Overall, was the decision wise? Hiring more-skilled, higher-paid labor led to direct labor cost variance. Given the direct labor efficiency variance, it appear that these more-skilled workers performed efficiently. The overall net effect is thus management's decision was

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started