Question

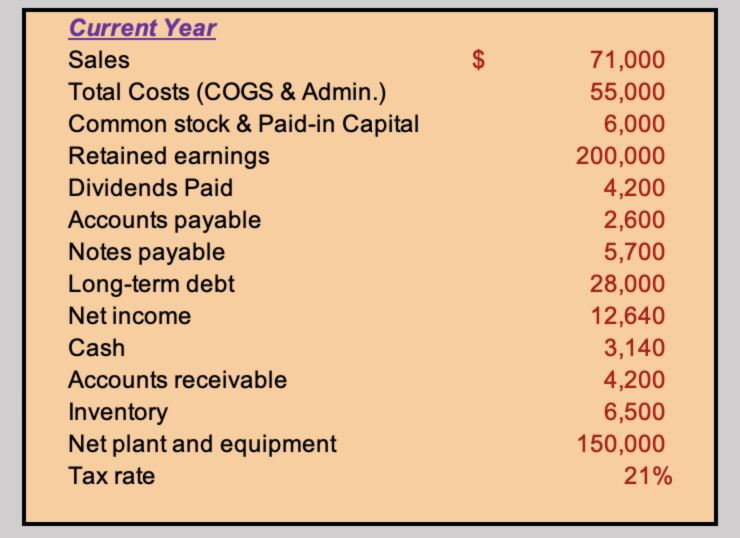

Use the pro forma balance sheet to calculate the external financing needs. Based on the assumptions of the SGR, what is the total growth in

Use the pro forma balance sheet to calculate the external financing needs.

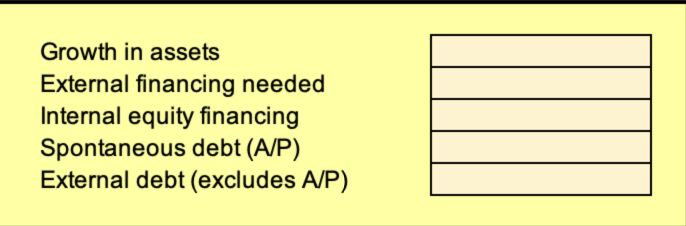

Based on the assumptions of the SGR, what is the total growth in assets and the external financing needed? (EFN will be around $X)

What is the internal equity financing and spontaneous (A/P) financing? NOTE: EFN plus the internal/spontaneous financing in this step should sum to the growth in assets.

Based on the assumptions of the SGR, what is the external debt financing?

Display all answers and formulas in the Excel sheet. This question has to be completed in Excel with the correct formulas.

CurrentYearSalesTotalCosts(COGS&Admin.)Commonstock&Paid-inCapitalRetainedearningsDividendsPaidAccountspayableNotespayableLong-termdebtNetincomeCashAccountsreceivableInventoryNetplantandequipmentTaxrate71,00055,0006,000200,0004,2002,6005,70028,00012,6403,1404,2006,500150,00021% Growth in assets External financing needed Internal equity financing Spontaneous debt (A/P) External debt (excludes A/P) CurrentYearSalesTotalCosts(COGS&Admin.)Commonstock&Paid-inCapitalRetainedearningsDividendsPaidAccountspayableNotespayableLong-termdebtNetincomeCashAccountsreceivableInventoryNetplantandequipmentTaxrate71,00055,0006,000200,0004,2002,6005,70028,00012,6403,1404,2006,500150,00021% Growth in assets External financing needed Internal equity financing Spontaneous debt (A/P) External debt (excludes A/P)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started