Answered step by step

Verified Expert Solution

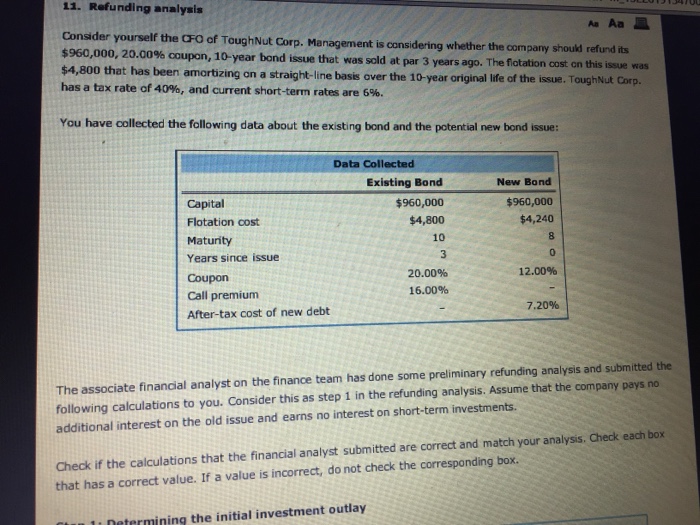

Question

1 Approved Answer

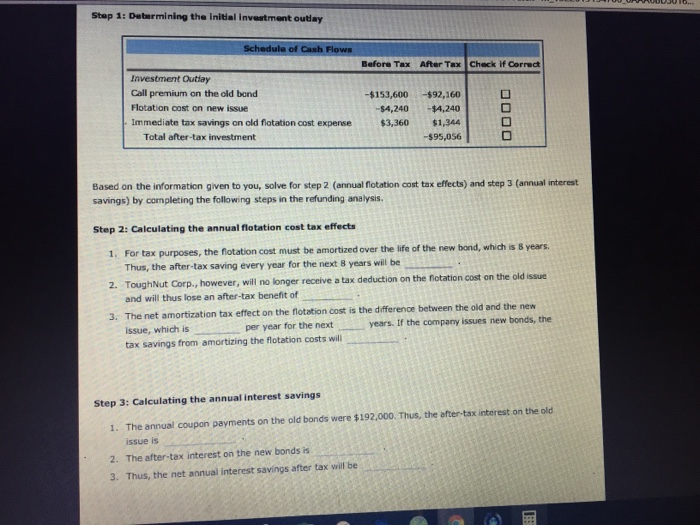

Step 2 1. 190.80, 254.40, 212.00 2. 249.60, 192.00, 212.00, 153.60 3.1. 12.00, 26.00, 20.00, 16.00 3.2. 13, 8, 3, 10 3.3. Decrease/increase Step 3

Step 2

1. 190.80, 254.40, 212.00

2. 249.60, 192.00, 212.00, 153.60

3.1. 12.00, 26.00, 20.00, 16.00

3.2. 13, 8, 3, 10

3.3. Decrease/increase

Step 3

1. 149,760, 92,160, 69,120, 115,200

2. 69,120, 82,944, 96,768, 62,208

3. 55,296, 50,688, 46080, 59904

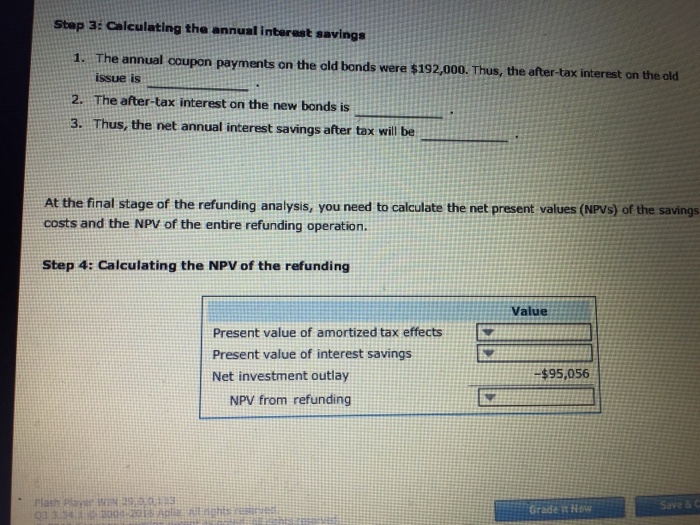

Step 4

1. 237.02, 142.21, 248.87, 118.51

2. 491,467.50, 273037.50, 327,645.00, 436,860.00

3. 213,720.01, 178,100.01, 274,156.01, -94,937.49

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started