Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Step 1: Quick Take: Evaluating Lump Sums and Annuities Present value (PV) represents the value of a future cash flow, or series of cash

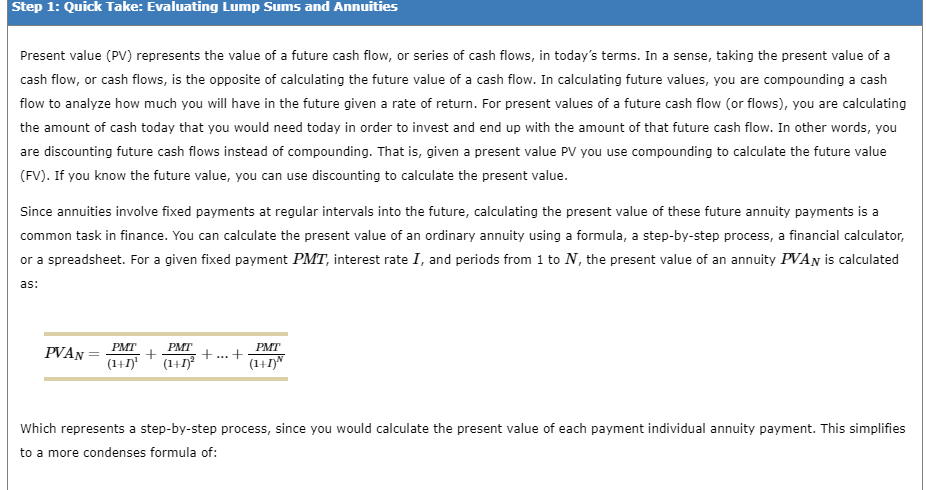

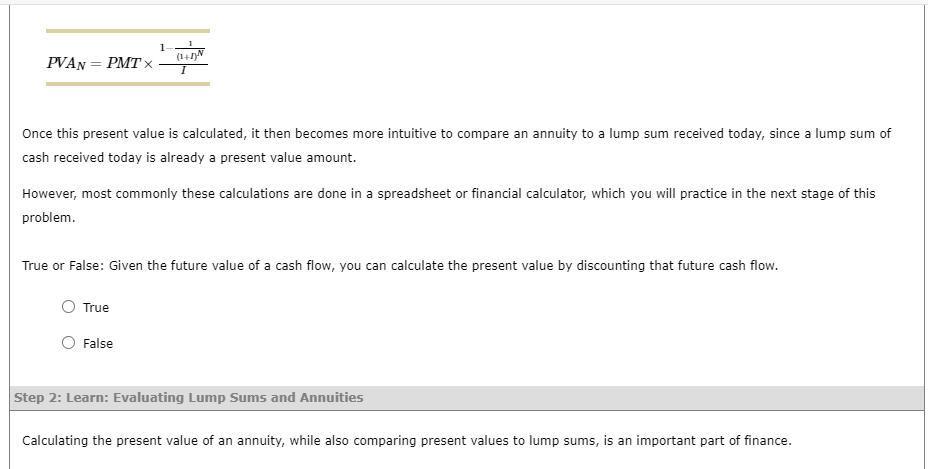

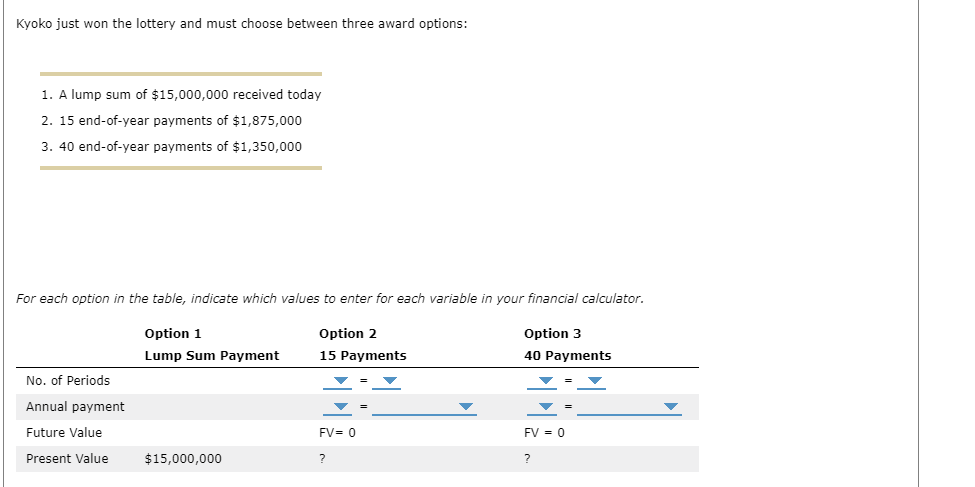

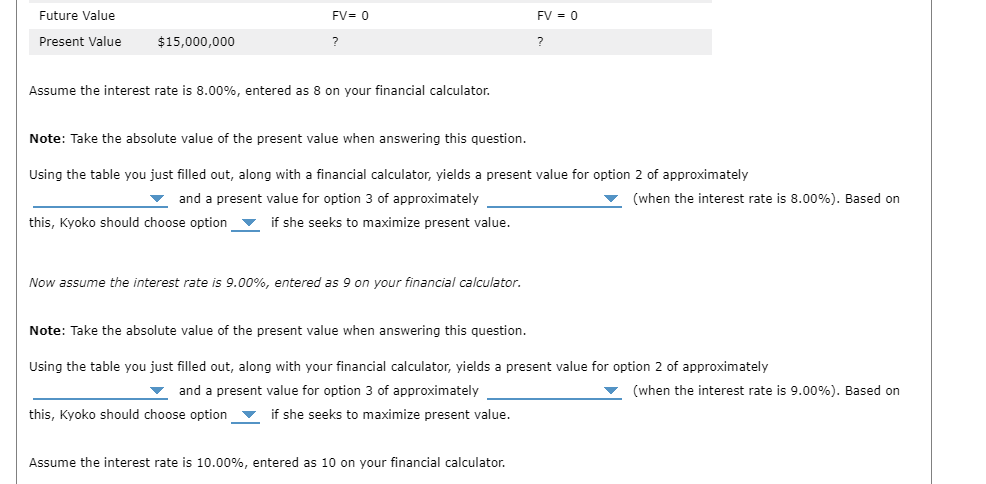

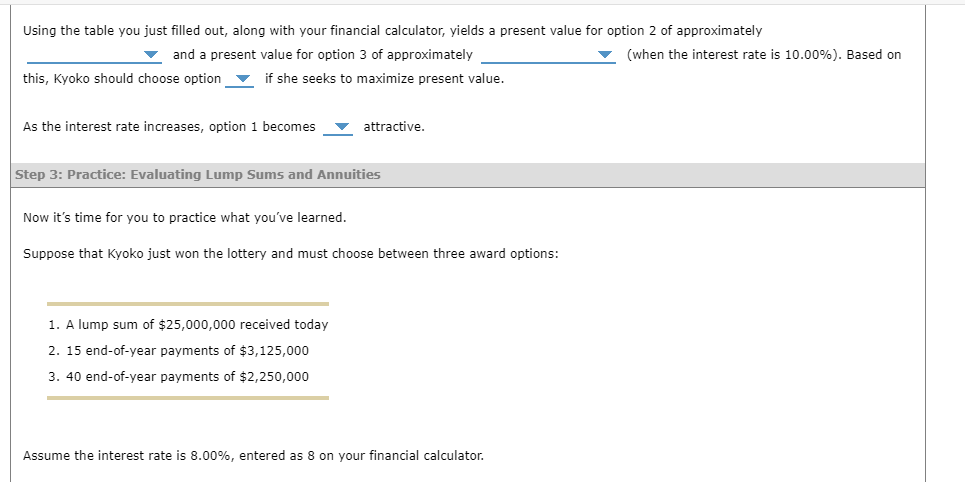

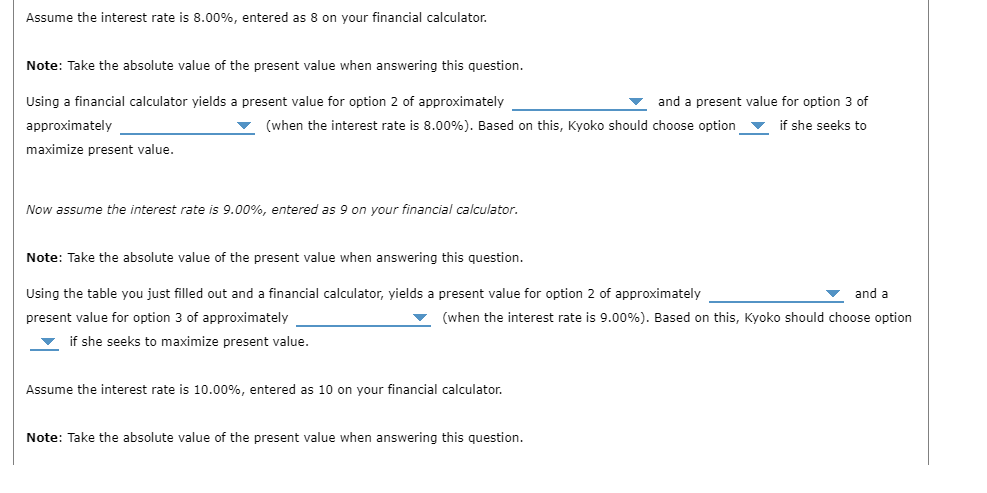

Step 1: Quick Take: Evaluating Lump Sums and Annuities Present value (PV) represents the value of a future cash flow, or series of cash flows, in today's terms. In a sense, taking the present value of a cash flow, or cash flows, is the opposite of calculating the future value of a cash flow. In calculating future values, you are compounding a cash flow to analyze how much you will have in the future given a rate of return. For present values of a future cash flow (or flows), you are calculating the amount of cash today that you would need today in order to invest and end up with the amount of that future cash flow. In other words, you are discounting future cash flows instead of compounding. That is, given a present value PV you use compounding to calculate the future value (FV). If you know the future value, you can use discounting to calculate the present value. Since annuities involve fixed payments at regular intervals into the future, calculating the present value of these future annuity payments is a common task in finance. You can calculate the present value of an ordinary annuity using a formula, a step-by-step process, a financial calculator, or a spreadsheet. For a given fixed payment PMT, interest rate I, and periods from 1 to N, the present value of an annuity PVAN is calculated as: PVAN PMT PMT (1+1) (1+1) + ... PMT (1+1) Which represents a step-by-step process, since you would calculate the present value of each payment individual annuity payment. This simplifies to a more condenses formula of: PVAN = PMT x 1 Once this present value is calculated, it then becomes more intuitive to compare an annuity to a lump sum received today, since a lump sum of cash received today is already a present value amount. (1+1)N However, most commonly these calculations are done in a spreadsheet or financial calculator, which you will practice in the next stage of this problem. True True or False: Given the future value of a cash flow, you can calculate the present value by discounting that future cash flow. False Step 2: Learn: Evaluating Lump Sums and Annuities Calculating the present value of an annuity, while also comparing present values to lump sums, is an important part of finance. Kyoko just won the lottery and must choose between three award options: 1. A lump sum of $15,000,000 received today 2. 15 end-of-year payments of $1,875,000 3. 40 end-of-year payments of $1,350,000 For each option in the table, indicate which values to enter for each variable in your financial calculator. No. of Periods Annual payment Future Value Present Value Option 1 Lump Sum Payment $15,000,000 Option 2 15 Payments FV= 0 ? Option 3 40 Payments FV = 0 ? Future Value Present Value $15,000,000 FV= 0 ? Assume the interest rate is 8.00%, entered as 8 on your financial calculator. Note: Take the absolute value of the present value when answering this question. Using the table you just filled out, along with a financial calculator, yields a present value for option 2 of approximately and a present value for option 3 of approximately this, Kyoko should choose option if she seeks to maximize present value. Now assume the interest rate is 9.00%, entered as 9 on your financial calculator. Note: Take the absolute value of the present value when answering this question. FV = 0 Assume the interest rate is 10.00%, entered as 10 on your financial calculator. (when the interest rate is 8.00%). Based on Using the table you just filled out, along with your financial calculator, yields a present value for option 2 of approximately and a present value for option 3 of approximately this, Kyoko should choose option if she seeks to maximize present value. (when the interest rate is 9.00%). Based on Using the table you just filled out, along with your financial calculator, yields a present value for option 2 of approximately and a present value for option 3 of approximately if she seeks to maximize present value. this, Kyoko should choose option As the interest rate increases, option 1 becomes attractive. Step 3: Practice: Evaluating Lump Sums and Annuities Now it's time for you to practice what you've learned. Suppose that Kyoko just won the lottery and must choose between three award options: 1. A lump sum of $25,000,000 received today 2. 15 end-of-year payments of $3,125,000 3. 40 end-of-year payments of $2,250,000 Assume the interest rate is 8.00%, entered as 8 on your financial calculator. (when the interest rate is 10.00%). Based on Assume the interest rate is 8.00%, entered as 8 on your financial calculator. Note: Take the absolute value of the present value when answering this question. Using a financial calculator yields a present value for option 2 of approximately approximately (when the interest rate is 8.00% ). Based on this, Kyoko should choose option maximize present value. Now assume the interest rate is 9.00%, entered as 9 on your financial calculator. Note: Take the absolute value of the present value when answering this question. Using the table you just filled out and a financial calculator, yields a present value for option 2 of approximately present value for option 3 of approximately if she seeks to maximize present value. and a present value for option 3 of if she seeks to and a (when the interest rate is 9.00 %) . Based on this, Kyoko should choose option Assume the interest rate is 10.00 %, entered as 10 on your financial calculator. Note: Take the absolute value of the present value when answering this question.

Step by Step Solution

★★★★★

3.32 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Option 1 Lump Sum Payment No of Periods 1 since its a lump sum received today Annu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started