Answered step by step

Verified Expert Solution

Question

1 Approved Answer

step 2 . the following: - The time frame needed to achieve your savings goal - Your family's anticipated living arrangements - Your desired quality

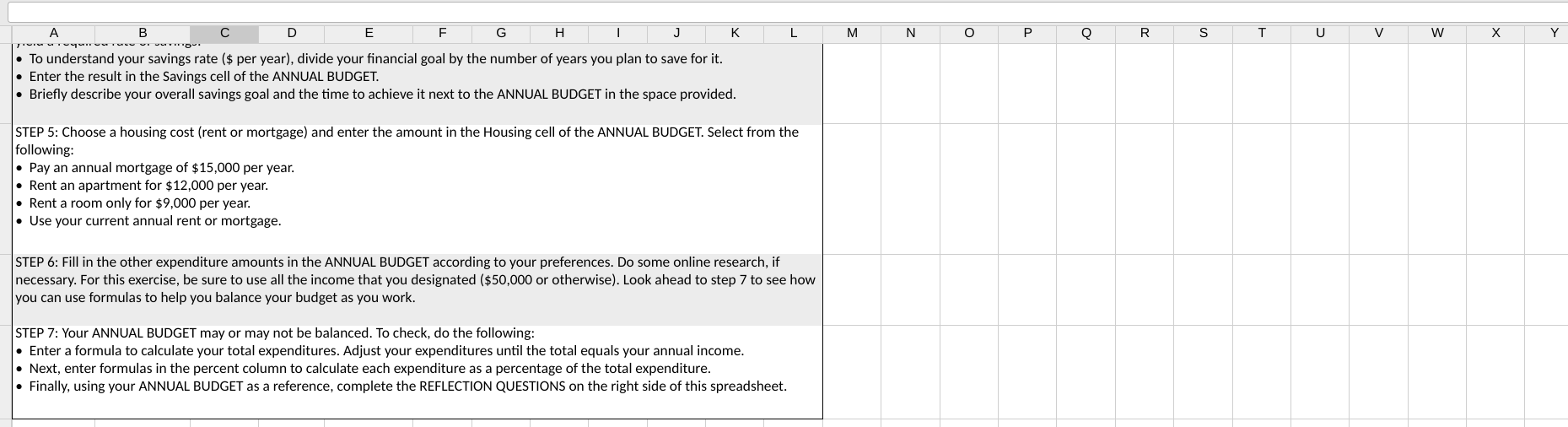

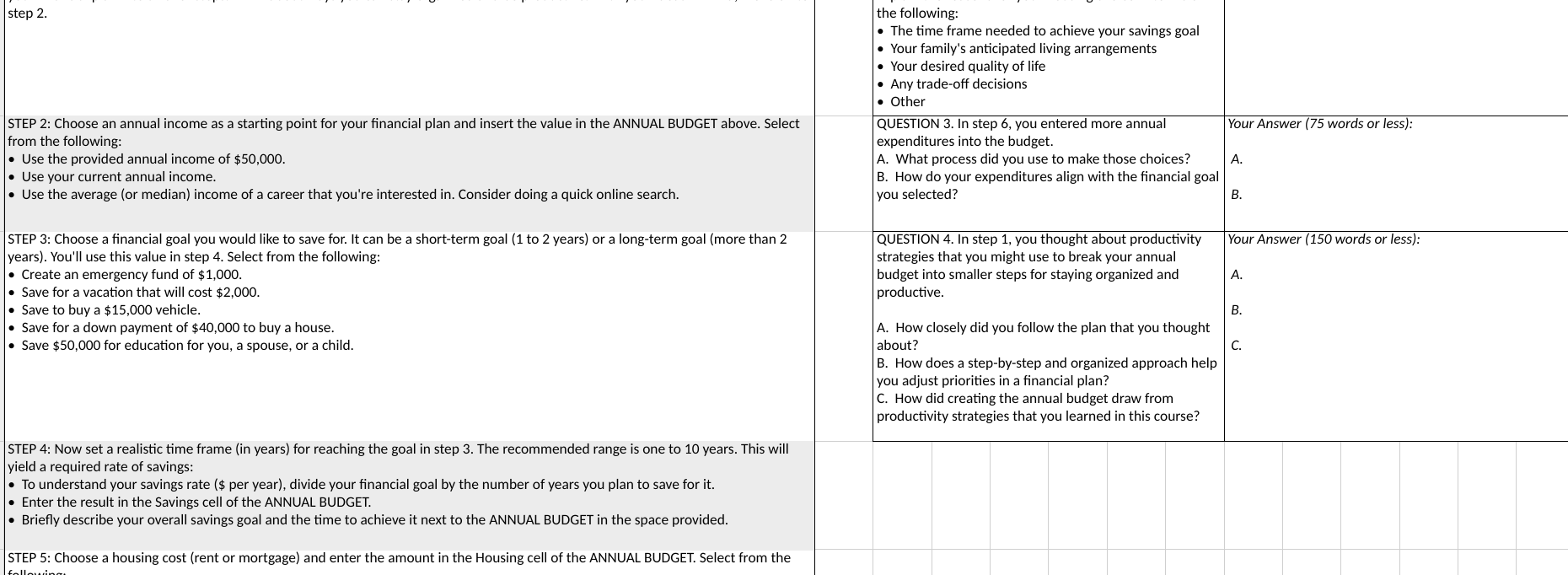

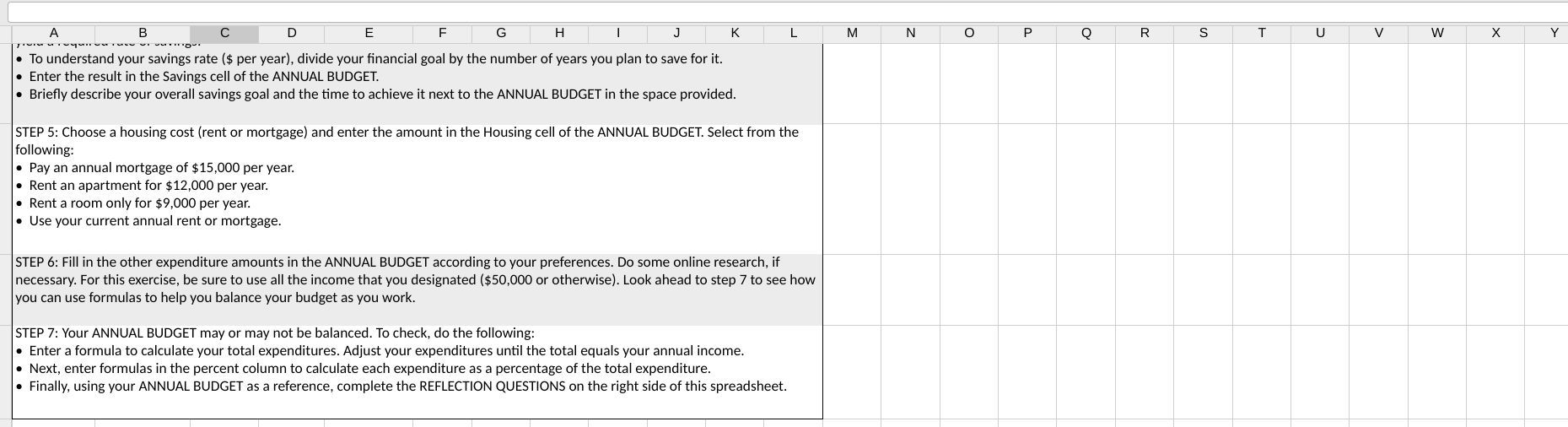

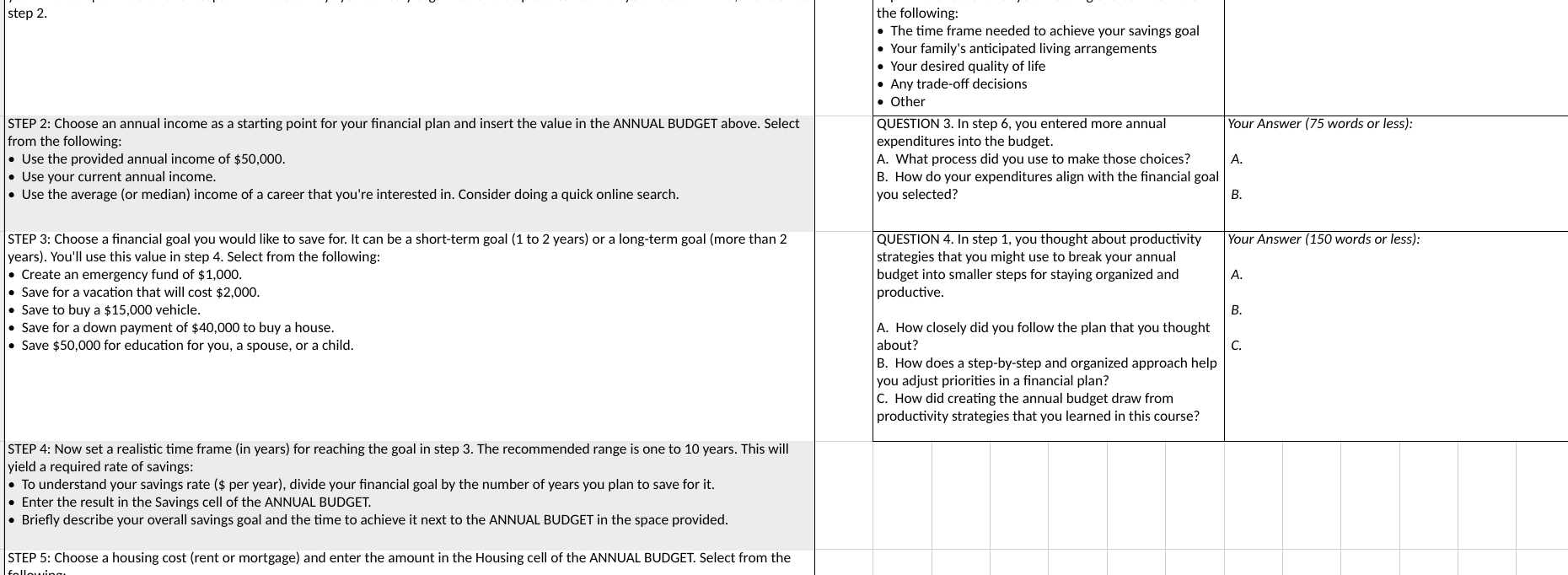

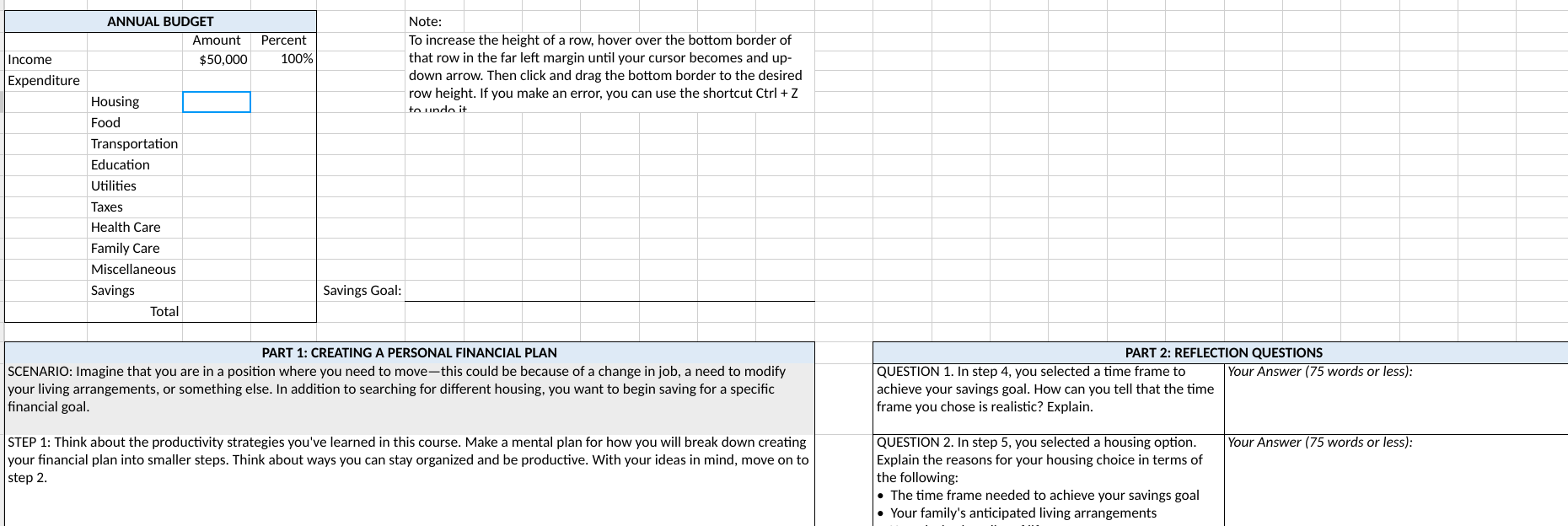

step 2 . the following: - The time frame needed to achieve your savings goal - Your family's anticipated living arrangements - Your desired quality of life - Any trade-off decisions - Other STEP 2: Choose an annual income as a starting point for your financial plan and insert the value in the ANNUAL BUDGET above. Select from the following: - Use the provided annual income of $50,000. - Use your current annual income. - Use the average (or median) income of a career that you're interested in. Consider doing a quick online search. STEP 3: Choose a financial goal you would like to save for. It can be a short-term goal (1 to 2 years) or a long-term goal (more than 2 years). You'll use this value in step 4. Select from the following: - Create an emergency fund of $1,000. - Save for a vacation that will cost $2,000. - Save to buy a $15,000 vehicle. - Save for a down payment of $40,000 to buy a house. - Save $50,000 for education for you, a spouse, or a child. STEP 4: Now set a realistic time frame (in years) for reaching the goal in step 3. The recommended range is one to 10 years. This will yield a required rate of savings: - To understand your savings rate (\$ per year), divide your financial goal by the number of years you plan to save for it. - Enter the result in the Savings cell of the ANNUAL BUDGET. - Briefly describe your overall savings goal and the time to achieve it next to the ANNUAL BUDGET in the space provided. STEP 5: Choose a housing cost (rent or mortgage) and enter the amount in the Housing cell of the ANNUAL BUDGET. Select from the QUESTION 3. In step 6, you entered more annual expenditures into the budget. A. What process did you use to make those choices? B. How do your expenditures align with the financial goal you selected? QUESTION 4. In step 1, you thought about productivity strategies that you might use to break your annual budget into smaller steps for staying organized and productive. A. How closely did you follow the plan that you thought about? B. How does a step-by-step and organized approach help you adjust priorities in a financial plan? C. How did creating the annual budget draw from productivity strategies that you learned in this course? Your Answer (75 words or less): A. B. Your Answer (150 words or less): A. B. C. C. step 2 . the following: - The time frame needed to achieve your savings goal - Your family's anticipated living arrangements - Your desired quality of life - Any trade-off decisions - Other STEP 2: Choose an annual income as a starting point for your financial plan and insert the value in the ANNUAL BUDGET above. Select from the following: - Use the provided annual income of $50,000. - Use your current annual income. - Use the average (or median) income of a career that you're interested in. Consider doing a quick online search. STEP 3: Choose a financial goal you would like to save for. It can be a short-term goal (1 to 2 years) or a long-term goal (more than 2 years). You'll use this value in step 4. Select from the following: - Create an emergency fund of $1,000. - Save for a vacation that will cost $2,000. - Save to buy a $15,000 vehicle. - Save for a down payment of $40,000 to buy a house. - Save $50,000 for education for you, a spouse, or a child. STEP 4: Now set a realistic time frame (in years) for reaching the goal in step 3. The recommended range is one to 10 years. This will yield a required rate of savings: - To understand your savings rate (\$ per year), divide your financial goal by the number of years you plan to save for it. - Enter the result in the Savings cell of the ANNUAL BUDGET. - Briefly describe your overall savings goal and the time to achieve it next to the ANNUAL BUDGET in the space provided. STEP 5: Choose a housing cost (rent or mortgage) and enter the amount in the Housing cell of the ANNUAL BUDGET. Select from the QUESTION 3. In step 6, you entered more annual expenditures into the budget. A. What process did you use to make those choices? B. How do your expenditures align with the financial goal you selected? QUESTION 4. In step 1, you thought about productivity strategies that you might use to break your annual budget into smaller steps for staying organized and productive. A. How closely did you follow the plan that you thought about? B. How does a step-by-step and organized approach help you adjust priorities in a financial plan? C. How did creating the annual budget draw from productivity strategies that you learned in this course? Your Answer (75 words or less): A. B. Your Answer (150 words or less): A. B. C. C. step 2 . the following: - The time frame needed to achieve your savings goal - Your family's anticipated living arrangements - Your desired quality of life - Any trade-off decisions - Other STEP 2: Choose an annual income as a starting point for your financial plan and insert the value in the ANNUAL BUDGET above. Select from the following: - Use the provided annual income of $50,000. - Use your current annual income. - Use the average (or median) income of a career that you're interested in. Consider doing a quick online search. STEP 3: Choose a financial goal you would like to save for. It can be a short-term goal (1 to 2 years) or a long-term goal (more than 2 years). You'll use this value in step 4. Select from the following: - Create an emergency fund of $1,000. - Save for a vacation that will cost $2,000. - Save to buy a $15,000 vehicle. - Save for a down payment of $40,000 to buy a house. - Save $50,000 for education for you, a spouse, or a child. STEP 4: Now set a realistic time frame (in years) for reaching the goal in step 3. The recommended range is one to 10 years. This will yield a required rate of savings: - To understand your savings rate (\$ per year), divide your financial goal by the number of years you plan to save for it. - Enter the result in the Savings cell of the ANNUAL BUDGET. - Briefly describe your overall savings goal and the time to achieve it next to the ANNUAL BUDGET in the space provided. STEP 5: Choose a housing cost (rent or mortgage) and enter the amount in the Housing cell of the ANNUAL BUDGET. Select from the QUESTION 3. In step 6, you entered more annual expenditures into the budget. A. What process did you use to make those choices? B. How do your expenditures align with the financial goal you selected? QUESTION 4. In step 1, you thought about productivity strategies that you might use to break your annual budget into smaller steps for staying organized and productive. A. How closely did you follow the plan that you thought about? B. How does a step-by-step and organized approach help you adjust priorities in a financial plan? C. How did creating the annual budget draw from productivity strategies that you learned in this course? Your Answer (75 words or less): A. B. Your Answer (150 words or less): A. B. C. C. step 2 . the following: - The time frame needed to achieve your savings goal - Your family's anticipated living arrangements - Your desired quality of life - Any trade-off decisions - Other STEP 2: Choose an annual income as a starting point for your financial plan and insert the value in the ANNUAL BUDGET above. Select from the following: - Use the provided annual income of $50,000. - Use your current annual income. - Use the average (or median) income of a career that you're interested in. Consider doing a quick online search. STEP 3: Choose a financial goal you would like to save for. It can be a short-term goal (1 to 2 years) or a long-term goal (more than 2 years). You'll use this value in step 4. Select from the following: - Create an emergency fund of $1,000. - Save for a vacation that will cost $2,000. - Save to buy a $15,000 vehicle. - Save for a down payment of $40,000 to buy a house. - Save $50,000 for education for you, a spouse, or a child. STEP 4: Now set a realistic time frame (in years) for reaching the goal in step 3. The recommended range is one to 10 years. This will yield a required rate of savings: - To understand your savings rate (\$ per year), divide your financial goal by the number of years you plan to save for it. - Enter the result in the Savings cell of the ANNUAL BUDGET. - Briefly describe your overall savings goal and the time to achieve it next to the ANNUAL BUDGET in the space provided. STEP 5: Choose a housing cost (rent or mortgage) and enter the amount in the Housing cell of the ANNUAL BUDGET. Select from the QUESTION 3. In step 6, you entered more annual expenditures into the budget. A. What process did you use to make those choices? B. How do your expenditures align with the financial goal you selected? QUESTION 4. In step 1, you thought about productivity strategies that you might use to break your annual budget into smaller steps for staying organized and productive. A. How closely did you follow the plan that you thought about? B. How does a step-by-step and organized approach help you adjust priorities in a financial plan? C. How did creating the annual budget draw from productivity strategies that you learned in this course? Your Answer (75 words or less): A. B. Your Answer (150 words or less): A. B. C. C

step 2 . the following: - The time frame needed to achieve your savings goal - Your family's anticipated living arrangements - Your desired quality of life - Any trade-off decisions - Other STEP 2: Choose an annual income as a starting point for your financial plan and insert the value in the ANNUAL BUDGET above. Select from the following: - Use the provided annual income of $50,000. - Use your current annual income. - Use the average (or median) income of a career that you're interested in. Consider doing a quick online search. STEP 3: Choose a financial goal you would like to save for. It can be a short-term goal (1 to 2 years) or a long-term goal (more than 2 years). You'll use this value in step 4. Select from the following: - Create an emergency fund of $1,000. - Save for a vacation that will cost $2,000. - Save to buy a $15,000 vehicle. - Save for a down payment of $40,000 to buy a house. - Save $50,000 for education for you, a spouse, or a child. STEP 4: Now set a realistic time frame (in years) for reaching the goal in step 3. The recommended range is one to 10 years. This will yield a required rate of savings: - To understand your savings rate (\$ per year), divide your financial goal by the number of years you plan to save for it. - Enter the result in the Savings cell of the ANNUAL BUDGET. - Briefly describe your overall savings goal and the time to achieve it next to the ANNUAL BUDGET in the space provided. STEP 5: Choose a housing cost (rent or mortgage) and enter the amount in the Housing cell of the ANNUAL BUDGET. Select from the QUESTION 3. In step 6, you entered more annual expenditures into the budget. A. What process did you use to make those choices? B. How do your expenditures align with the financial goal you selected? QUESTION 4. In step 1, you thought about productivity strategies that you might use to break your annual budget into smaller steps for staying organized and productive. A. How closely did you follow the plan that you thought about? B. How does a step-by-step and organized approach help you adjust priorities in a financial plan? C. How did creating the annual budget draw from productivity strategies that you learned in this course? Your Answer (75 words or less): A. B. Your Answer (150 words or less): A. B. C. C. step 2 . the following: - The time frame needed to achieve your savings goal - Your family's anticipated living arrangements - Your desired quality of life - Any trade-off decisions - Other STEP 2: Choose an annual income as a starting point for your financial plan and insert the value in the ANNUAL BUDGET above. Select from the following: - Use the provided annual income of $50,000. - Use your current annual income. - Use the average (or median) income of a career that you're interested in. Consider doing a quick online search. STEP 3: Choose a financial goal you would like to save for. It can be a short-term goal (1 to 2 years) or a long-term goal (more than 2 years). You'll use this value in step 4. Select from the following: - Create an emergency fund of $1,000. - Save for a vacation that will cost $2,000. - Save to buy a $15,000 vehicle. - Save for a down payment of $40,000 to buy a house. - Save $50,000 for education for you, a spouse, or a child. STEP 4: Now set a realistic time frame (in years) for reaching the goal in step 3. The recommended range is one to 10 years. This will yield a required rate of savings: - To understand your savings rate (\$ per year), divide your financial goal by the number of years you plan to save for it. - Enter the result in the Savings cell of the ANNUAL BUDGET. - Briefly describe your overall savings goal and the time to achieve it next to the ANNUAL BUDGET in the space provided. STEP 5: Choose a housing cost (rent or mortgage) and enter the amount in the Housing cell of the ANNUAL BUDGET. Select from the QUESTION 3. In step 6, you entered more annual expenditures into the budget. A. What process did you use to make those choices? B. How do your expenditures align with the financial goal you selected? QUESTION 4. In step 1, you thought about productivity strategies that you might use to break your annual budget into smaller steps for staying organized and productive. A. How closely did you follow the plan that you thought about? B. How does a step-by-step and organized approach help you adjust priorities in a financial plan? C. How did creating the annual budget draw from productivity strategies that you learned in this course? Your Answer (75 words or less): A. B. Your Answer (150 words or less): A. B. C. C. step 2 . the following: - The time frame needed to achieve your savings goal - Your family's anticipated living arrangements - Your desired quality of life - Any trade-off decisions - Other STEP 2: Choose an annual income as a starting point for your financial plan and insert the value in the ANNUAL BUDGET above. Select from the following: - Use the provided annual income of $50,000. - Use your current annual income. - Use the average (or median) income of a career that you're interested in. Consider doing a quick online search. STEP 3: Choose a financial goal you would like to save for. It can be a short-term goal (1 to 2 years) or a long-term goal (more than 2 years). You'll use this value in step 4. Select from the following: - Create an emergency fund of $1,000. - Save for a vacation that will cost $2,000. - Save to buy a $15,000 vehicle. - Save for a down payment of $40,000 to buy a house. - Save $50,000 for education for you, a spouse, or a child. STEP 4: Now set a realistic time frame (in years) for reaching the goal in step 3. The recommended range is one to 10 years. This will yield a required rate of savings: - To understand your savings rate (\$ per year), divide your financial goal by the number of years you plan to save for it. - Enter the result in the Savings cell of the ANNUAL BUDGET. - Briefly describe your overall savings goal and the time to achieve it next to the ANNUAL BUDGET in the space provided. STEP 5: Choose a housing cost (rent or mortgage) and enter the amount in the Housing cell of the ANNUAL BUDGET. Select from the QUESTION 3. In step 6, you entered more annual expenditures into the budget. A. What process did you use to make those choices? B. How do your expenditures align with the financial goal you selected? QUESTION 4. In step 1, you thought about productivity strategies that you might use to break your annual budget into smaller steps for staying organized and productive. A. How closely did you follow the plan that you thought about? B. How does a step-by-step and organized approach help you adjust priorities in a financial plan? C. How did creating the annual budget draw from productivity strategies that you learned in this course? Your Answer (75 words or less): A. B. Your Answer (150 words or less): A. B. C. C. step 2 . the following: - The time frame needed to achieve your savings goal - Your family's anticipated living arrangements - Your desired quality of life - Any trade-off decisions - Other STEP 2: Choose an annual income as a starting point for your financial plan and insert the value in the ANNUAL BUDGET above. Select from the following: - Use the provided annual income of $50,000. - Use your current annual income. - Use the average (or median) income of a career that you're interested in. Consider doing a quick online search. STEP 3: Choose a financial goal you would like to save for. It can be a short-term goal (1 to 2 years) or a long-term goal (more than 2 years). You'll use this value in step 4. Select from the following: - Create an emergency fund of $1,000. - Save for a vacation that will cost $2,000. - Save to buy a $15,000 vehicle. - Save for a down payment of $40,000 to buy a house. - Save $50,000 for education for you, a spouse, or a child. STEP 4: Now set a realistic time frame (in years) for reaching the goal in step 3. The recommended range is one to 10 years. This will yield a required rate of savings: - To understand your savings rate (\$ per year), divide your financial goal by the number of years you plan to save for it. - Enter the result in the Savings cell of the ANNUAL BUDGET. - Briefly describe your overall savings goal and the time to achieve it next to the ANNUAL BUDGET in the space provided. STEP 5: Choose a housing cost (rent or mortgage) and enter the amount in the Housing cell of the ANNUAL BUDGET. Select from the QUESTION 3. In step 6, you entered more annual expenditures into the budget. A. What process did you use to make those choices? B. How do your expenditures align with the financial goal you selected? QUESTION 4. In step 1, you thought about productivity strategies that you might use to break your annual budget into smaller steps for staying organized and productive. A. How closely did you follow the plan that you thought about? B. How does a step-by-step and organized approach help you adjust priorities in a financial plan? C. How did creating the annual budget draw from productivity strategies that you learned in this course? Your Answer (75 words or less): A. B. Your Answer (150 words or less): A. B. C. C Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started