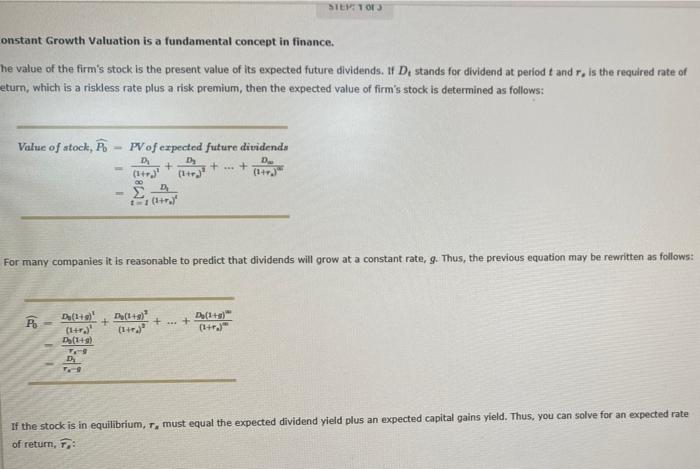

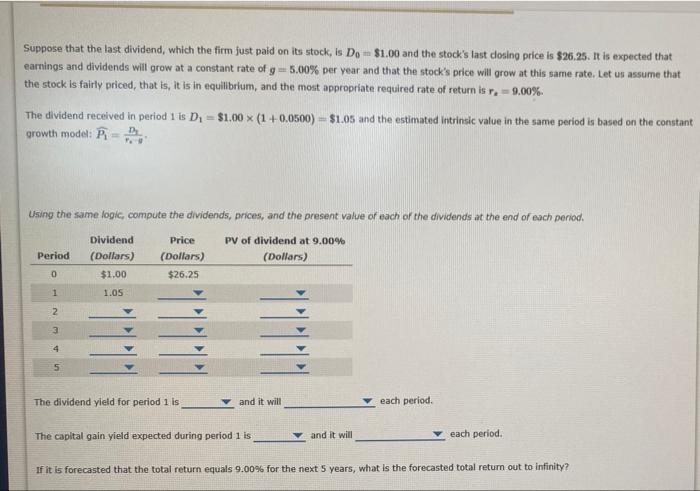

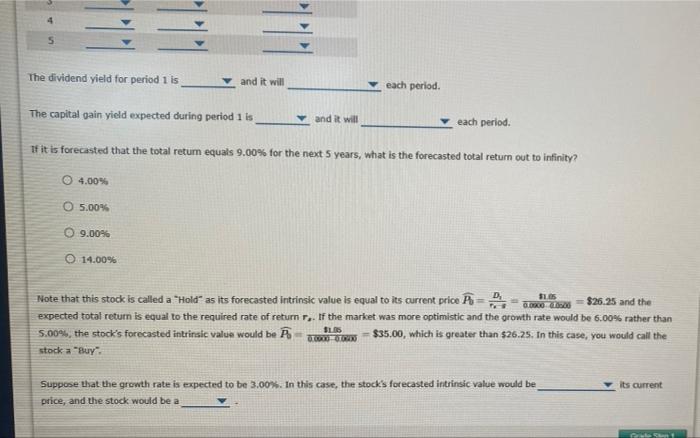

STEP 13 onstant Growth Valuation is a fundamental concept in finance. he value of the firm's stock is the present value of its expected future dividends. If De stands for dividend at period t and r, is the required rate of return, which is a riskless rate plus a risk premium, then the expected value of firm's stock is determined as follows: Value of stock, P PV of expected future dividende D + + (1+r) (1tr3 + For many companies it is reasonable to predict that dividends will grow at a constant rate, g. Thus, the previous equation may be rewritten as follows: A D) + + (11) D(1) ... + (1+) D(149) D T. If the stock is in equilibrium, T, must equal the expected dividend yield plus an expected capital gains yield. Thus, you can solve for an expected rate of return, 7, Suppose that the last dividend, which the firm just paid on its stock, is Do - $1.00 and the stock's last dosing price is $26.25. It is expected that earnings and dividends will grow at a constant rate of g = 5.00% per year and that the stock's price will grow at this same rate. Let us assume that the stock is fairly priced, that is, it is in equilibrium, and the most appropriate required rate of return is r. - 9.00% The dividend received in period 1 is Di = $1.00 (1 +0.0500) $1.05 and the estimated intrinsic value in the same period is based on the constant growth model: Using the same logic, compute the dividends, prices, and the present value of each of the dividends at the end of each period. Dividend (Dollars) $1.00 Period Price (Dollars) $26.25 PV of dividend at 9.00% (Dollars) 0 1 1.05 2 3 4 The dividend yield for period 1 is and it will each period. The capital gain yield expected during period 1 is and it will each period. If it is forecasted that the total return equals 9.00% for the next 5 years, what is the forecasted total return out to infinity? 5 The dividend yield for period 1 is and it will each period. The capital gain yield expected during period 1 is y and it will each period. If it is forecasted that the total retum equals 9.00% for the next 5 years, what is the forecasted total return out to infinity? 4.00% O 5.00% 9.00% 14.00% D. Note that this stock is called a "Hold" as its forecasted intrinsic value is equal to its current price A-= $26.25 and the expected total return is equal to the required rate of return s. If the market was more optimistic and the growth rate would be 6.00% rather than 5.00% the stock's forecasted intrinsic value would be R $35.00, which is greater than $26.25. In this case, you would call the stock a "Buy": S. TRX TX its current Suppose that the growth rate is expected to be 3.00%. In this case, the stock's forecasted intrinsic value would be price, and the stock would be a