Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Step 1, Journalize Accounting Period Transactions Step 2, Post all journal entries from step 1 to general ledger accounts (T accounts) Step 3, Prepare an

| Step 1, "Journalize" Accounting Period Transactions |

| Step 2, "Post" all journal entries from step 1 to general ledger accounts (T accounts) |

| Step 3, Prepare an unadjusted trial balance at period ending (date). |

Step 4, "Journalize" Adjusting Year-end Entries

Step 5, Carry over existing T-Accounts from Tab "Steps 1-3" and Post all journal entries from step 1 to general ledger accounts (T accounts)

Step 6, Prepare an Adjusted trial balance at period ending (date).

| Step 7, Prepare Year-End Financial Statements |

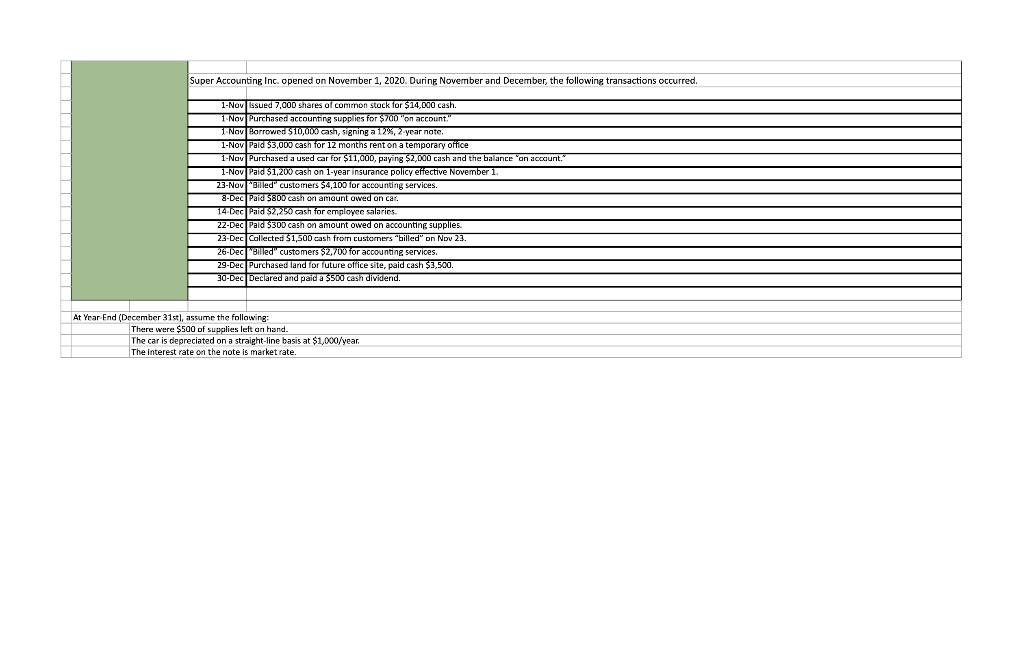

Super Accounting Inc. opened on November 1, 2020. During November and December, the following transactions occurred. 1-Nov Issued 7,000 shares of common stock for $14,000 cash. 1.Nov Purchased accounting supplies for $700 "on account." 1 Nov Borrowed $10,000 cash, signing a 12%, 2 year note. 1-Nov Paid $3,000 cash for 12 months rent on a temporary office 1-Nav Purchased a used car for $11,000, paying $2,000 cash and the balance an account: 1-Nov Paid $1,200 cash on 1 year insurance policy effective November 1. 23-Novilled" customers $4,100 for accounting services 3-Dec Paid 5800 cash an amount owed on car 14-Dec Paid $2,250 cash for employee salaries. 22-Dec Paid $300 cash on amount owed on accounting supplies. 23-Dec Collected $1,500 cash from customers "billed" on Nov 23. 26-Dec "illed" customers $2,700 for accounting services. 29-Dec Purchased land for future office site, paid cash $3,500. 30-Dec Declared and paid a $500 cash dividend, At Year End (December 31st), assume the following: There were $500 of supplies left on hand. The car is depreciated on a straight-line basis at $1,000/year The interest rate on the note is market rate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started