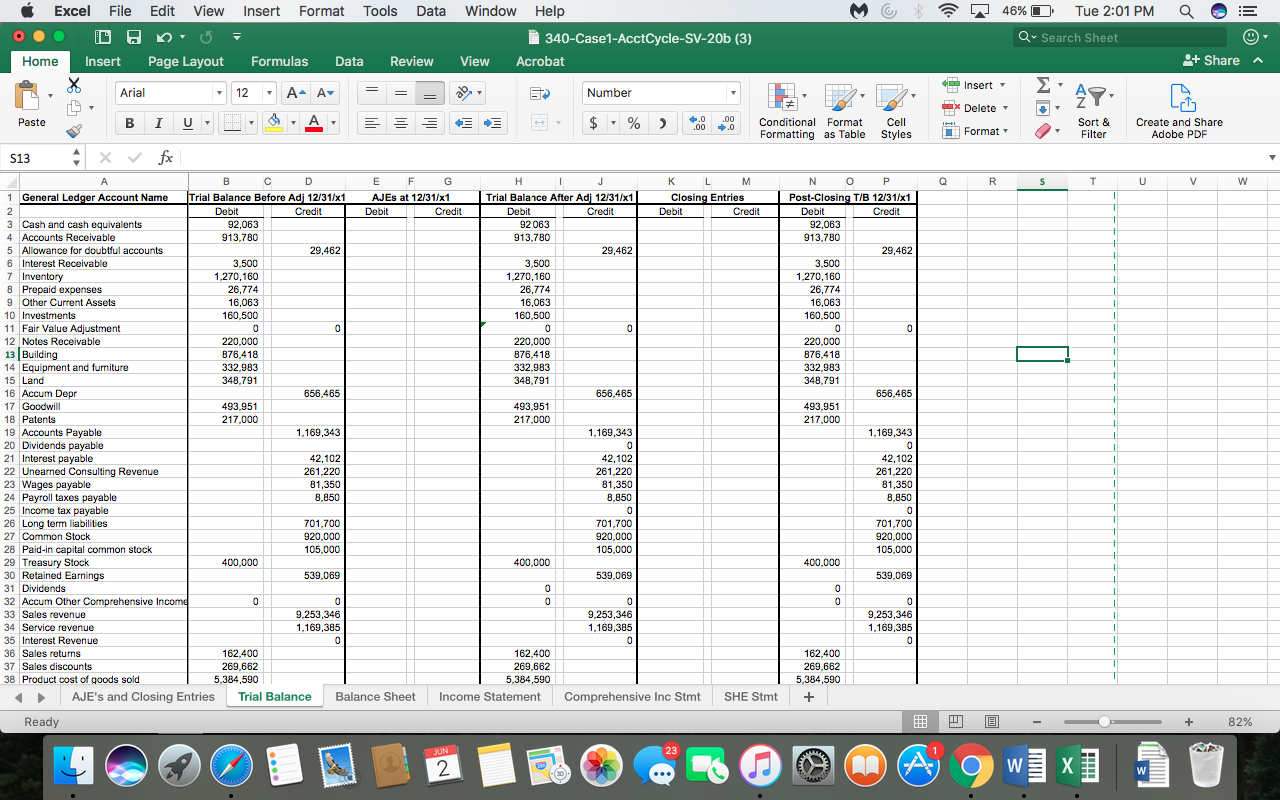

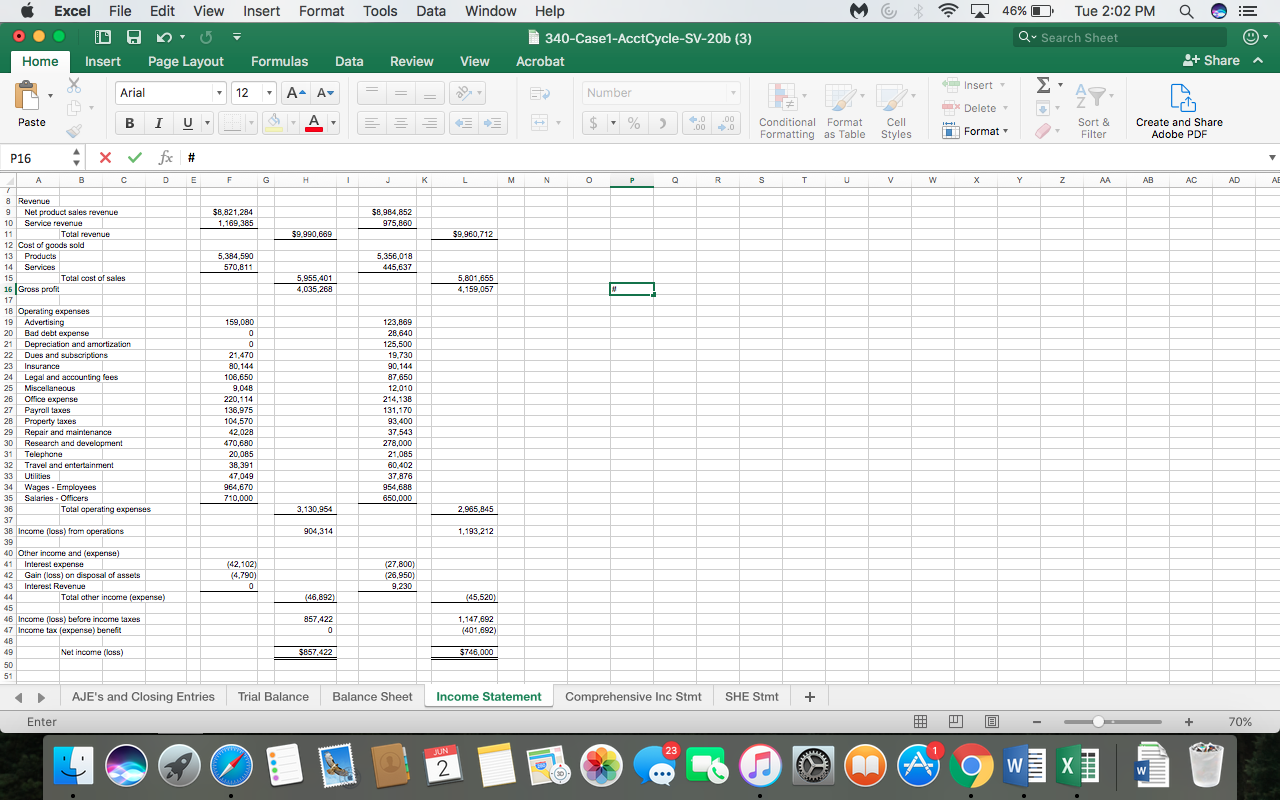

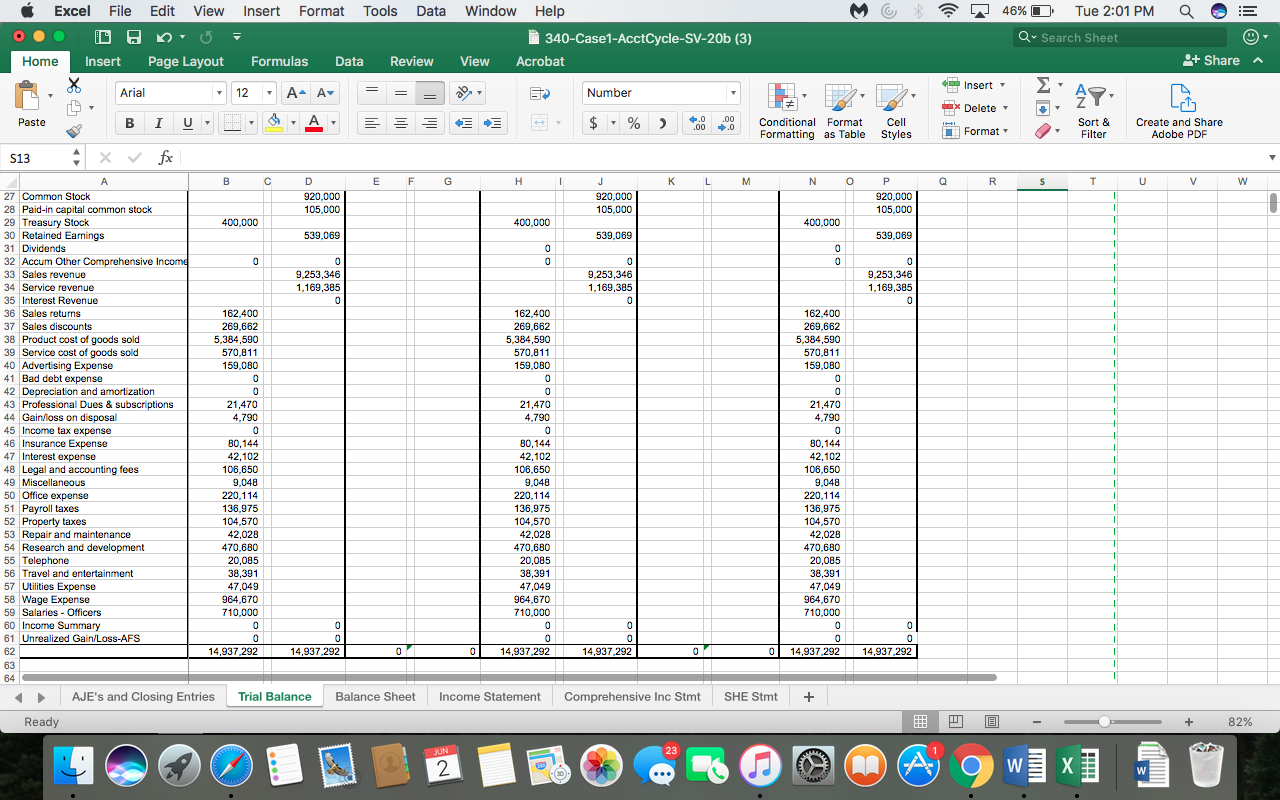

Step 2: Record the 11 adjusting journal entries based on the additional information given. Record all AJEs on the Excel spreadsheet using the tab at the bottom of the spreadsheet labeled AJEs and Closing Entries. Post each debit and credit of the AJE s to the Trial Balance (second tab at the bottom of spreadsheet) in the two columns labeled AJEs (Columns E & G). CMC uses a perpetual inventory system which means that when they record the sale of a product (at the selling price), they also update COGS and Inventory (at cost). This requires two journal entries: (1) record the sale by debiting A/R and crediting Sales Revenue for the selling price. (2) Debit COGS and credit Inventory @ cost Recommendation: use cell referencing when posting to the Trial Balance to eliminate potential typos and follow-through errors.

Step 3: Once all AJEs have been recorded & posted to the Trial Balance, check your work with the CHECK FIGURES FOR CASE 1. If your Trial Balance agrees with these Check Figures, you are ready to move on to Step 4.

Step 4: Record the (5) Closing entries on the first tab labelled AJEs & Closing. Post to the Trial Balance in columns K & M.

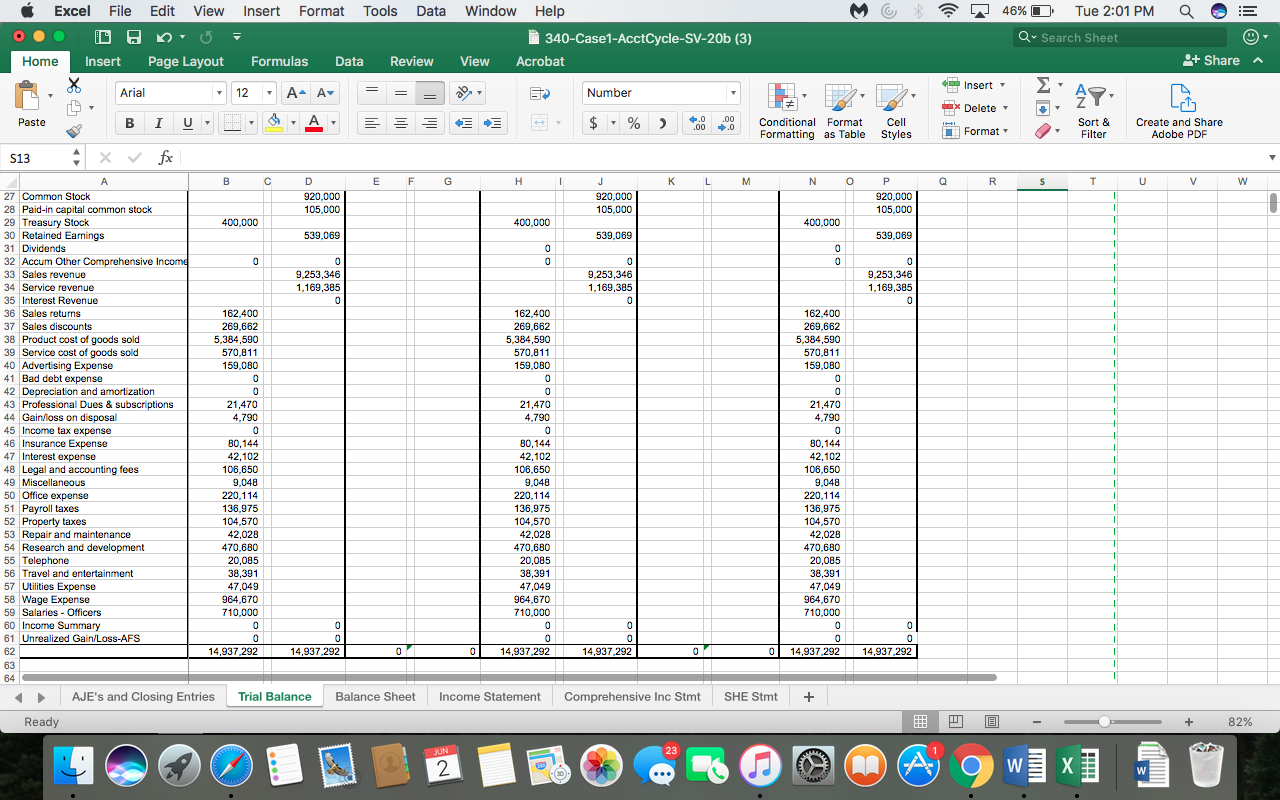

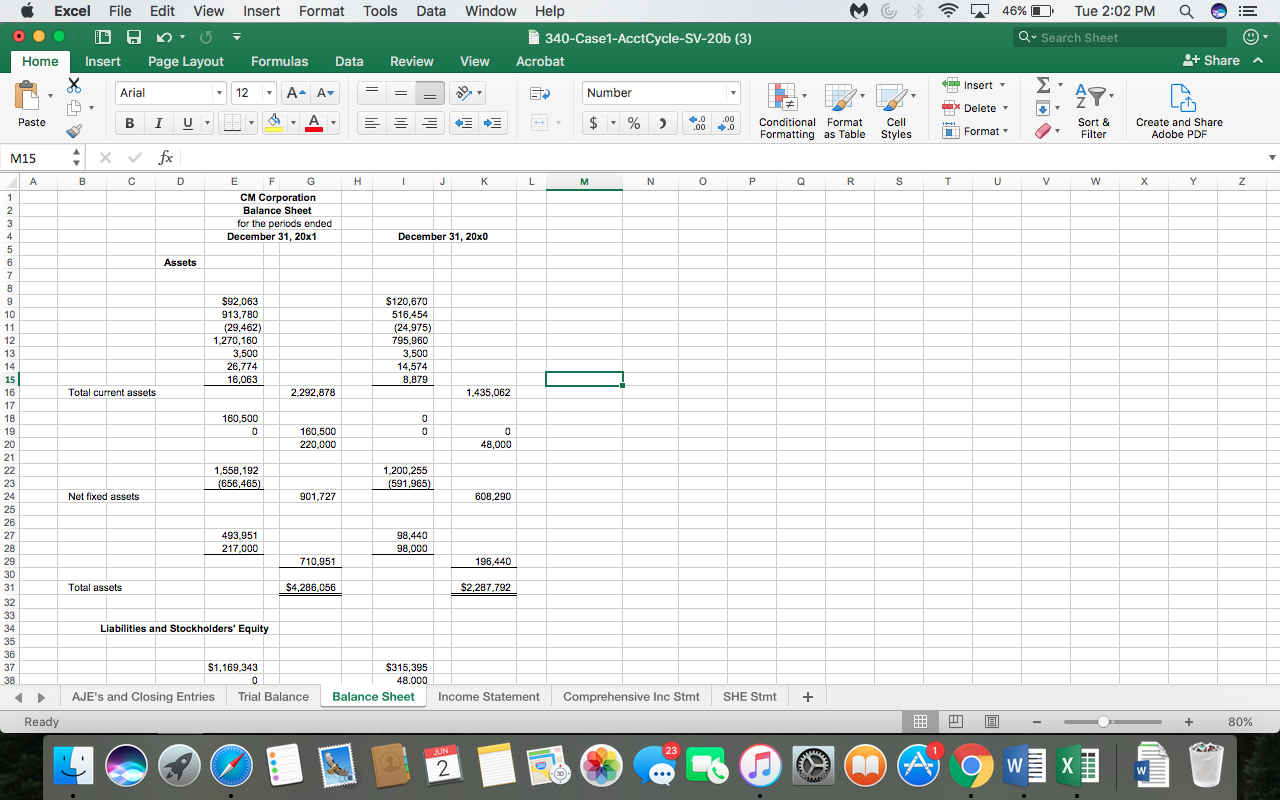

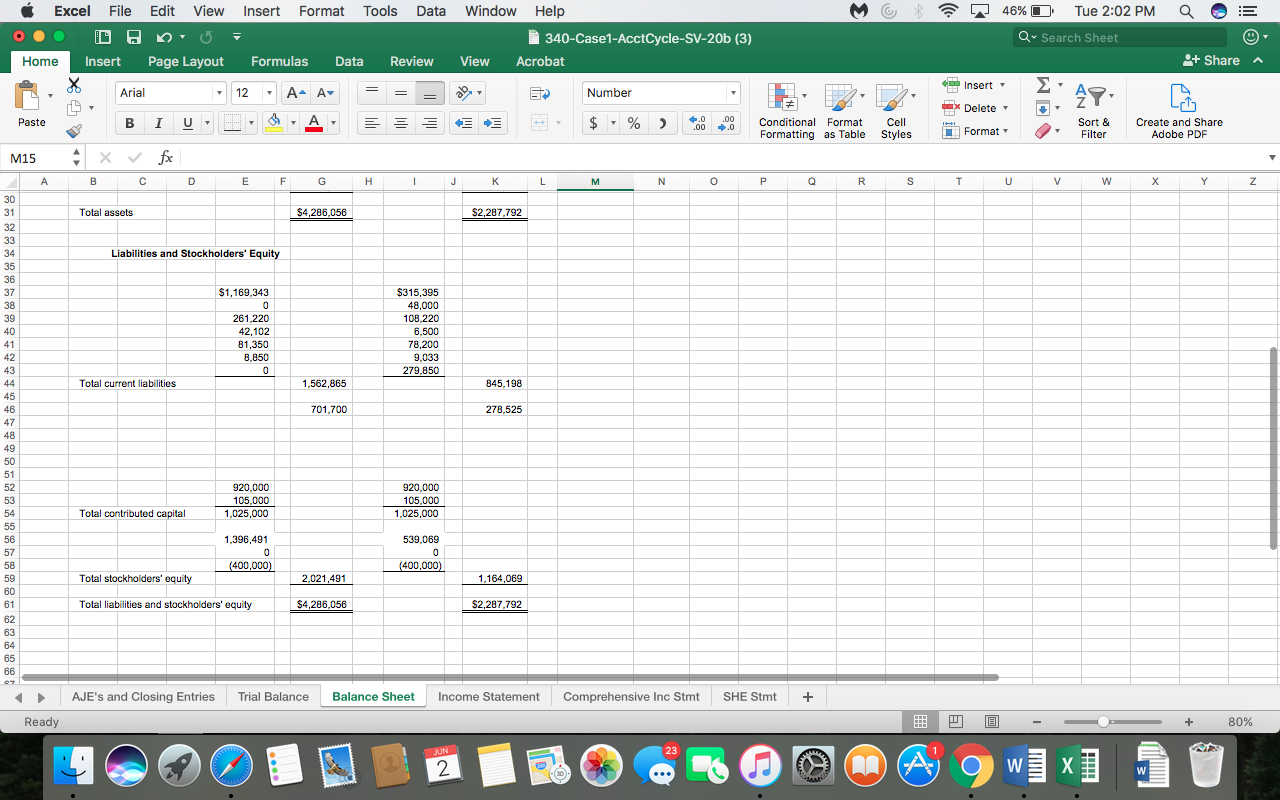

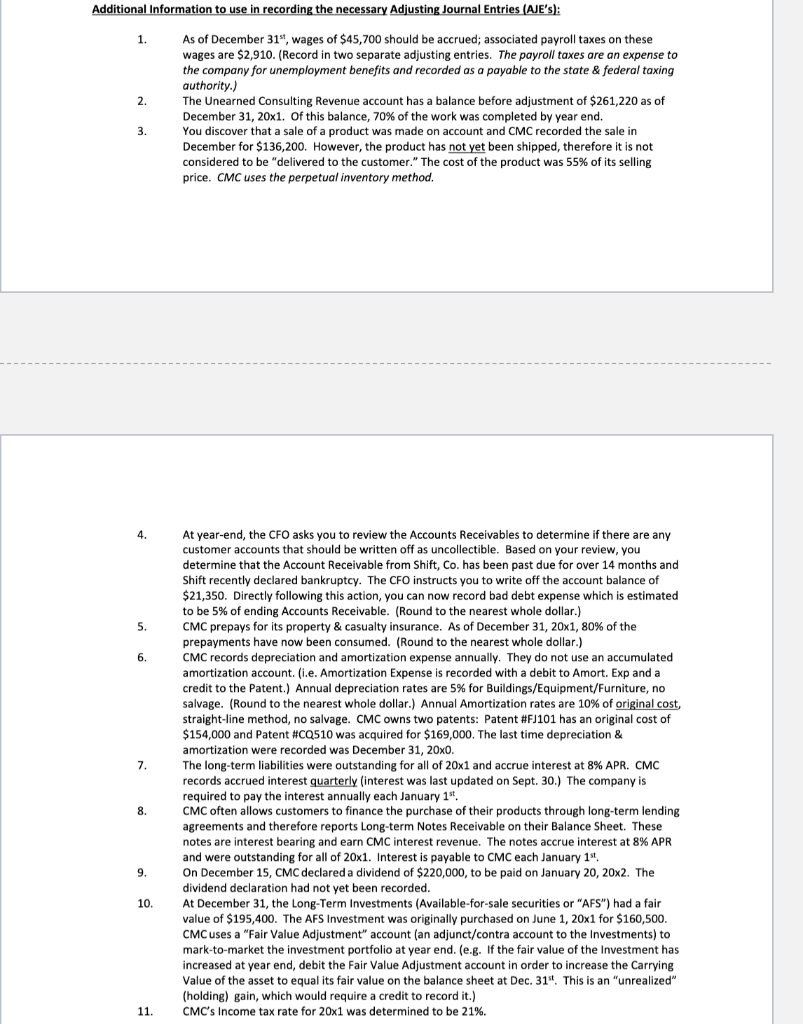

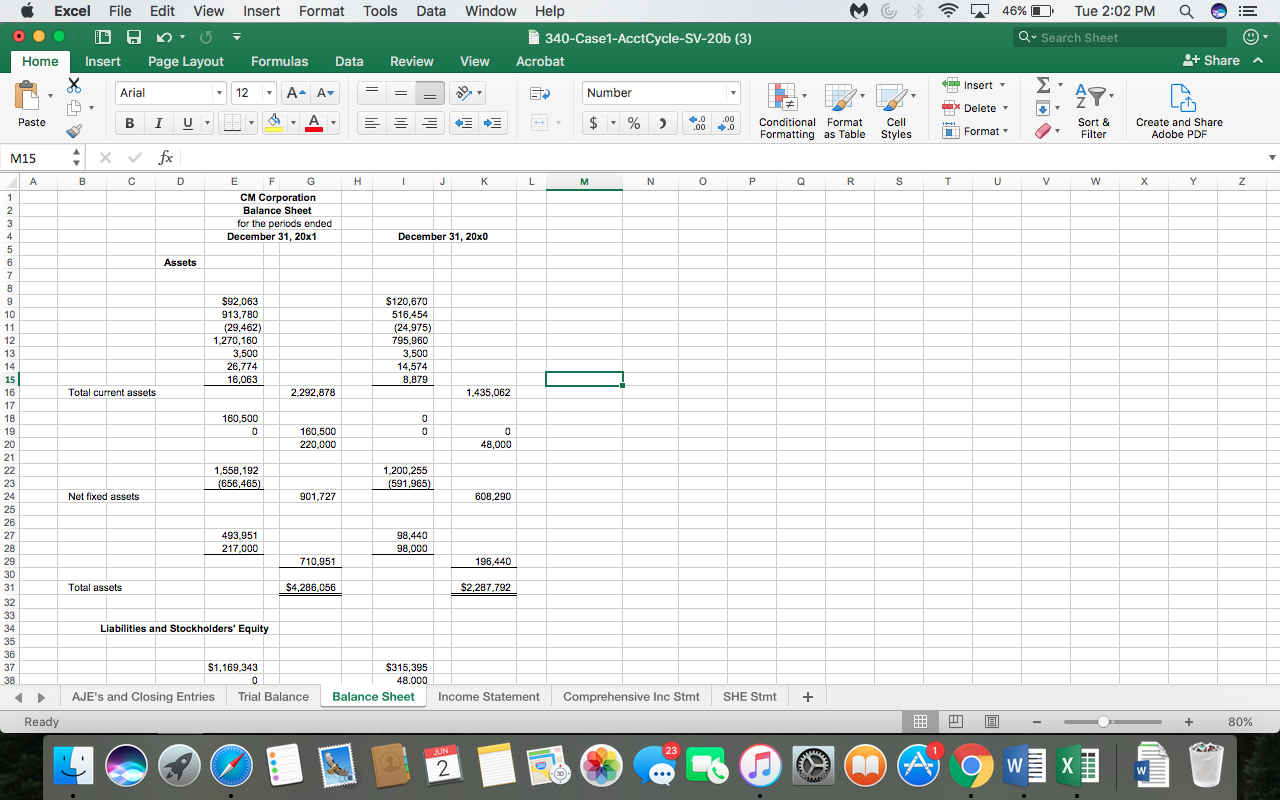

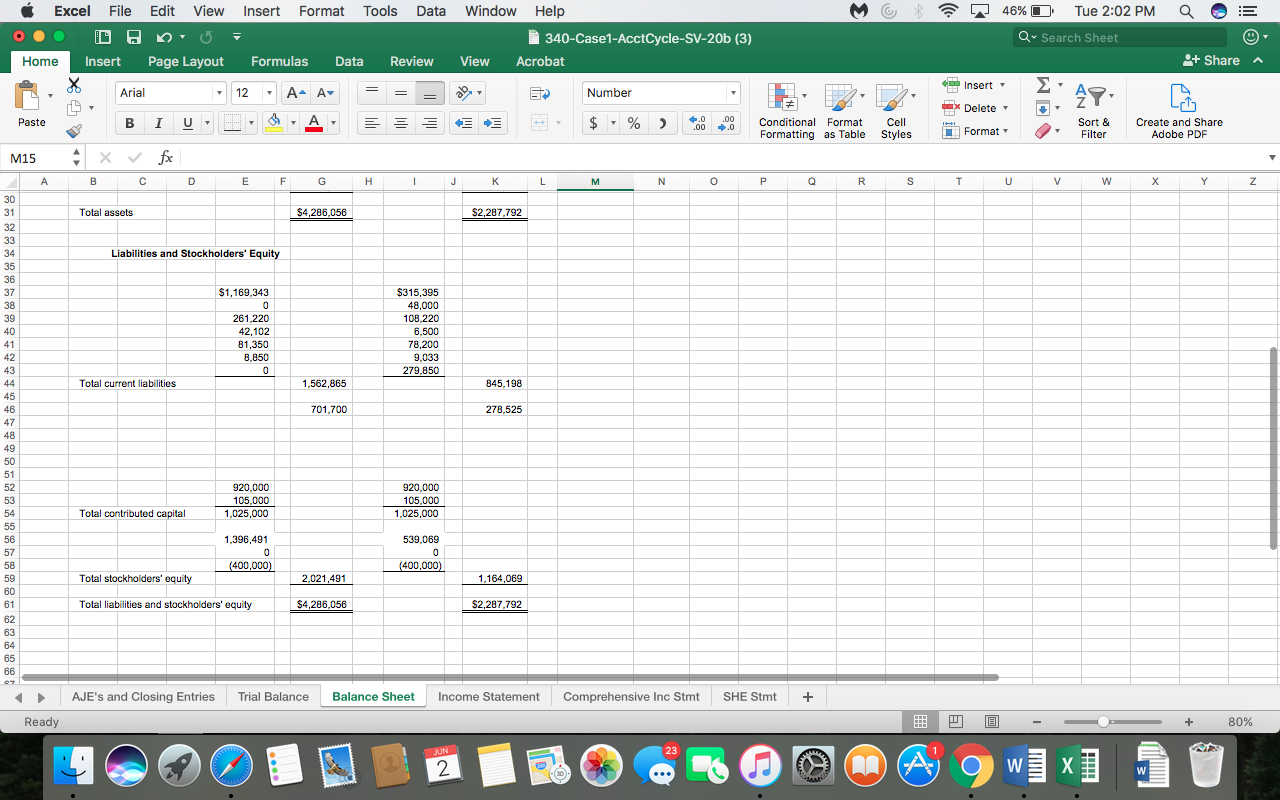

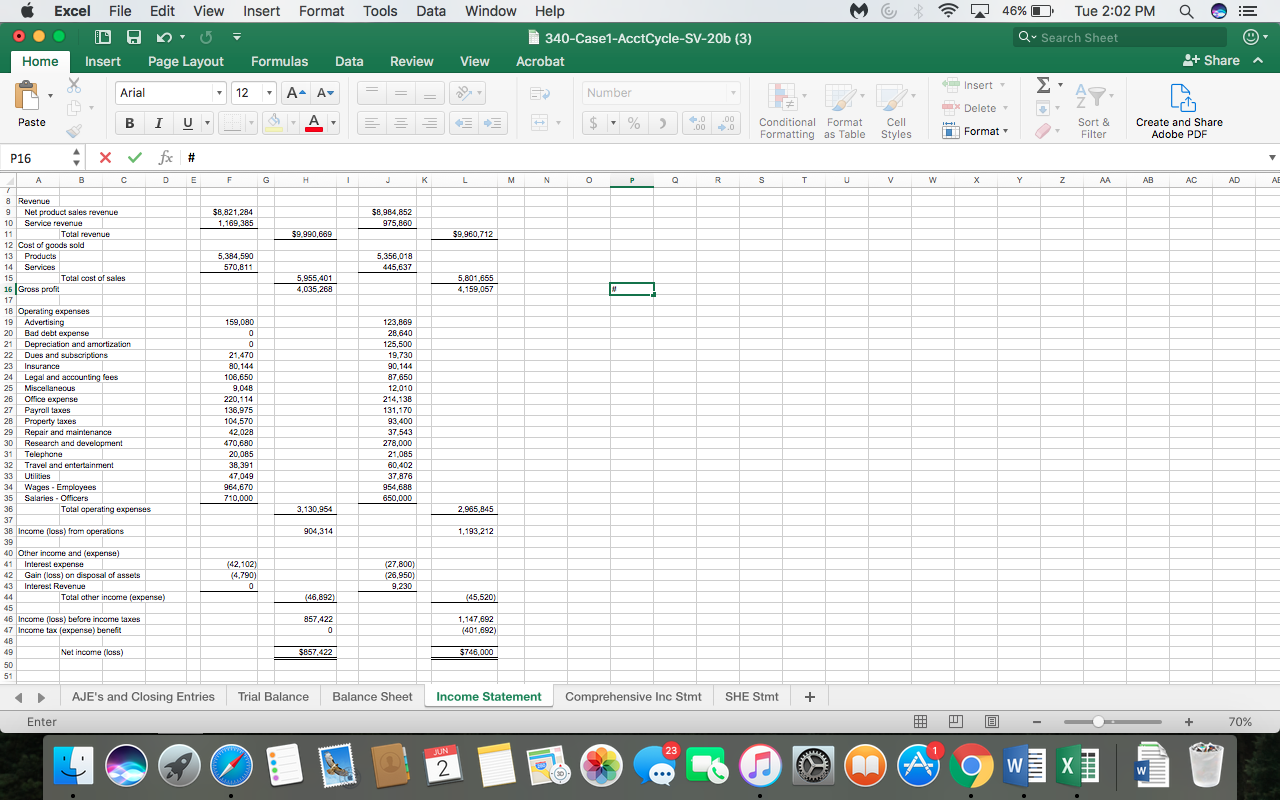

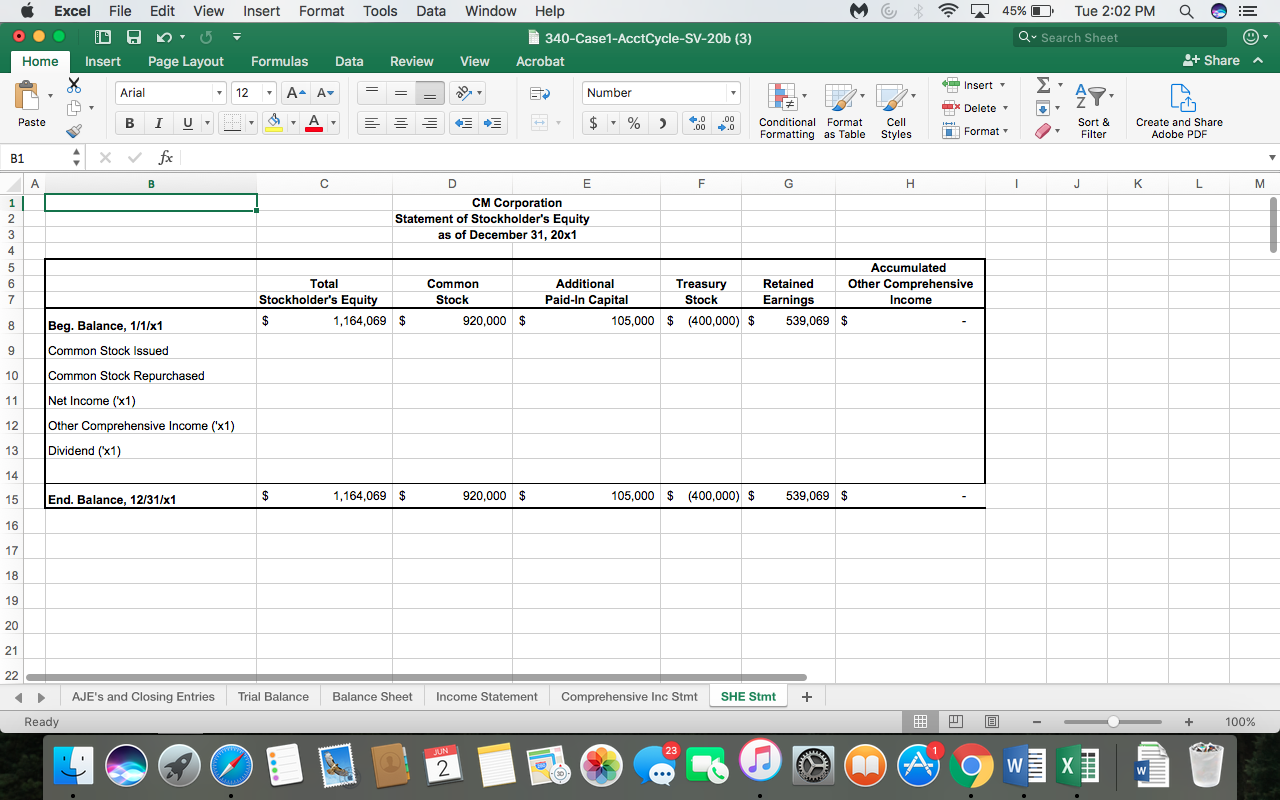

Step 5: Complete the Comprehensive Income Statement (CMC reports Comprehensive Income on a separate statement) and the Statement of Stockholders Equity in good form. The Statement of Stockholders Equity should reconcile with the SHE portion of your balance sheet which is automatically updated for you. (Use cell referencing to link the appropriate cells from the other financial statements. Keep in mind that not all cells on the Statement of Stockholders Equity will require any updates. For example, no new stock was issued during 20x1; the balance in the contributed capital accounts will therefore not change.)

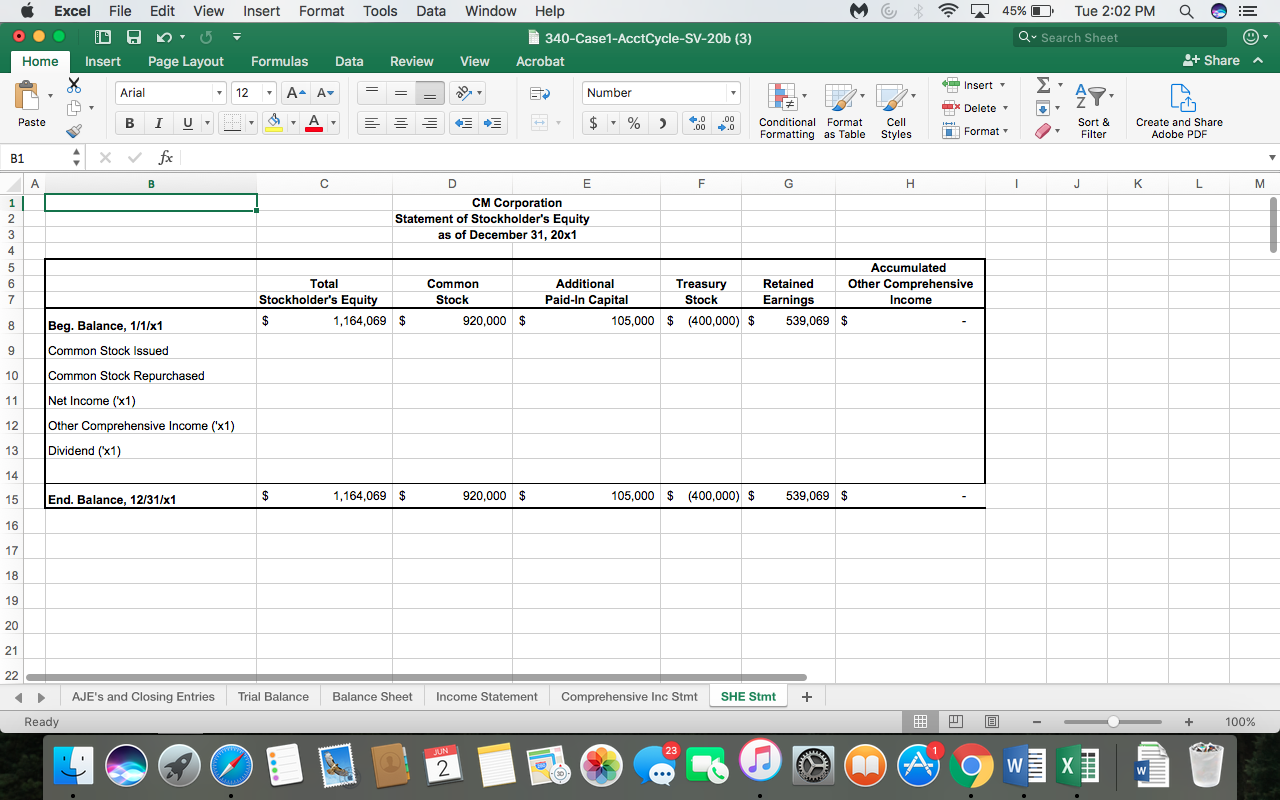

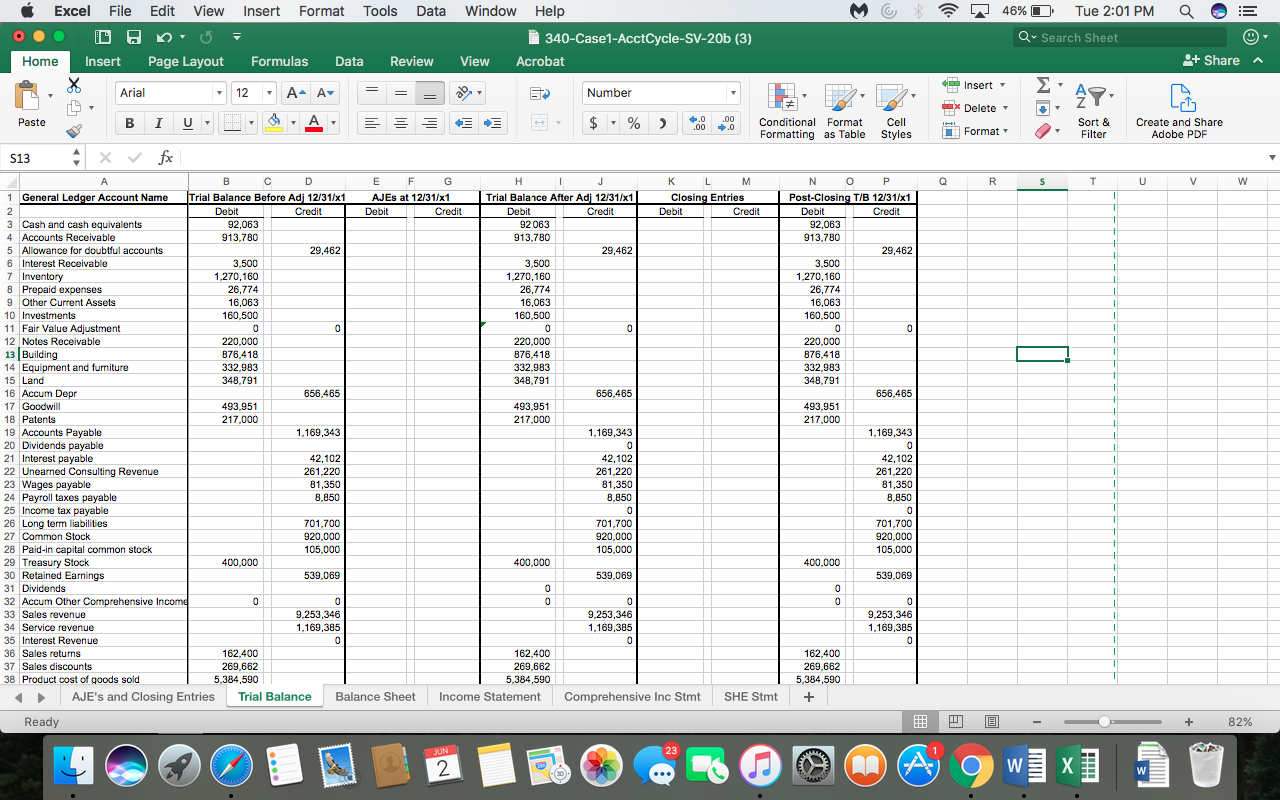

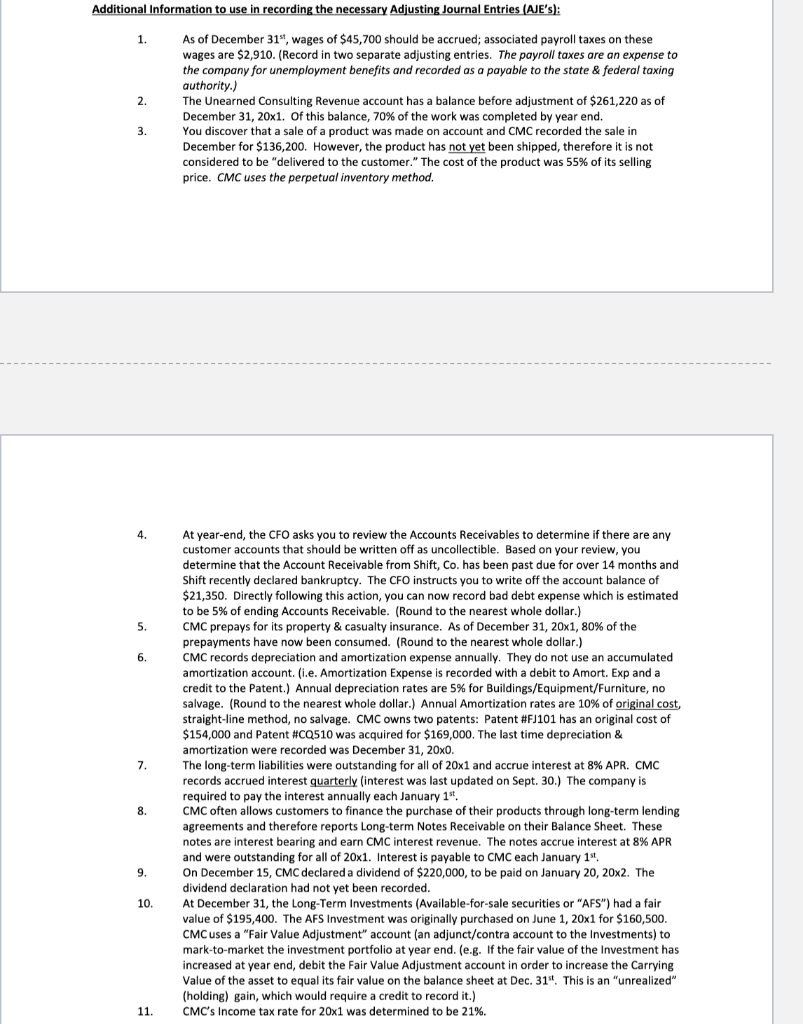

Additional Information to use in recording the necessary Adjusting Journal Entries (AJEs):

1. As of December 31st, wages of $45,700 should be accrued; associated payroll taxes on these wages are $2,910. (Record in two separate adjusting entries. The payroll taxes are an expense to the company for unemployment benefits and recorded as a payable to the state & federal taxing authority.)

2. The Unearned Consulting Revenue account has a balance before adjustment of $261,220 as of December 31, 20x1. Of this balance, 70% of the work was completed by year end.

3. You discover that a sale of a product was made on account and CMC recorded the sale in December for $136,200. However, the product has not yet been shipped, therefore it is not considered to be delivered to the customer. The cost of the product was 55% of its selling price. CMC uses the perpetual inventory method.\

Here is additional information.

Excel File Edit View Insert Format Tools Data 46% 0 Tue 2:01 PM Window Help 340-Case1-AcctCycle-SV-20b (3) View Acrobat Q Search Sheet Home Insert Page Layout Formulas Data Review 2+ Share Insert Arial 12 A A DO Number 49 Delete Paste B I u U- A = $ % % ) 4.0 .00 .00 1.0 Conditional Format Formatting as Table Cell Styles Format Sort & Filter Create and Share Adobe PDF S13 fx Q R S T V w 1 92063 + 1 1 1 1 - - - N o Post-Closing T/B 12/31/x1 Debit Credit 92,063 913,780 29,462 3,500 1,270,160 26,774 16,063 160,500 0 220.000 876,418 332,983 348,791 656,465 493,951 217.000 1,169,343 0 42,102 261,220 81,350 3,850 1 1 1 + A BC D E F G K L M 1 General Ledger Account Name Trial Balance Before Adj 12/31/x1 AJEs at 12/31/x1 Trial Balance After Adj 12/31/x1| Closing Entries 2 Debit Credit Debit Credit Debit Credit Debit Credit 3 Cash and cash equivalents 92,063 4 Accounts Receivable 913.780 913,780 5 Allowance for doubtful accounts 29,462 29,462 6 Interest Receivable 3,500 3,500 7 Inventory 1,270,160 1,270,160 8 Prepaid expenses 26,774 26,774 9 Other Current Assets 16,063 16,063 10 Investments 160,500 160,500 11 Fair Value Adjustment 0 0 0 12 Notes Receivable 220.000 220,000 13 Building 876,418 876,418 14 Equipment and furniture 332.983 332,983 15 Land 348.791 348.791 16 Accum Depr 656,465 656,465 17 Goodwill 493.951 493,951 18 Patents 217,000 217,000 19 Accounts Payable 1,169,343 1,169,343 20 Dividends payable 0 21 Interest payable 42,102 42,102 22 Unearned Consulting Revenue 261,220 261,220 23 Wages payable 81,350 81,350 24 Payroll taxes payable 8,850 8.850 25 Income tax payable 0 26 Long term liabilities 701,700 701,700 27 Common Stock 920,000 920,000 28 Paid-in capital common stock 105,000 105,000 29 Treasury Stock 400.000 400.000 30 Retained Earnings 539,069 539,069 31 Dividends 0 32 Accum Other Comprehensive Incomd 0 0 0 33 Sales revenue 9,253,346 9,253,346 34 Service revenue 1,169,385 1.169,385 35 Interest Revenue 0 0 36 Sales returns 162.400 162,400 37 Sales discounts 269,662 269,662 38 Product cost of goods sold 5,384,590 5,384,590 AJE's and Closing Entries Trial Balance Balance Sheet Income Statement Comprehensive Inc Stmt SHE Stmt + 1 1 1 1 1 - 1 1 1 1 1 701,700 920,000 105,000 + + 400,000 + 539,069 0 0 1 - 0 9,253,346 1,169,385 0 1 1 - 1 1 162.400 269,662 5,384,590 + = Ready + 82% 23 Se JUN 2 MA W 1 W Excel File Edit View Insert Format Tools Data 46% 0 Tue 2:01 PM Window Help 340-Case1-AcctCycle-SV-20b (3) View Acrobat Q Search Sheet Home Insert Page Layout Formulas Data Review 2+ Share Insert Arial 12 A A DO Number 49 Delete Paste B I U A = = $ % ) 4.0 .00 .00 1.0 Conditional Format Formatting as Table Cell Styles Format Sort & Filter Create and Share Adobe PDF S13 fx G H 1 K L M N O Q R S T V w - J 920.000 105,000 920,000 105,000 il 400.000 400.000 1 TO 539,069 539,069 1 0 0 0 0 + T 0 9,253,346 1,169,385 0 0 9.253,346 1,169,385 0 1 1 1 1 162.400 269,662 5,384,590 570,811 159.000 1 1 1 - 1 1 1 1 + + A D E F 27 Common Stock 920,000 28 Paid-in capital common stock 105,000 29 Treasury Stock 400,000 30 Retained Earnings 539,069 31 Dividends 32 Accum Other Comprehensive Income 0 0 33 Sales revenue 9,253,346 34 Service revenue 1,169,385 35 Interest Revenue 0 36 Sales returns 162.400 37 Sales discounts 269,662 38 Product cost of goods sold 5,384,590 39 Service cost of goods sold 570,811 40 Advertising Expense 159.080 41 Bad debt expense 0 42 Depreciation and amortization 0 43 Professional Dues & subscriptions 21,470 44 Gain/loss on disposal 4,790 45 Income tax expense 0 46 Insurance Expense 80,144 47 Interest expense 42,102 48 Legal and accounting fees 106,650 49 Miscellaneous 9.048 50 Office expense 220.114 51 Payroll taxes 136,975 52 Property taxes 104.570 53 Repair and maintenance 42,028 54 Research and development 470,680 55 Telephone 20,085 56 Travel and entertainment 38,391 57 Utilities Expense 47.049 58 Wage Expense 964,670 59 Salaries - Officers 710,000 60 Income Summary 0 0 61 Unrealized Gain/Loss-AFS 0 0 62 14,937,292 14,937,292 0 63 64 AJE's and Closing Entries Trial Balance Balance Sheet 1 - 162.400 269,662 5,384,590 570,811 159.080 0 0 21,470 4,790 0 30,144 42,102 106,650 9.048 220.114 136,975 104,570 42,028 470,680 20,085 38.391 47.049 964,670 710.000 0 0 14,937,292 - 0 21,470 4,790 0 80,144 42,102 106,650 9.048 220,114 136,975 104.570 42,028 470.680 20,085 38,391 47,049 964,670 710.000 0 0 14,937,292 - 1 1 1 1 1 1 + + Il 1 1 0 0 14,937292 0 0 14,937.292 - 0 0 0 - 1 Income Statement Comprehensive Inc Stmt SHE Stmt + Ready + 82% 23 Sud JUN 2 W 1 W Excel File Edit View Insert Format Tools Data 46% 0 Tue 2:02 PM Window Help 340-Case1-AcctCycle-SV-20b (3) View Acrobat Q Search Sheet Home Insert Page Layout Formulas Data Review 2+ Share Insert Arial 12 A- A+ DO Number 49 Delete Paste B I U A = = = $ % ) 4.0 .00 .00 1.0 Conditional Format Formatting as Table Cell Styles Format Sort & Filter Create and Share Adobe PDF M15 fx A B D H 1 J K L M N 0 P Q R S T U V W Y Z E F G CM Corporation Balance Sheet for the periods ended December 31, 20x1 December 31, 20x0 Assets $92,063 913,780 (29,462) 1,270,160 3,500 26,774 16,063 $120,670 516,454 (24,975) 795,960 3.500 14,574 8.879 Total current assets 2,292,878 1.435,062 160,500 0 0 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 160.500 220,000 0 48,000 1,558,192 (656,465) 1,200,255 (591,965) Net fixed assets 901,727 608.290 493,951 217,000 98,440 98,000 710,951 196,440 Total assets $4.286.056 $2,287.792 Liabilities and Stockholders' Equity $1,169,343 0 AJE's and Closing Entries Trial Balance $315,395 48.000 Balance Sheet Income Statement Comprehensive Inc Stmt SHE Stmt + Ready + 80% JUN 23 Sud 2 W 1 W Excel File Edit View Insert Format Tools Data 46% 0 Tue 2:02 PM Window Help 340-Case1-AcctCycle-SV-20b (3) View Acrobat Q Search Sheet Home Insert Page Layout Formulas Data Review 2+ Share Insert Arial 12 A- A+ DO Number AP Delete Paste B I U A A = = $ - % % ) 4.0 .00 .00 1.0 Conditional Format Formatting as Table Cell Styles Format Sort & Filter Create and Share Adobe PDF M15 fx D E F G H 1 J K L M N o P Q R S T U V W Y Z Total assets $4,286,056 $2,287.792 Liabilities and Stockholders' Equity $1,169,343 0 261,220 42,102 81,350 3.850 0 $315,395 48,000 108,220 6,500 78,200 9,033 279,850 Total current liabilities 1,562,865 845,198 701,700 278,525 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 07 920,000 105,000 1,025,000 920,000 105,000 1,025,000 Total contributed capital 1,396,491 0 (400,000) 539,069 0 (400,000) Total stockholders' equity 2,021,491 1,164,069 Total liabilities and stockholders' equity $4,286,056 $2,287,792 AJE's and Closing Entries Trial Balance Balance Sheet Income Statement Comprehensive Inc Stmt SHE Stmt + Ready + 80% 23 JUN 2 W 1 W Excel File Edit View 46% 0 Tue 2:02 PM Insert Format Tools Data Window Help 340-Case1-AcctCycle-SV-20b (3) Formulas Data Review View Acrobat Q Search Sheet Home Insert Page Layout 2+ Share Insert Arial 12 A- A Number 49 Delete Paste I u B .00 " E $ % ) .00 Conditional Format Cell Formatting as Table Styles T Format Sort & Filter Create and Share Adobe PDF P16 for # K L M N O P Q R S T V W Z AB AC AD AD $9.960,712 5,801,655 4,159,057 B E F G H 1 J 7 8 Revenue 9 Net product sales revenue $8.821,284 $8.984,852 10 Service revenue 1,169,385 975,860 11 Total revenue $9.990,669 12 Cost of goods sold 13 Products 5,384,590 5,356,018 14 Services 570,811 445,637 15 Total cost of sales 5,955,401 16 Gross profil 4,035,268 17 18 Operating expenses 19 Advertising 159,000 123,869 20 Bad debt expense 0 26,640 21 Depreciation and amortization 0 125,500 22 Dues and subscriptions 21.470 19.730 23 Insurance 80,144 90.144 24 Legal and accounting fees 106,650 87.650 25 Miscellaneous 9,046 12.010 26 Office expense 220,114 214,136 27 Payroll taxes 138,975 131,170 28 Property taxes 104,570 93.400 29 Repair and maintenance 42.028 37,543 30 Research and development 470,680 278,000 31 Telephone 20.085 21,085 32 Travel and entertainment 38.391 60.402 33 Utilities 47.046 37.876 34 Wages. Employees 964,670 954,688 35 Salaries - Officers 710,000 650,000 36 Total operating expenses 3,130,954 37 38 Income foss) from operations 904,314 39 40 Other income and expense) 41 Interest expense (42,102) (27,800) 42 Gain (loss) on disposal of assets (4,790) (26,950) 43 Interest Ravenue 0 9,230 44 Total other income (expense) (46,892) 45 46 Income floss) before income taxes 857,422 47 Income tax (expense) benefit 0 48 49 Net income (loss) $857,422 50 51 AJE's and Closing Entries Trial Balance Balance Sheet 2,985,845 1,193 212 (45,520) 1,147,692 (401.692) $746,000 Income Statement Comprehensive Inc Stmt SHE Stmt + Enter O + 70% 23 Sud JUN 2 (A W W 45% O Tue 2:02 PM Excel File Edit View Insert Format Tools Data Window Help 340-Case1-AcctCycle-SV-20b (3) Home Insert Page Layout Formulas Data Review View Acrobat Q Search Sheet 2+ Share Insert Arial 12 A- A+ DO Number 49 Delete - Paste B I U A = $ % ) 4.0 .00 .00 1.0 Conditional Format Formatting as Table Cell Styles T Format Sort & Filter Create and Share Adobe PDF B1 fx A B F G H J - L M D E CM Corporation Statement of Stockholder's Equity as of December 31, 20x1 1 2 3 4 5 6 7 Total Stockholder's Equity $ 1,164,069 $ Common Stock 920,000 $ Additional Treasury Paid-In Capital Stock 105,000 $ (400,000) $ Accumulated Retained Other Comprehensive Earnings Income 539,069 $ 8 Beg. Balance, 1/1/x1 9 Common Stock Issued 10 11 Common Stock Repurchased Net Income (x1) Other Comprehensive Income (x1) 12 13 Dividend ("X1) 14 15 End. Balance, 12/31/x1 $ 1,164,069 $ 920,000 $ 105,000 $ (400,000) $ 539,069 $ 16 17 18 19 20 21 22 AJE's and Closing Entries Trial Balance Balance Sheet Income Statement Comprehensive Inc Stmt SHE Stmt + Ready + 100% 23 JUN 2 W MIMI WU W Additional Information to use in recording the necessary Adjusting Journal Entries (AJE's): 1. 2. As of December 31, wages of $45,700 should be accrued; associated payroll taxes on these wages are $2,910. (Record in two separate adjusting entries. The payroll taxes are an expense to the company for unemployment benefits and recorded as a payable to the state & federal taxing authority.) The Unearned Consulting Revenue account has a balance before adjustment of $261,220 as of December 31, 20x1. Of this balance, 70% of the work was completed by year end. You discover that a sale of a product was made on account and CMC recorded the sale in December for $136,200. However, the product has not yet been shipped, therefore it is not considered to be "delivered to the customer." The cost of the product was 55% of its selling price. CMC uses the perpetual inventory method. 3. 4. 5. 6. 7. At year-end, the CFO asks you to review the Accounts Receivables to determine if there are any customer accounts that should be written off as uncollectible. Based on your review, you determine that the Account Receivable from Shift, Co. has been past due for over 14 months and Shift recently declared bankruptcy. The CFO instructs you to write off the account balance of $21,350. Directly following this action, you can now record bad debt expense which is estimated to be 5% of ending Accounts Receivable. (Round to the nearest whole dollar.) CMC prepays for its property & casualty insurance. As of December 31, 20x1, 80% of the prepayments have now been consumed. (Round to the nearest whole dollar.) CMC records depreciation and amortization expense annually. They do not use an accumulated amortization account. (.e. Amortization Expense is recorded with a debit to Amort. Exp and a credit to the Patent.) Annual depreciation rates are 5% for Buildings/Equipment/Furniture, no salvage. (Round to the nearest whole dollar.) Annual Amortization rates are 10% of original cost, straight-line method, no salvage. CMC owns two patents: Patent #FJ101 has an original cost of $154,000 and Patent #CQ510 was acquired for $169,000. The last time depreciation & amortization were recorded was December 31, 20x0. The long-term liabilities were outstanding for all of 20x1 and accrue interest at 8% APR. CMC records accrued interest quarterly (interest was last updated on Sept. 30.) The company is required to pay the interest annually each January 1st CMC often allows customers to finance the purchase of their products through long-term lending agreements and therefore reports Long-term Notes Receivable on their Balance Sheet. These notes are interest bearing and earn CMC interest revenue. The notes accrue interest at 8% APR and were outstanding for all of 20x1. Interest is payable to CMC each January 1st On December 15, CMC declared a dividend of $220,000, to be paid on January 20, 20x2. The dividend declaration had not yet been recorded. At December 31, the Long-Term Investments (Available-for-sale securities or "AFS") had a fair value of $195,400. The AFS Investment was originally purchased on June 1, 20x1 for $160,500. CMC uses a "Fair Value Adjustment" account (an adjunct/contra account to the Investments) to mark-to-market the investment portfolio at year end. (e.g. If the fair value of the Investment has increased at year end, debit the Fair Value Adjustment account in order to increase the Carrying Value of the asset to equal its fair value on the balance sheet at Dec. 31. This is an "unrealized (holding) gain, which would require a credit to record it.) CMC's Income tax rate for 20x1 was determined to be 21%. 8. 9. 10. 11. Excel File Edit View Insert Format Tools Data 46% 0 Tue 2:01 PM Window Help 340-Case1-AcctCycle-SV-20b (3) View Acrobat Q Search Sheet Home Insert Page Layout Formulas Data Review 2+ Share Insert Arial 12 A A DO Number 49 Delete Paste B I u U- A = $ % % ) 4.0 .00 .00 1.0 Conditional Format Formatting as Table Cell Styles Format Sort & Filter Create and Share Adobe PDF S13 fx Q R S T V w 1 92063 + 1 1 1 1 - - - N o Post-Closing T/B 12/31/x1 Debit Credit 92,063 913,780 29,462 3,500 1,270,160 26,774 16,063 160,500 0 220.000 876,418 332,983 348,791 656,465 493,951 217.000 1,169,343 0 42,102 261,220 81,350 3,850 1 1 1 + A BC D E F G K L M 1 General Ledger Account Name Trial Balance Before Adj 12/31/x1 AJEs at 12/31/x1 Trial Balance After Adj 12/31/x1| Closing Entries 2 Debit Credit Debit Credit Debit Credit Debit Credit 3 Cash and cash equivalents 92,063 4 Accounts Receivable 913.780 913,780 5 Allowance for doubtful accounts 29,462 29,462 6 Interest Receivable 3,500 3,500 7 Inventory 1,270,160 1,270,160 8 Prepaid expenses 26,774 26,774 9 Other Current Assets 16,063 16,063 10 Investments 160,500 160,500 11 Fair Value Adjustment 0 0 0 12 Notes Receivable 220.000 220,000 13 Building 876,418 876,418 14 Equipment and furniture 332.983 332,983 15 Land 348.791 348.791 16 Accum Depr 656,465 656,465 17 Goodwill 493.951 493,951 18 Patents 217,000 217,000 19 Accounts Payable 1,169,343 1,169,343 20 Dividends payable 0 21 Interest payable 42,102 42,102 22 Unearned Consulting Revenue 261,220 261,220 23 Wages payable 81,350 81,350 24 Payroll taxes payable 8,850 8.850 25 Income tax payable 0 26 Long term liabilities 701,700 701,700 27 Common Stock 920,000 920,000 28 Paid-in capital common stock 105,000 105,000 29 Treasury Stock 400.000 400.000 30 Retained Earnings 539,069 539,069 31 Dividends 0 32 Accum Other Comprehensive Incomd 0 0 0 33 Sales revenue 9,253,346 9,253,346 34 Service revenue 1,169,385 1.169,385 35 Interest Revenue 0 0 36 Sales returns 162.400 162,400 37 Sales discounts 269,662 269,662 38 Product cost of goods sold 5,384,590 5,384,590 AJE's and Closing Entries Trial Balance Balance Sheet Income Statement Comprehensive Inc Stmt SHE Stmt + 1 1 1 1 1 - 1 1 1 1 1 701,700 920,000 105,000 + + 400,000 + 539,069 0 0 1 - 0 9,253,346 1,169,385 0 1 1 - 1 1 162.400 269,662 5,384,590 + = Ready + 82% 23 Se JUN 2 MA W 1 W Excel File Edit View Insert Format Tools Data 46% 0 Tue 2:01 PM Window Help 340-Case1-AcctCycle-SV-20b (3) View Acrobat Q Search Sheet Home Insert Page Layout Formulas Data Review 2+ Share Insert Arial 12 A A DO Number 49 Delete Paste B I U A = = $ % ) 4.0 .00 .00 1.0 Conditional Format Formatting as Table Cell Styles Format Sort & Filter Create and Share Adobe PDF S13 fx G H 1 K L M N O Q R S T V w - J 920.000 105,000 920,000 105,000 il 400.000 400.000 1 TO 539,069 539,069 1 0 0 0 0 + T 0 9,253,346 1,169,385 0 0 9.253,346 1,169,385 0 1 1 1 1 162.400 269,662 5,384,590 570,811 159.000 1 1 1 - 1 1 1 1 + + A D E F 27 Common Stock 920,000 28 Paid-in capital common stock 105,000 29 Treasury Stock 400,000 30 Retained Earnings 539,069 31 Dividends 32 Accum Other Comprehensive Income 0 0 33 Sales revenue 9,253,346 34 Service revenue 1,169,385 35 Interest Revenue 0 36 Sales returns 162.400 37 Sales discounts 269,662 38 Product cost of goods sold 5,384,590 39 Service cost of goods sold 570,811 40 Advertising Expense 159.080 41 Bad debt expense 0 42 Depreciation and amortization 0 43 Professional Dues & subscriptions 21,470 44 Gain/loss on disposal 4,790 45 Income tax expense 0 46 Insurance Expense 80,144 47 Interest expense 42,102 48 Legal and accounting fees 106,650 49 Miscellaneous 9.048 50 Office expense 220.114 51 Payroll taxes 136,975 52 Property taxes 104.570 53 Repair and maintenance 42,028 54 Research and development 470,680 55 Telephone 20,085 56 Travel and entertainment 38,391 57 Utilities Expense 47.049 58 Wage Expense 964,670 59 Salaries - Officers 710,000 60 Income Summary 0 0 61 Unrealized Gain/Loss-AFS 0 0 62 14,937,292 14,937,292 0 63 64 AJE's and Closing Entries Trial Balance Balance Sheet 1 - 162.400 269,662 5,384,590 570,811 159.080 0 0 21,470 4,790 0 30,144 42,102 106,650 9.048 220.114 136,975 104,570 42,028 470,680 20,085 38.391 47.049 964,670 710.000 0 0 14,937,292 - 0 21,470 4,790 0 80,144 42,102 106,650 9.048 220,114 136,975 104.570 42,028 470.680 20,085 38,391 47,049 964,670 710.000 0 0 14,937,292 - 1 1 1 1 1 1 + + Il 1 1 0 0 14,937292 0 0 14,937.292 - 0 0 0 - 1 Income Statement Comprehensive Inc Stmt SHE Stmt + Ready + 82% 23 Sud JUN 2 W 1 W Excel File Edit View Insert Format Tools Data 46% 0 Tue 2:02 PM Window Help 340-Case1-AcctCycle-SV-20b (3) View Acrobat Q Search Sheet Home Insert Page Layout Formulas Data Review 2+ Share Insert Arial 12 A- A+ DO Number 49 Delete Paste B I U A = = = $ % ) 4.0 .00 .00 1.0 Conditional Format Formatting as Table Cell Styles Format Sort & Filter Create and Share Adobe PDF M15 fx A B D H 1 J K L M N 0 P Q R S T U V W Y Z E F G CM Corporation Balance Sheet for the periods ended December 31, 20x1 December 31, 20x0 Assets $92,063 913,780 (29,462) 1,270,160 3,500 26,774 16,063 $120,670 516,454 (24,975) 795,960 3.500 14,574 8.879 Total current assets 2,292,878 1.435,062 160,500 0 0 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 160.500 220,000 0 48,000 1,558,192 (656,465) 1,200,255 (591,965) Net fixed assets 901,727 608.290 493,951 217,000 98,440 98,000 710,951 196,440 Total assets $4.286.056 $2,287.792 Liabilities and Stockholders' Equity $1,169,343 0 AJE's and Closing Entries Trial Balance $315,395 48.000 Balance Sheet Income Statement Comprehensive Inc Stmt SHE Stmt + Ready + 80% JUN 23 Sud 2 W 1 W Excel File Edit View Insert Format Tools Data 46% 0 Tue 2:02 PM Window Help 340-Case1-AcctCycle-SV-20b (3) View Acrobat Q Search Sheet Home Insert Page Layout Formulas Data Review 2+ Share Insert Arial 12 A- A+ DO Number AP Delete Paste B I U A A = = $ - % % ) 4.0 .00 .00 1.0 Conditional Format Formatting as Table Cell Styles Format Sort & Filter Create and Share Adobe PDF M15 fx D E F G H 1 J K L M N o P Q R S T U V W Y Z Total assets $4,286,056 $2,287.792 Liabilities and Stockholders' Equity $1,169,343 0 261,220 42,102 81,350 3.850 0 $315,395 48,000 108,220 6,500 78,200 9,033 279,850 Total current liabilities 1,562,865 845,198 701,700 278,525 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 07 920,000 105,000 1,025,000 920,000 105,000 1,025,000 Total contributed capital 1,396,491 0 (400,000) 539,069 0 (400,000) Total stockholders' equity 2,021,491 1,164,069 Total liabilities and stockholders' equity $4,286,056 $2,287,792 AJE's and Closing Entries Trial Balance Balance Sheet Income Statement Comprehensive Inc Stmt SHE Stmt + Ready + 80% 23 JUN 2 W 1 W Excel File Edit View 46% 0 Tue 2:02 PM Insert Format Tools Data Window Help 340-Case1-AcctCycle-SV-20b (3) Formulas Data Review View Acrobat Q Search Sheet Home Insert Page Layout 2+ Share Insert Arial 12 A- A Number 49 Delete Paste I u B .00 " E $ % ) .00 Conditional Format Cell Formatting as Table Styles T Format Sort & Filter Create and Share Adobe PDF P16 for # K L M N O P Q R S T V W Z AB AC AD AD $9.960,712 5,801,655 4,159,057 B E F G H 1 J 7 8 Revenue 9 Net product sales revenue $8.821,284 $8.984,852 10 Service revenue 1,169,385 975,860 11 Total revenue $9.990,669 12 Cost of goods sold 13 Products 5,384,590 5,356,018 14 Services 570,811 445,637 15 Total cost of sales 5,955,401 16 Gross profil 4,035,268 17 18 Operating expenses 19 Advertising 159,000 123,869 20 Bad debt expense 0 26,640 21 Depreciation and amortization 0 125,500 22 Dues and subscriptions 21.470 19.730 23 Insurance 80,144 90.144 24 Legal and accounting fees 106,650 87.650 25 Miscellaneous 9,046 12.010 26 Office expense 220,114 214,136 27 Payroll taxes 138,975 131,170 28 Property taxes 104,570 93.400 29 Repair and maintenance 42.028 37,543 30 Research and development 470,680 278,000 31 Telephone 20.085 21,085 32 Travel and entertainment 38.391 60.402 33 Utilities 47.046 37.876 34 Wages. Employees 964,670 954,688 35 Salaries - Officers 710,000 650,000 36 Total operating expenses 3,130,954 37 38 Income foss) from operations 904,314 39 40 Other income and expense) 41 Interest expense (42,102) (27,800) 42 Gain (loss) on disposal of assets (4,790) (26,950) 43 Interest Ravenue 0 9,230 44 Total other income (expense) (46,892) 45 46 Income floss) before income taxes 857,422 47 Income tax (expense) benefit 0 48 49 Net income (loss) $857,422 50 51 AJE's and Closing Entries Trial Balance Balance Sheet 2,985,845 1,193 212 (45,520) 1,147,692 (401.692) $746,000 Income Statement Comprehensive Inc Stmt SHE Stmt + Enter O + 70% 23 Sud JUN 2 (A W W 45% O Tue 2:02 PM Excel File Edit View Insert Format Tools Data Window Help 340-Case1-AcctCycle-SV-20b (3) Home Insert Page Layout Formulas Data Review View Acrobat Q Search Sheet 2+ Share Insert Arial 12 A- A+ DO Number 49 Delete - Paste B I U A = $ % ) 4.0 .00 .00 1.0 Conditional Format Formatting as Table Cell Styles T Format Sort & Filter Create and Share Adobe PDF B1 fx A B F G H J - L M D E CM Corporation Statement of Stockholder's Equity as of December 31, 20x1 1 2 3 4 5 6 7 Total Stockholder's Equity $ 1,164,069 $ Common Stock 920,000 $ Additional Treasury Paid-In Capital Stock 105,000 $ (400,000) $ Accumulated Retained Other Comprehensive Earnings Income 539,069 $ 8 Beg. Balance, 1/1/x1 9 Common Stock Issued 10 11 Common Stock Repurchased Net Income (x1) Other Comprehensive Income (x1) 12 13 Dividend ("X1) 14 15 End. Balance, 12/31/x1 $ 1,164,069 $ 920,000 $ 105,000 $ (400,000) $ 539,069 $ 16 17 18 19 20 21 22 AJE's and Closing Entries Trial Balance Balance Sheet Income Statement Comprehensive Inc Stmt SHE Stmt + Ready + 100% 23 JUN 2 W MIMI WU W Additional Information to use in recording the necessary Adjusting Journal Entries (AJE's): 1. 2. As of December 31, wages of $45,700 should be accrued; associated payroll taxes on these wages are $2,910. (Record in two separate adjusting entries. The payroll taxes are an expense to the company for unemployment benefits and recorded as a payable to the state & federal taxing authority.) The Unearned Consulting Revenue account has a balance before adjustment of $261,220 as of December 31, 20x1. Of this balance, 70% of the work was completed by year end. You discover that a sale of a product was made on account and CMC recorded the sale in December for $136,200. However, the product has not yet been shipped, therefore it is not considered to be "delivered to the customer." The cost of the product was 55% of its selling price. CMC uses the perpetual inventory method. 3. 4. 5. 6. 7. At year-end, the CFO asks you to review the Accounts Receivables to determine if there are any customer accounts that should be written off as uncollectible. Based on your review, you determine that the Account Receivable from Shift, Co. has been past due for over 14 months and Shift recently declared bankruptcy. The CFO instructs you to write off the account balance of $21,350. Directly following this action, you can now record bad debt expense which is estimated to be 5% of ending Accounts Receivable. (Round to the nearest whole dollar.) CMC prepays for its property & casualty insurance. As of December 31, 20x1, 80% of the prepayments have now been consumed. (Round to the nearest whole dollar.) CMC records depreciation and amortization expense annually. They do not use an accumulated amortization account. (.e. Amortization Expense is recorded with a debit to Amort. Exp and a credit to the Patent.) Annual depreciation rates are 5% for Buildings/Equipment/Furniture, no salvage. (Round to the nearest whole dollar.) Annual Amortization rates are 10% of original cost, straight-line method, no salvage. CMC owns two patents: Patent #FJ101 has an original cost of $154,000 and Patent #CQ510 was acquired for $169,000. The last time depreciation & amortization were recorded was December 31, 20x0. The long-term liabilities were outstanding for all of 20x1 and accrue interest at 8% APR. CMC records accrued interest quarterly (interest was last updated on Sept. 30.) The company is required to pay the interest annually each January 1st CMC often allows customers to finance the purchase of their products through long-term lending agreements and therefore reports Long-term Notes Receivable on their Balance Sheet. These notes are interest bearing and earn CMC interest revenue. The notes accrue interest at 8% APR and were outstanding for all of 20x1. Interest is payable to CMC each January 1st On December 15, CMC declared a dividend of $220,000, to be paid on January 20, 20x2. The dividend declaration had not yet been recorded. At December 31, the Long-Term Investments (Available-for-sale securities or "AFS") had a fair value of $195,400. The AFS Investment was originally purchased on June 1, 20x1 for $160,500. CMC uses a "Fair Value Adjustment" account (an adjunct/contra account to the Investments) to mark-to-market the investment portfolio at year end. (e.g. If the fair value of the Investment has increased at year end, debit the Fair Value Adjustment account in order to increase the Carrying Value of the asset to equal its fair value on the balance sheet at Dec. 31. This is an "unrealized (holding) gain, which would require a credit to record it.) CMC's Income tax rate for 20x1 was determined to be 21%. 8. 9. 10. 11