Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Step #1: List five (5) bullets that describe the immigration debate going on in the U.S. These five (5) bullets should include a point

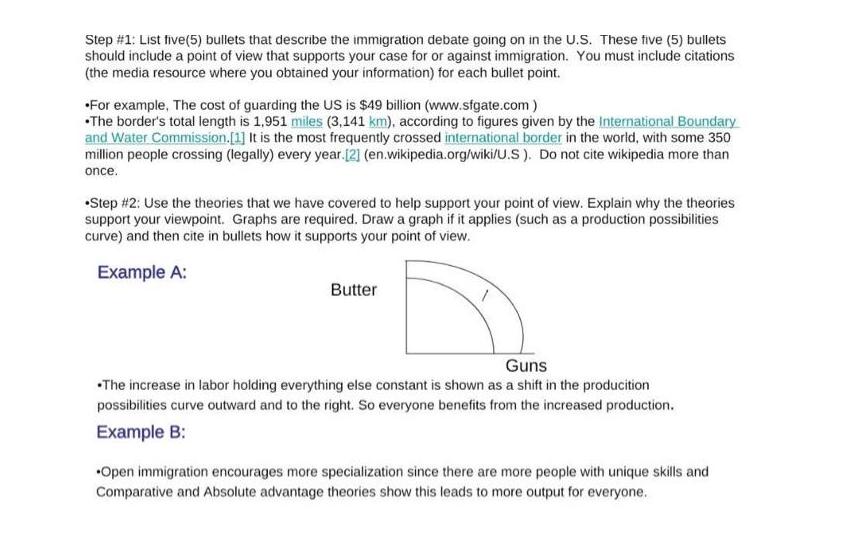

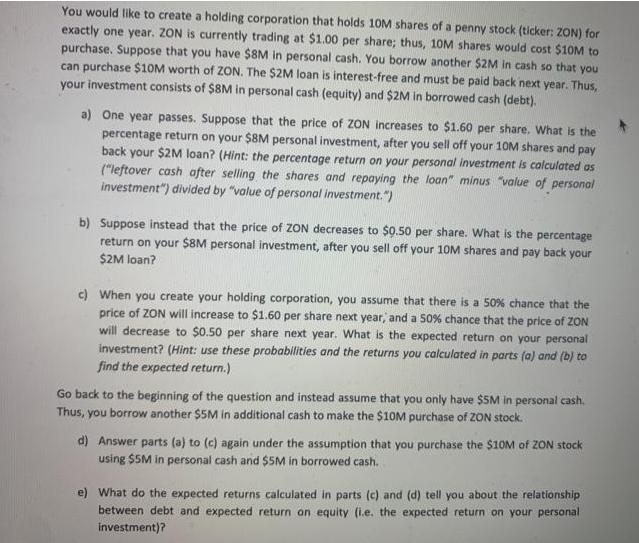

Step #1: List five (5) bullets that describe the immigration debate going on in the U.S. These five (5) bullets should include a point of view that supports your case for or against immigration. You must include citations (the media resource where you obtained your information) for each bullet point. For example, The cost of guarding the US is $49 billion (www.sfgate.com) The border's total length is 1,951 miles (3,141 km), according to figures given by the International Boundary and Water Commission.[1] It is the most frequently crossed international border in the world, with some 350 million people crossing (legally) every year.[2] (en.wikipedia.org/wiki/U.S). Do not cite wikipedia more than once. Step #2: Use the theories that we have covered to help support your point of view. Explain why the theories support your viewpoint. Graphs are required. Draw a graph if it applies (such as a production possibilities curve) and then cite in bullets how it supports your point of view. Example A: Butter Guns The increase in labor holding everything else constant is shown as a shift in the producition possibilities curve outward and to the right. So everyone benefits from the increased production. Example B: Open immigration encourages more specialization since there are more people with unique skills and Comparative and Absolute advantage theories show this leads to more output for everyone. You would like to create a holding corporation that holds 10M shares of a penny stock (ticker: ZON) for exactly one year. ZON is currently trading at $1.00 per share; thus, 10M shares would cost $10M to purchase. Suppose that you have $8M in personal cash. You borrow another $2M in cash so that you can purchase $10M worth of ZON. The $2M loan is interest-free and must be paid back next year. Thus, your investment consists of $8M in personal cash (equity) and $2M in borrowed cash (debt). a) One year passes. Suppose that the price of ZON increases to $1.60 per share. What is the percentage return on your $8M personal investment, after you sell off your 10M shares and pay back your $2M loan? (Hint: the percentage return on your personal investment is calculated as ("leftover cash after selling the shares and repaying the loan" minus "value of personal investment") divided by "value of personal investment.") b) Suppose instead that the price of ZON decreases to $0.50 per share. What is the percentage return on your $8M personal investment, after you sell off your 10M shares and pay back your $2M loan? c) When you create your holding corporation, you assume that there is a 50% chance that the price of ZON will increase to $1.60 per share next year, and a 50% chance that the price of ZON will decrease to $0.50 per share next year. What is the expected return on your personal investment? (Hint: use these probabilities and the returns you calculated in parts (a) and (b) to find the expected return.) Go back to the beginning of the question and instead assume that you only have $5M in personal cash. Thus, you borrow another $5M in additional cash to make the $10M purchase of ZON stock. d) Answer parts (a) to (c) again under the assumption that you purchase the $10M of ZON stock using $5M in personal cash and $5M in borrowed cash. e) What do the expected returns calculated in parts (c) and (d) tell you about the relationship between debt and expected return on equity (i.e. the expected return on your personal investment)?

Step by Step Solution

★★★★★

3.31 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

The following information is provided in the question Price of Stock 1 No of shares to be purchased 10M Available cash Equity 8M Interest free loan De...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started