Answered step by step

Verified Expert Solution

Question

1 Approved Answer

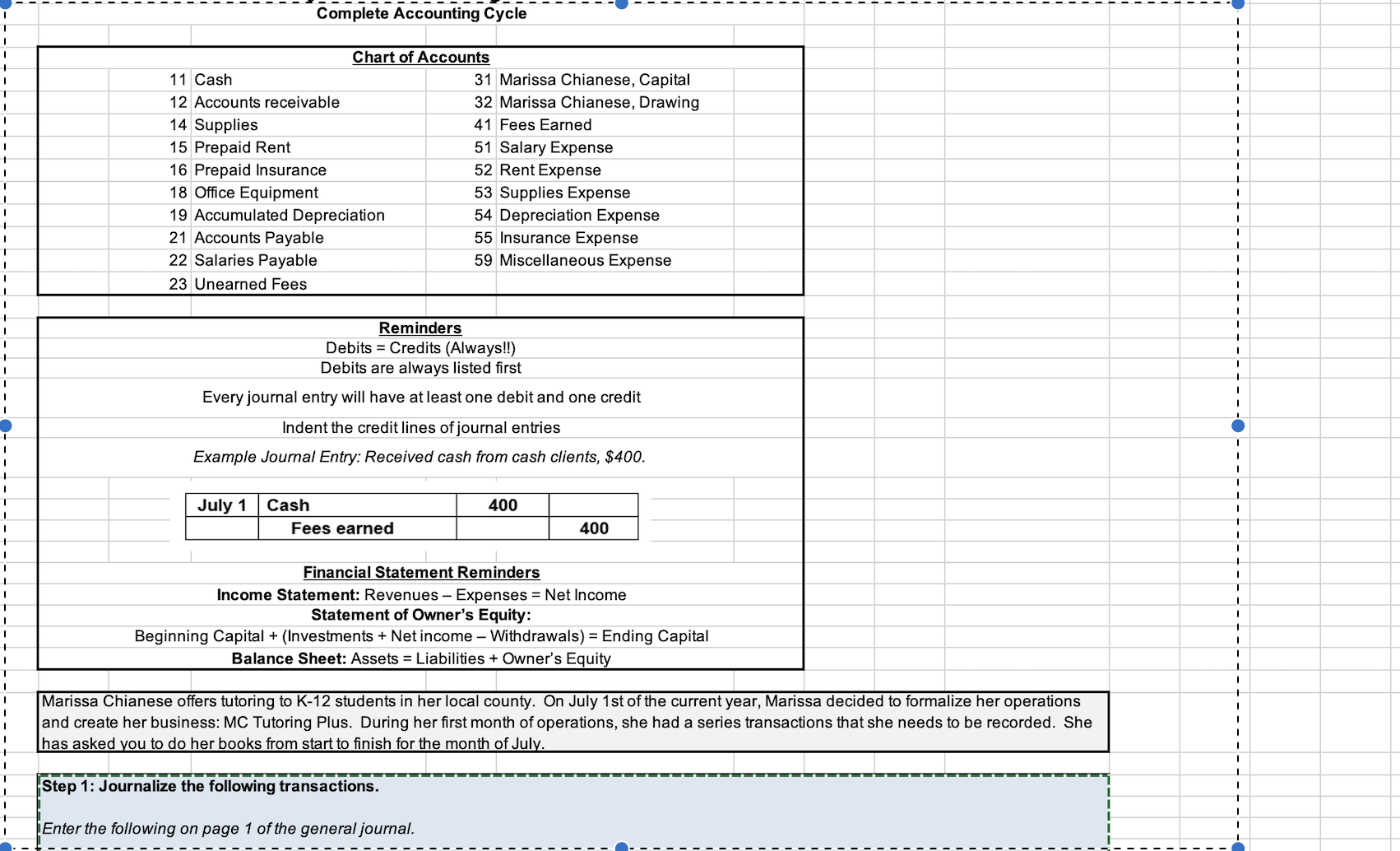

[Step 1 : Journalize the following transactions. Enter the following on page 1 of the general journal. July 1 Marissa Chianese contributed the following assets

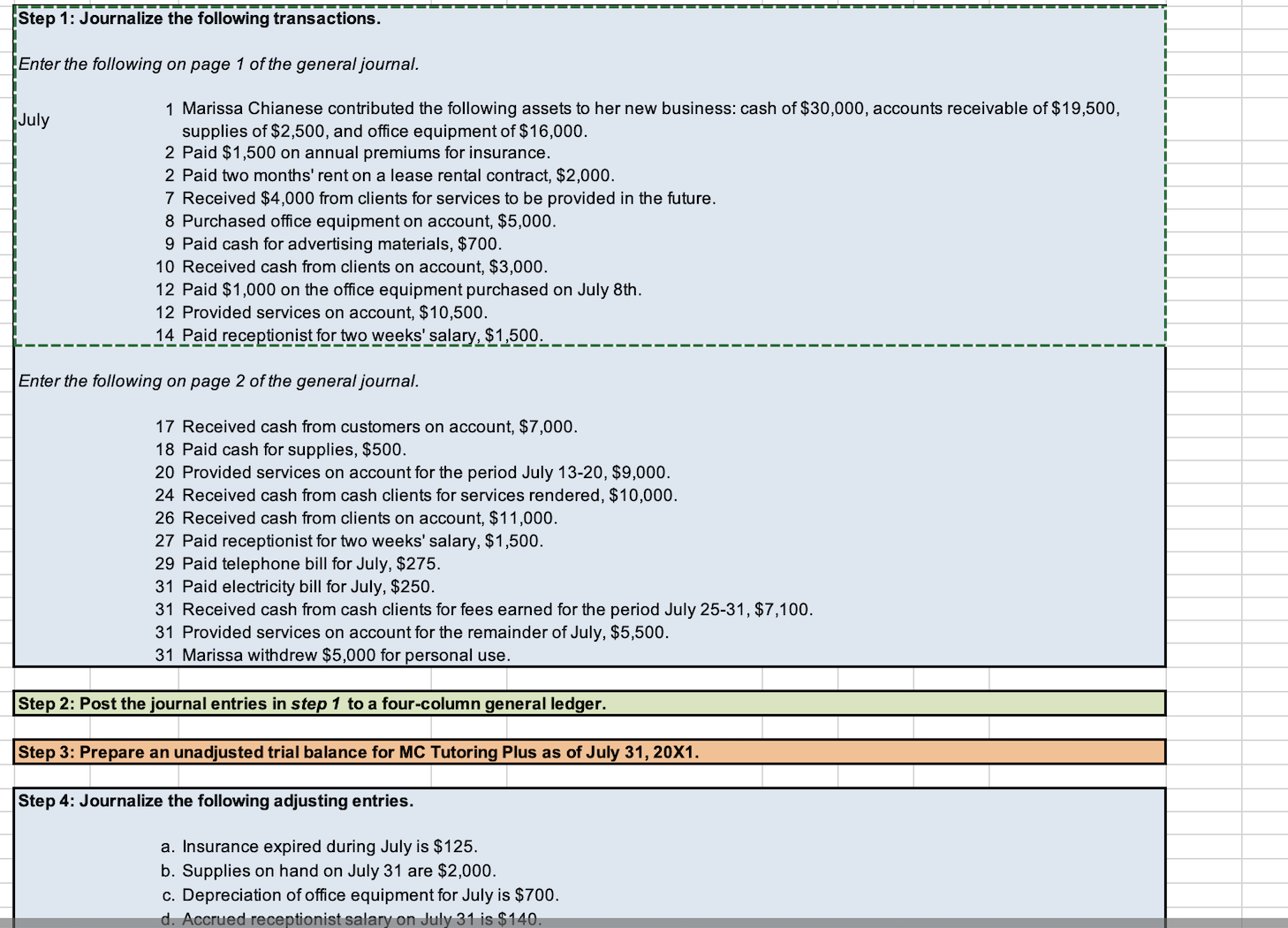

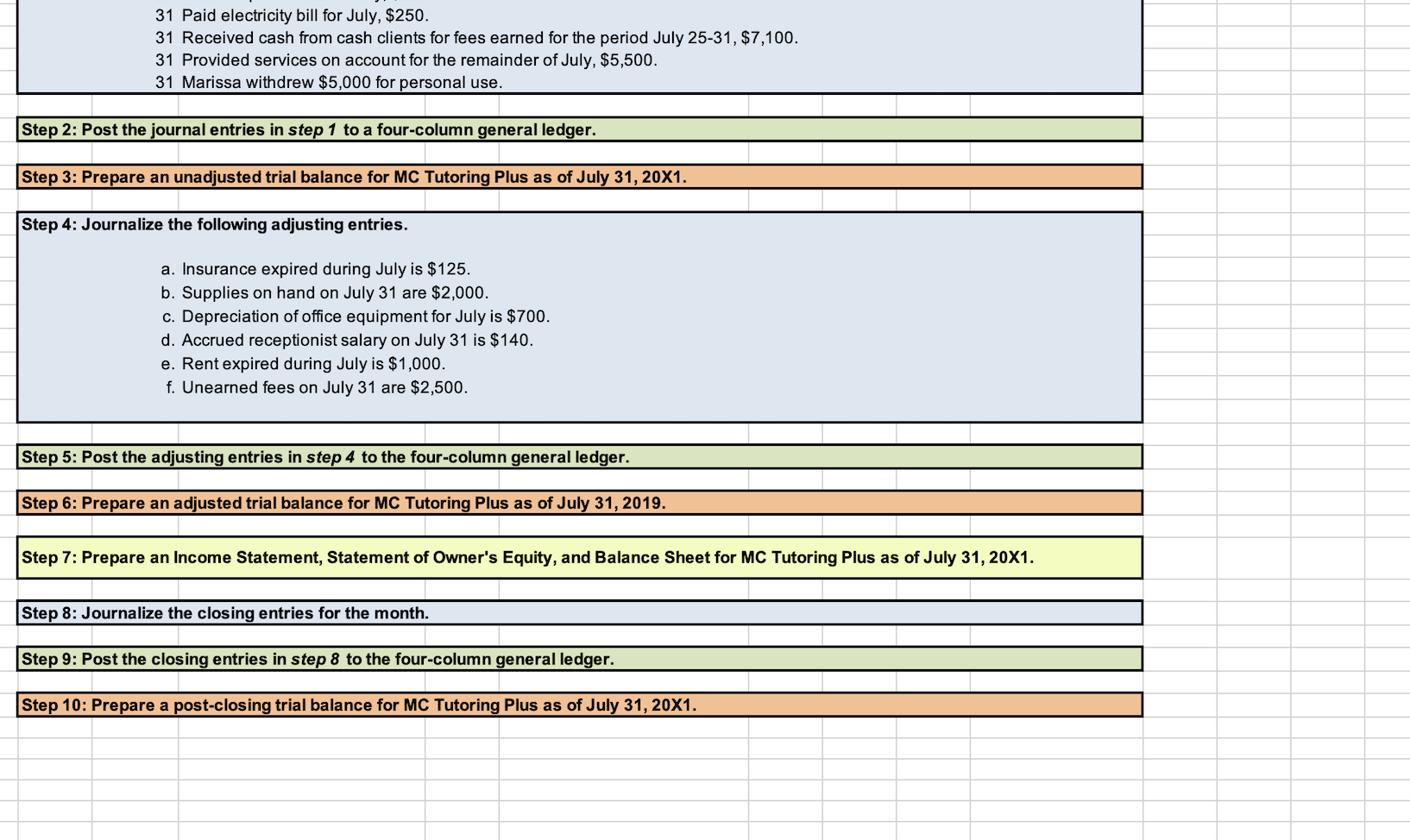

[Step 1 : Journalize the following transactions. Enter the following on page 1 of the general journal. July 1 Marissa Chianese contributed the following assets to her new business: cash of $30,000, accounts receivable of $19,500, supplies of $2,500, and office equipment of $16,000. 2 Paid $1,500 on annual premiums for insurance. 2 Paid two months' rent on a lease rental contract, $2,000. 7 Received $4,000 from clients for services to be provided in the future. 8 Purchased office equipment on account, $5,000. 9 Paid cash for advertising materials, $700. 10 Received cash from clients on account, $3,000. 12 Paid $1,000 on the office equipment purchased on July 8 th. 12 Provided services on account, $10,500. 14 Paid receptionist for two weeks' salary, $1,500. Enter the following on page 2 of the general journal. 17 Received cash from customers on account, $7,000. 18 Paid cash for supplies, $500. 20 Provided services on account for the period July 13-20, $9,000. 24 Received cash from cash clients for services rendered, $10,000. 26 Received cash from clients on account, $11,000. 27 Paid receptionist for two weeks' salary, $1,500. 29 Paid telephone bill for July, $275. 31 Paid electricity bill for July, $250. 31 Received cash from cash clients for fees earned for the period July 2531,$7,100. 31 Provided services on account for the remainder of July, $5,500. 31 Marissa withdrew $5,000 for personal use. Step 2: Post the journal entries in step 1 to a four-column general ledger. Step 3: Prepare an unadjusted trial balance for MC Tutoring Plus as of July 31, 20X1. Step 4: Journalize the following adjusting entries. a. Insurance expired during July is $125. b. Supplies on hand on July 31 are $2,000. c. Depreciation of office equipment for July is $700. d. Accrued receptionist salary on July 31 is $140. [Step 1 : Journalize the following transactions. Enter the following on page 1 of the general journal. July 1 Marissa Chianese contributed the following assets to her new business: cash of $30,000, accounts receivable of $19,500, supplies of $2,500, and office equipment of $16,000. 2 Paid $1,500 on annual premiums for insurance. 2 Paid two months' rent on a lease rental contract, $2,000. 7 Received $4,000 from clients for services to be provided in the future. 8 Purchased office equipment on account, $5,000. 9 Paid cash for advertising materials, $700. 10 Received cash from clients on account, $3,000. 12 Paid $1,000 on the office equipment purchased on July 8 th. 12 Provided services on account, $10,500. 14 Paid receptionist for two weeks' salary, $1,500. Enter the following on page 2 of the general journal. 17 Received cash from customers on account, $7,000. 18 Paid cash for supplies, $500. 20 Provided services on account for the period July 13-20, $9,000. 24 Received cash from cash clients for services rendered, $10,000. 26 Received cash from clients on account, $11,000. 27 Paid receptionist for two weeks' salary, $1,500. 29 Paid telephone bill for July, $275. 31 Paid electricity bill for July, $250. 31 Received cash from cash clients for fees earned for the period July 2531,$7,100. 31 Provided services on account for the remainder of July, $5,500. 31 Marissa withdrew $5,000 for personal use. Step 2: Post the journal entries in step 1 to a four-column general ledger. Step 3: Prepare an unadjusted trial balance for MC Tutoring Plus as of July 31, 20X1. Step 4: Journalize the following adjusting entries. a. Insurance expired during July is $125. b. Supplies on hand on July 31 are $2,000. c. Depreciation of office equipment for July is $700. d. Accrued receptionist salary on July 31 is $140

[Step 1 : Journalize the following transactions. Enter the following on page 1 of the general journal. July 1 Marissa Chianese contributed the following assets to her new business: cash of $30,000, accounts receivable of $19,500, supplies of $2,500, and office equipment of $16,000. 2 Paid $1,500 on annual premiums for insurance. 2 Paid two months' rent on a lease rental contract, $2,000. 7 Received $4,000 from clients for services to be provided in the future. 8 Purchased office equipment on account, $5,000. 9 Paid cash for advertising materials, $700. 10 Received cash from clients on account, $3,000. 12 Paid $1,000 on the office equipment purchased on July 8 th. 12 Provided services on account, $10,500. 14 Paid receptionist for two weeks' salary, $1,500. Enter the following on page 2 of the general journal. 17 Received cash from customers on account, $7,000. 18 Paid cash for supplies, $500. 20 Provided services on account for the period July 13-20, $9,000. 24 Received cash from cash clients for services rendered, $10,000. 26 Received cash from clients on account, $11,000. 27 Paid receptionist for two weeks' salary, $1,500. 29 Paid telephone bill for July, $275. 31 Paid electricity bill for July, $250. 31 Received cash from cash clients for fees earned for the period July 2531,$7,100. 31 Provided services on account for the remainder of July, $5,500. 31 Marissa withdrew $5,000 for personal use. Step 2: Post the journal entries in step 1 to a four-column general ledger. Step 3: Prepare an unadjusted trial balance for MC Tutoring Plus as of July 31, 20X1. Step 4: Journalize the following adjusting entries. a. Insurance expired during July is $125. b. Supplies on hand on July 31 are $2,000. c. Depreciation of office equipment for July is $700. d. Accrued receptionist salary on July 31 is $140. [Step 1 : Journalize the following transactions. Enter the following on page 1 of the general journal. July 1 Marissa Chianese contributed the following assets to her new business: cash of $30,000, accounts receivable of $19,500, supplies of $2,500, and office equipment of $16,000. 2 Paid $1,500 on annual premiums for insurance. 2 Paid two months' rent on a lease rental contract, $2,000. 7 Received $4,000 from clients for services to be provided in the future. 8 Purchased office equipment on account, $5,000. 9 Paid cash for advertising materials, $700. 10 Received cash from clients on account, $3,000. 12 Paid $1,000 on the office equipment purchased on July 8 th. 12 Provided services on account, $10,500. 14 Paid receptionist for two weeks' salary, $1,500. Enter the following on page 2 of the general journal. 17 Received cash from customers on account, $7,000. 18 Paid cash for supplies, $500. 20 Provided services on account for the period July 13-20, $9,000. 24 Received cash from cash clients for services rendered, $10,000. 26 Received cash from clients on account, $11,000. 27 Paid receptionist for two weeks' salary, $1,500. 29 Paid telephone bill for July, $275. 31 Paid electricity bill for July, $250. 31 Received cash from cash clients for fees earned for the period July 2531,$7,100. 31 Provided services on account for the remainder of July, $5,500. 31 Marissa withdrew $5,000 for personal use. Step 2: Post the journal entries in step 1 to a four-column general ledger. Step 3: Prepare an unadjusted trial balance for MC Tutoring Plus as of July 31, 20X1. Step 4: Journalize the following adjusting entries. a. Insurance expired during July is $125. b. Supplies on hand on July 31 are $2,000. c. Depreciation of office equipment for July is $700. d. Accrued receptionist salary on July 31 is $140 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started