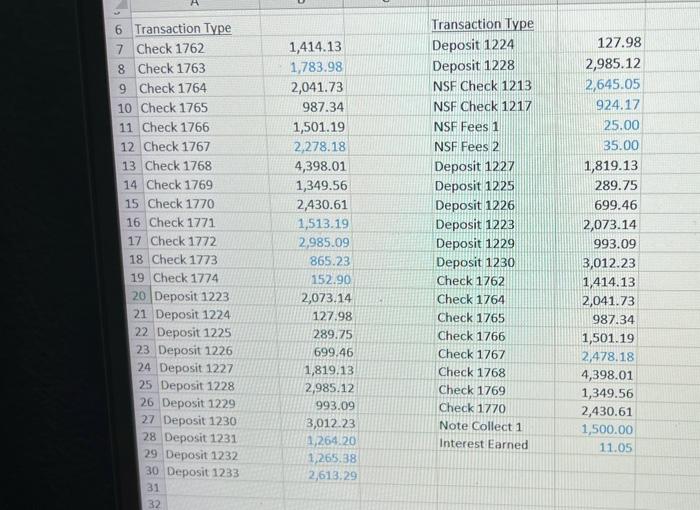

Step 1: Copy the data to a new worksheet called "working data". Next, hold the Control Key and highlight both columns of numbers. Then, select Conditional formatting and then click on New Rules: Select "Format only unique or duplicate values" and select "unique" under Format all. Click on the Eormat ... command to set the color fill you would like for the unique values. Select OK, and the screen will format the unique numbers as follows, highlighting the numbers in each column that need to be reconciled: The cells highlighted those items that need to be reconciled. The cells in the general ledger column highlighted are items recorded by the company but not by the bank. The checks highlighted would be corsidered outstanding checks. The deposits highlighted would be considering outstanding deposits. The cells in the bank statement column highlights are items recorded by the bank but not by the company. The cells pertaining to the same check or deposit number highlighted in both the general ledger and the bank statement column are considered to be errors: Step 1: Copy the data to a new worksheet called "working data". Next, hold the Control Key and highlight both columns of numbers. Then, select Conditional formatting and then click on New Rules: Select "Format only unique or duplicate values" and select "unique" under Format all. Click on the Eormat ... command to set the color fill you would like for the unique values. Select OK, and the screen will format the unique numbers as follows, highlighting the numbers in each column that need to be reconciled: The cells highlighted those items that need to be reconciled. The cells in the general ledger column highlighted are items recorded by the company but not by the bank. The checks highlighted would be corsidered outstanding checks. The deposits highlighted would be considering outstanding deposits. The cells in the bank statement column highlights are items recorded by the bank but not by the company. The cells pertaining to the same check or deposit number highlighted in both the general ledger and the bank statement column are considered to be errors