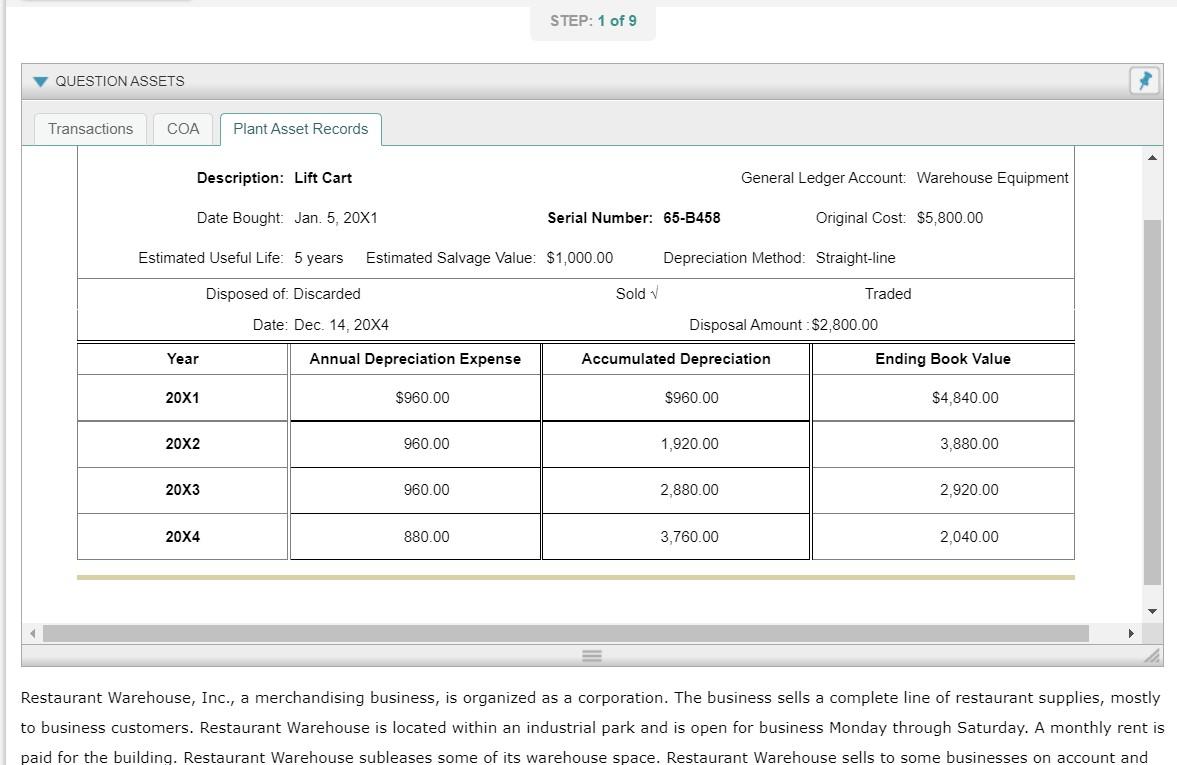

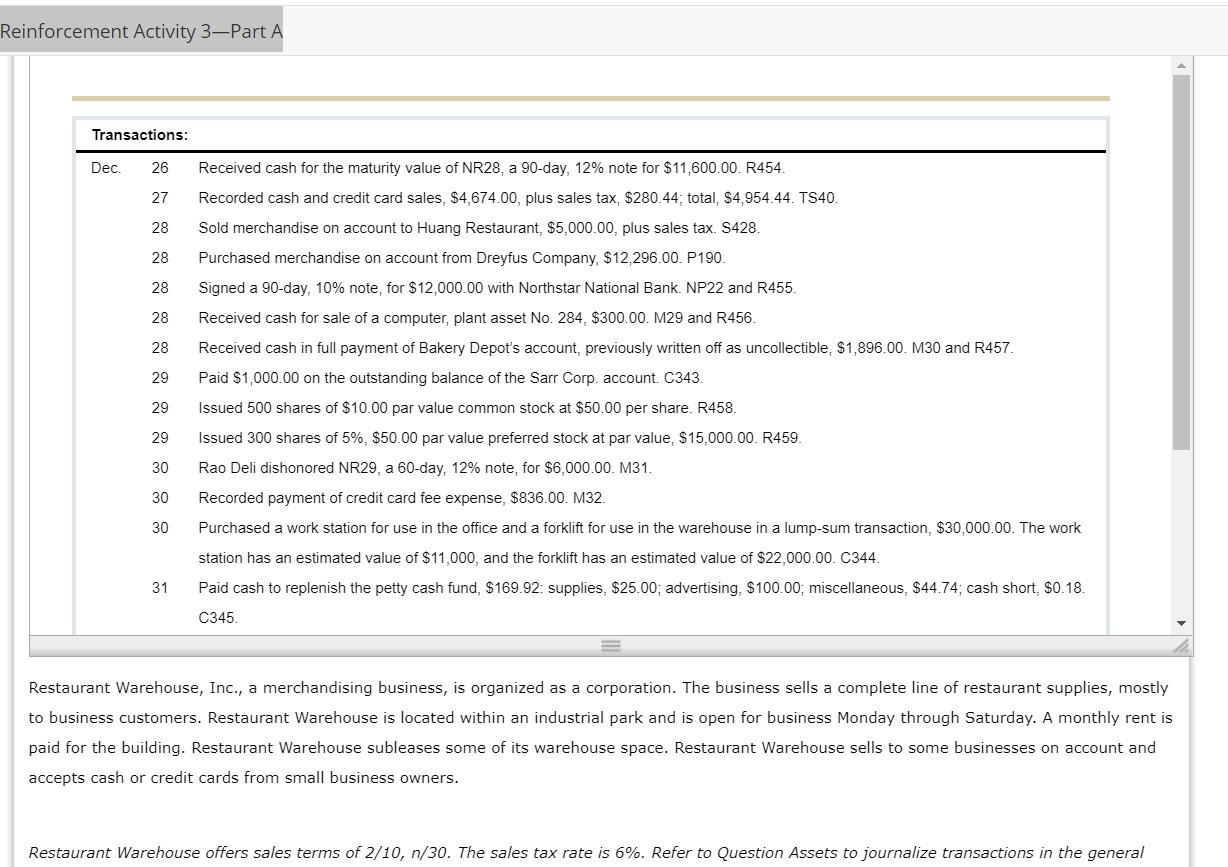

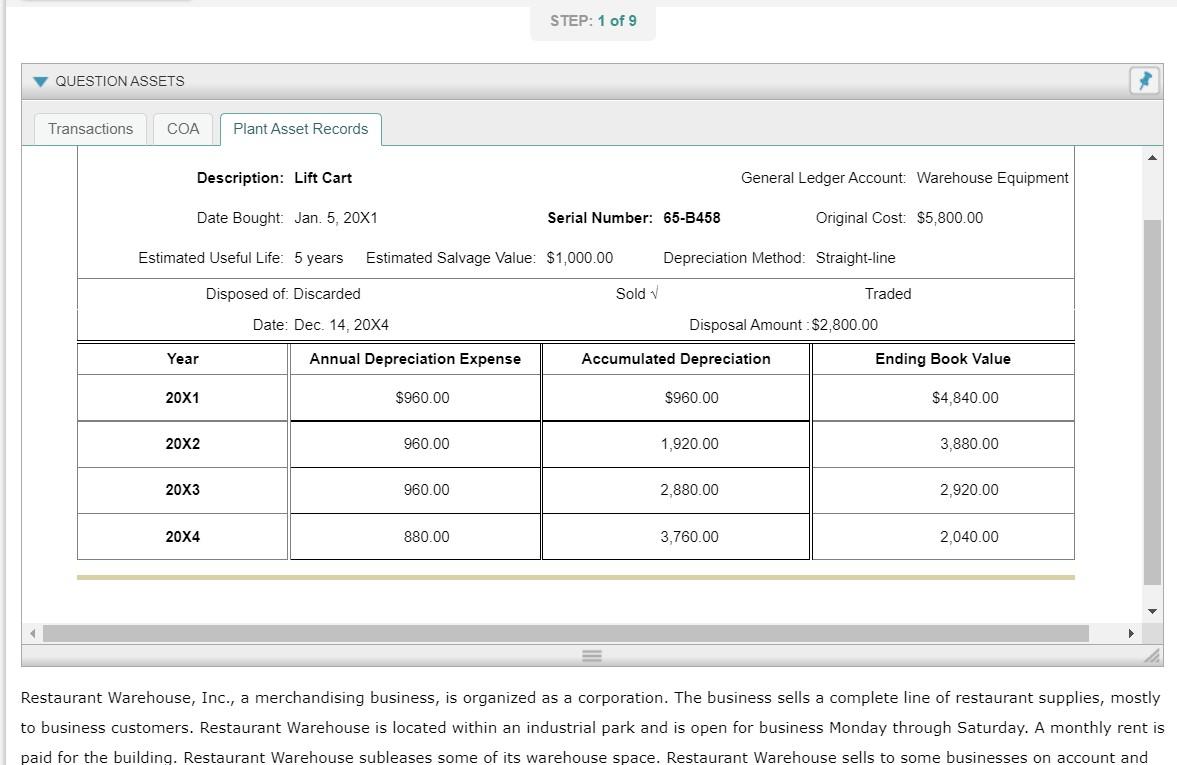

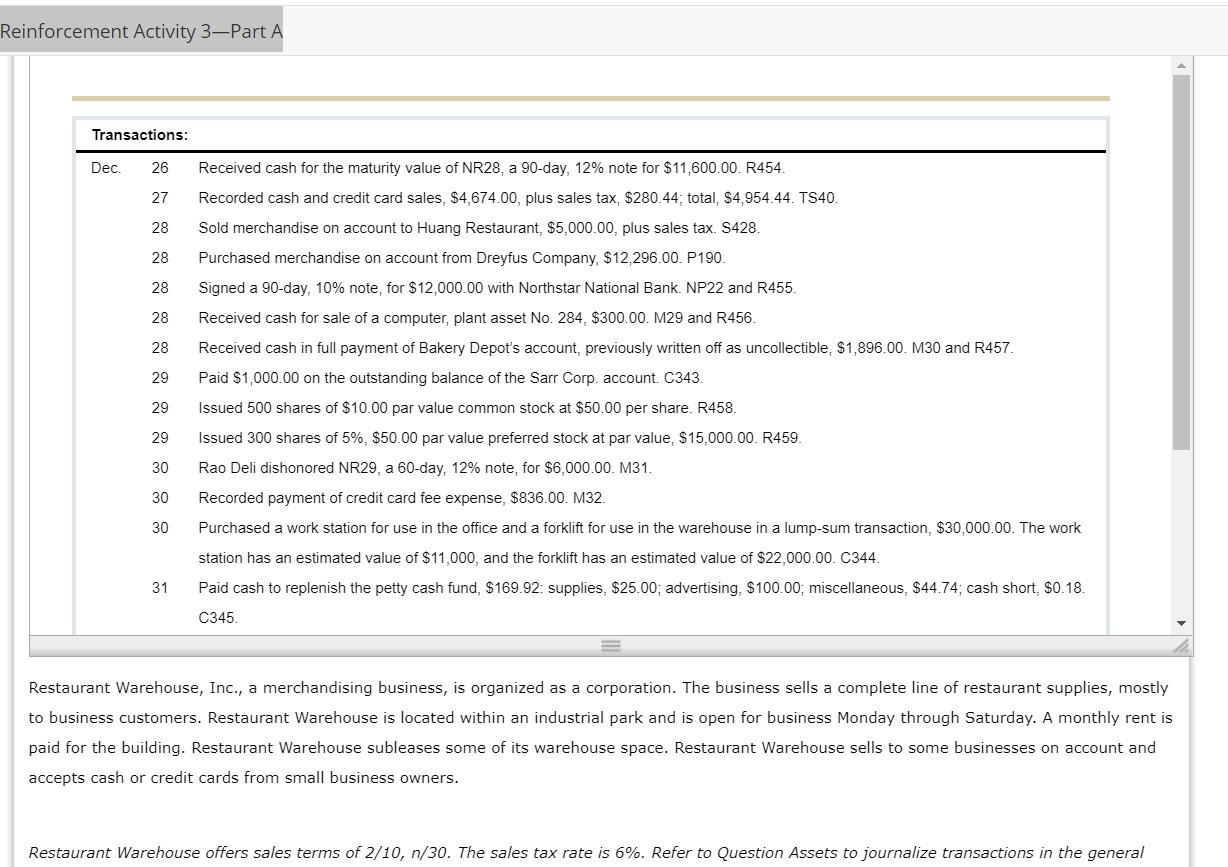

STEP: 1 of 9 QUESTION ASSETS Transactions COA Plant Asset Records Description: Lift Cart General Ledger Account: Warehouse Equipment Date Bought: Jan. 5, 20X1 Serial Number: 65-B458 Original Cost: $5,800.00 Estimated Useful Life: 5 years Estimated Salvage Value: $1,000.00 Depreciation Method: Straight-line Disposed of: Discarded Sold V Traded Date: Dec. 14, 20X4 Disposal Amount: $2,800.00 Year Annual Depreciation Expense Accumulated Depreciation Ending Book Value 20X1 $960.00 $960.00 $4,840.00 20X2 960.00 1,920.00 3,880.00 20X3 960.00 2,880.00 2,920.00 20X4 880.00 3,760.00 2,040.00 Restaurant Warehouse, Inc., a merchandising business, is organized as a corporation. The business sells a complete line of restaurant supplies, mostly to business customers. Restaurant Warehouse is located within an industrial park and is open for business Monday through Saturday. A monthly rent is paid for the building. Restaurant Warehouse subleases some of its warehouse space. Restaurant Warehouse sells to some businesses on account and Reinforcement Activity 3Part A Transactions: Dec 26 27 28 28 28 28 28 29 Received cash for the maturity value of NR28, a 90-day, 12% note for $11,600.00 R454. Recorded cash and credit card sales, $4,674.00, plus sales tax, $280.44, total, $4,954.44. TS40. Sold merchandise on account to Huang Restaurant, $5,000.00, plus sales tax. S428. Purchased merchandise on account from Dreyfus Company, $12,296.00. P190. Signed a 90-day, 10% note, for $12,000.00 with Northstar National Bank. NP22 and R455 Received cash for sale of a computer, plant asset No. 284, $300.00. M29 and R456. Received cash in full payment of Bakery Depot's account, previously written off as uncollectible, S1,896.00. M30 and R457. Paid $1,000.00 on the outstanding balance of the Sarr Corp. account. C343. Issued 500 shares of $10.00 par value common stock at $50.00 per share. R458. Issued 300 shares of 5%, $50.00 par value preferred stock at par value, $15,000.00. R459. Rao Deli dishonored NR29, a 60-day, 12% note, for $6,000.00. M31. Recorded payment of credit card fee expense, $836.00. M32. Purchased a work station for use in the office and a forklift for use in the warehouse in a lump-sum transaction, $30,000.00. The work station has an estimated value of $11,000, and the forklift has an estimated value of $22,000.00. C344. Paid cash to replenish the petty cash fund, $169.92: supplies, $25.00, advertising, $100.00; miscellaneous, $44.74; cash short, $0.18. C345 29 29 30 30 30 31 Restaurant Warehouse, Inc., a merchandising business, is organized as a corporation. The business sells a complete line of restaurant supplies, mostly to business customers. Restaurant Warehouse is located within an industrial park and is open for business Monday through Saturday. A monthly rent is paid for the building. Restaurant Warehouse subleases some of its warehouse space. Restaurant Warehouse sells to some businesses on account and accepts cash or credit cards from small business owners. Restaurant Warehouse offers sales terms of 2/10, n/30. The sales tax rate is 6%. Refer to Question Assets to journalize transactions in the general STEP: 1 of 9 QUESTION ASSETS Transactions COA Plant Asset Records Description: Lift Cart General Ledger Account: Warehouse Equipment Date Bought: Jan. 5, 20X1 Serial Number: 65-B458 Original Cost: $5,800.00 Estimated Useful Life: 5 years Estimated Salvage Value: $1,000.00 Depreciation Method: Straight-line Disposed of: Discarded Sold V Traded Date: Dec. 14, 20X4 Disposal Amount: $2,800.00 Year Annual Depreciation Expense Accumulated Depreciation Ending Book Value 20X1 $960.00 $960.00 $4,840.00 20X2 960.00 1,920.00 3,880.00 20X3 960.00 2,880.00 2,920.00 20X4 880.00 3,760.00 2,040.00 Restaurant Warehouse, Inc., a merchandising business, is organized as a corporation. The business sells a complete line of restaurant supplies, mostly to business customers. Restaurant Warehouse is located within an industrial park and is open for business Monday through Saturday. A monthly rent is paid for the building. Restaurant Warehouse subleases some of its warehouse space. Restaurant Warehouse sells to some businesses on account and Reinforcement Activity 3Part A Transactions: Dec 26 27 28 28 28 28 28 29 Received cash for the maturity value of NR28, a 90-day, 12% note for $11,600.00 R454. Recorded cash and credit card sales, $4,674.00, plus sales tax, $280.44, total, $4,954.44. TS40. Sold merchandise on account to Huang Restaurant, $5,000.00, plus sales tax. S428. Purchased merchandise on account from Dreyfus Company, $12,296.00. P190. Signed a 90-day, 10% note, for $12,000.00 with Northstar National Bank. NP22 and R455 Received cash for sale of a computer, plant asset No. 284, $300.00. M29 and R456. Received cash in full payment of Bakery Depot's account, previously written off as uncollectible, S1,896.00. M30 and R457. Paid $1,000.00 on the outstanding balance of the Sarr Corp. account. C343. Issued 500 shares of $10.00 par value common stock at $50.00 per share. R458. Issued 300 shares of 5%, $50.00 par value preferred stock at par value, $15,000.00. R459. Rao Deli dishonored NR29, a 60-day, 12% note, for $6,000.00. M31. Recorded payment of credit card fee expense, $836.00. M32. Purchased a work station for use in the office and a forklift for use in the warehouse in a lump-sum transaction, $30,000.00. The work station has an estimated value of $11,000, and the forklift has an estimated value of $22,000.00. C344. Paid cash to replenish the petty cash fund, $169.92: supplies, $25.00, advertising, $100.00; miscellaneous, $44.74; cash short, $0.18. C345 29 29 30 30 30 31 Restaurant Warehouse, Inc., a merchandising business, is organized as a corporation. The business sells a complete line of restaurant supplies, mostly to business customers. Restaurant Warehouse is located within an industrial park and is open for business Monday through Saturday. A monthly rent is paid for the building. Restaurant Warehouse subleases some of its warehouse space. Restaurant Warehouse sells to some businesses on account and accepts cash or credit cards from small business owners. Restaurant Warehouse offers sales terms of 2/10, n/30. The sales tax rate is 6%. Refer to Question Assets to journalize transactions in the general