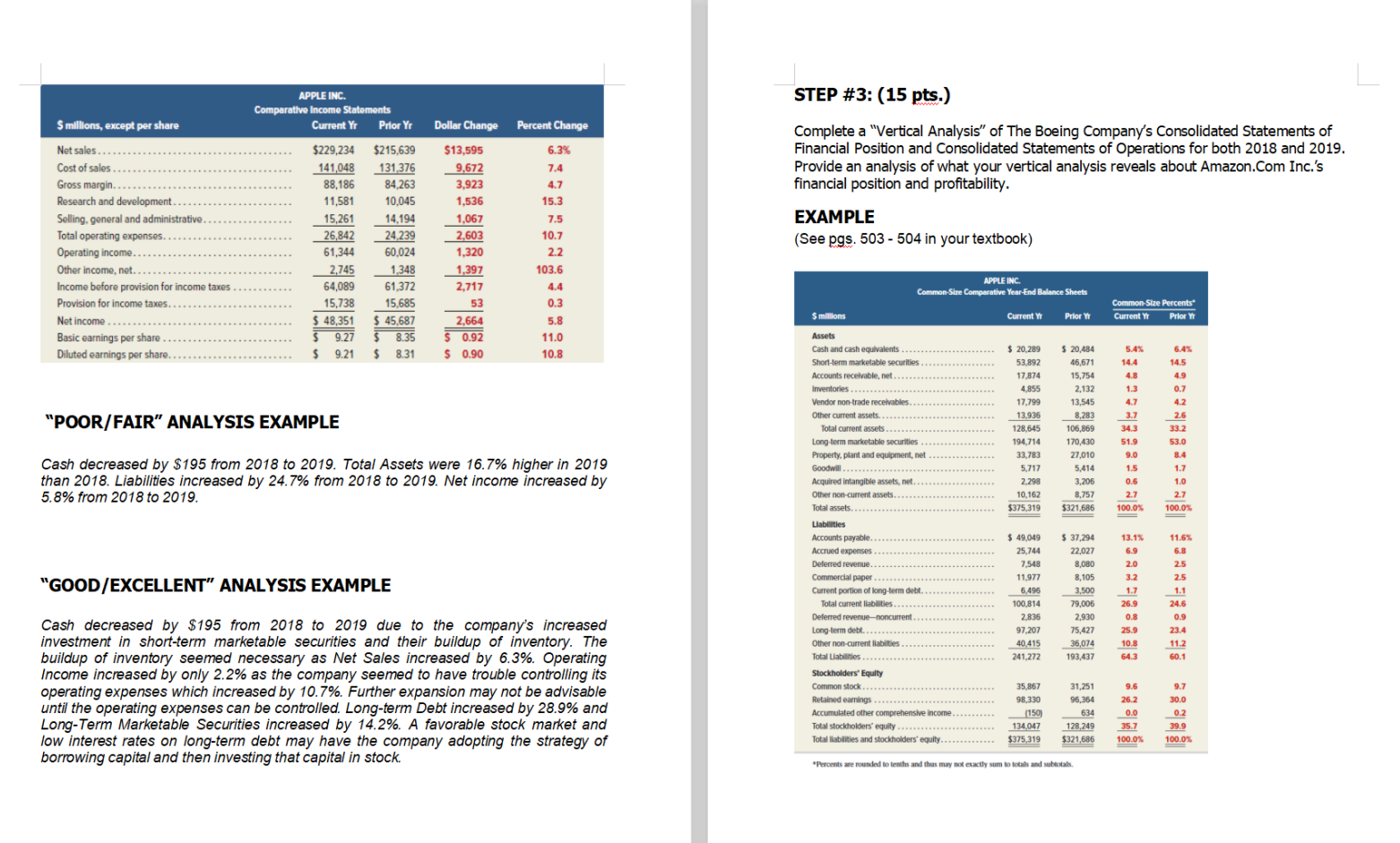

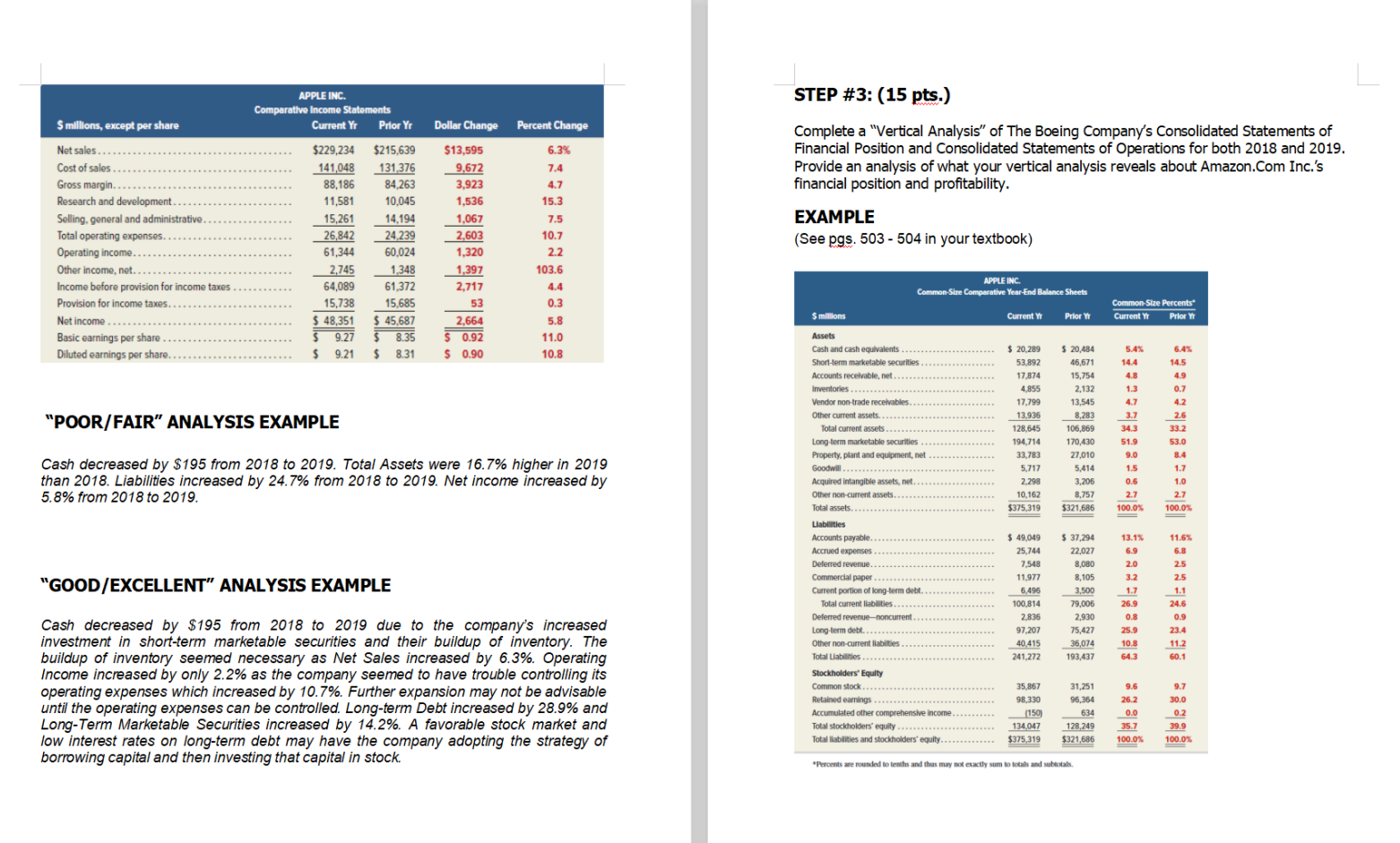

STEP #3: (15 pts.) APPLE INC. Comparative Income Statements Current Yr Prior YI $ millions, except per share Dollar Change Percent Change $13,595 9,672 3.923 1,536 1,067 2,603 Complete a "Vertical Analysis of The Boeing Company's Consolidated Statements of Financial Position and Consolidated Statements of Operations for both 2018 and 2019. Provide an analysis of what your vertical analysis reveals about Amazon.com Inc.'s financial position and profitability. EXAMPLE (See pgs. 503-504 in your textbook) Net sales Cost of sales Gross margin Research and development Selling, general and administrative Total operating expenses. Operating income. Other income, net.. Income before provision for income taxes Provision for income taxes. Net income.. Basic earnings per share Diluted earnings per share. $229,234 141,048 88,186 11,581 15,261 26,842 61,344 2,745 64,089 15,738 $ 48,351 9.27 $ 9.21 $215,639 131,376 84.263 10.045 14,194 24.239 60.024 1,348 61,372 15.685 $ 45,687 8.35 $ 8.31 1,320 6.3% 7.4 4.7 15.3 7.5 10.7 2.2 103.6 4.4 0.3 5.8 11.0 10.8 APPLE INC Common Size Comparative Year-End Balance Sheets 1,397 2.717 53 2,664 0.92 $ 0.90 Common Size Percents Current Y Prior Y $ millions Current Prior 5.4% 14.4 "POOR/FAIR" ANALYSIS EXAMPLE $ 20,289 53,892 17,874 4855 17.799 13,936 128,645 194,714 33,783 5,717 2,298 10,162 $375,319 $ 20,484 46,671 15,754 2,132 13,545 8,283 106,869 170,430 27,010 5,414 3,206 8,757 $321,686 4.8 1.3 4.7 3.7 34.3 51.9 9.0 1.5 0.6 6.4% 14.5 4.9 0.7 4.2 2.6 33.2 53.0 8.4 1.7 1.0 Cash decreased by $195 from 2018 to 2019. Total Assets were 16.7% higher in 2019 than 2018. Liabilities increased by 24.7% from 2018 to 2019. Net income increased by 5.8% from 2018 to 2019. 2.7 100.0% 100.0% Assets Cash and cash equivalents Short-term marketable securities Accounts receivable, net Inventories.. Vendor non-trade receivables Other current assets. Total current assets Long-term marketable securities Property, plant and equipment, net Goodwill.... Acquired intangible assets, net Other non-current assets Total assets Llabilities Accounts payable Accrued expenses Deferred revenue. Commercial paper Current portion of long-term debt Total current liabilities. Deferred revenue-noncurrent Long-term debt. Other non-current liabilties Total Liabilities Stockholders' Equity Common stock Retained earnings Accumulated other comprehensive income Total stockholders' equity Total liabilities and stockholders' equity...... $ 49,049 25.744 7,548 11.977 6.496 100,814 2.836 97.207 40.415 241.272 "GOOD/EXCELLENT" ANALYSIS EXAMPLE $ 37,294 22,027 8,080 8,105 3,500 79,006 2,930 75,427 36,074 193,437 13.1% 6.9 2.0 3.2 1.7 26.9 11.6% 6.8 2.5 2.5 1.1 24.6 0.9 23.4 11.2 60.1 0.8 25.9 10.8 64.3 Cash decreased by $195 from 2018 to 2019 due to the company's increased investment in short-term marketable securities and their buildup of inventory. The buildup of inventory seemed necessary as Net Sales increased by 6.3%. Operating Income increased by only 2.2% as the company seemed to have trouble controlling its operating expenses which increased by 10.7%. Further expansion may not be advisable until the operating expenses can be controlled. Long-term Debt increased by 28.9% and Long-Term Marketable Securities increased by 14.2%. A favorable stock market and low interest rates on long-term debt may have the company adopting the strategy of borrowing capital and then investing that capital in stock. 35867 98.330 (150) 134047 $375,319 31,251 96,364 634 128,249 $321,686 9.6 26.2 0.0 35.7 100.0% 9.7 30.0 0.2 39.9 100.0% Percents are rounded to tenths and thus may not exactly sum to totals and subtotals STEP #3: (15 pts.) APPLE INC. Comparative Income Statements Current Yr Prior YI $ millions, except per share Dollar Change Percent Change $13,595 9,672 3.923 1,536 1,067 2,603 Complete a "Vertical Analysis of The Boeing Company's Consolidated Statements of Financial Position and Consolidated Statements of Operations for both 2018 and 2019. Provide an analysis of what your vertical analysis reveals about Amazon.com Inc.'s financial position and profitability. EXAMPLE (See pgs. 503-504 in your textbook) Net sales Cost of sales Gross margin Research and development Selling, general and administrative Total operating expenses. Operating income. Other income, net.. Income before provision for income taxes Provision for income taxes. Net income.. Basic earnings per share Diluted earnings per share. $229,234 141,048 88,186 11,581 15,261 26,842 61,344 2,745 64,089 15,738 $ 48,351 9.27 $ 9.21 $215,639 131,376 84.263 10.045 14,194 24.239 60.024 1,348 61,372 15.685 $ 45,687 8.35 $ 8.31 1,320 6.3% 7.4 4.7 15.3 7.5 10.7 2.2 103.6 4.4 0.3 5.8 11.0 10.8 APPLE INC Common Size Comparative Year-End Balance Sheets 1,397 2.717 53 2,664 0.92 $ 0.90 Common Size Percents Current Y Prior Y $ millions Current Prior 5.4% 14.4 "POOR/FAIR" ANALYSIS EXAMPLE $ 20,289 53,892 17,874 4855 17.799 13,936 128,645 194,714 33,783 5,717 2,298 10,162 $375,319 $ 20,484 46,671 15,754 2,132 13,545 8,283 106,869 170,430 27,010 5,414 3,206 8,757 $321,686 4.8 1.3 4.7 3.7 34.3 51.9 9.0 1.5 0.6 6.4% 14.5 4.9 0.7 4.2 2.6 33.2 53.0 8.4 1.7 1.0 Cash decreased by $195 from 2018 to 2019. Total Assets were 16.7% higher in 2019 than 2018. Liabilities increased by 24.7% from 2018 to 2019. Net income increased by 5.8% from 2018 to 2019. 2.7 100.0% 100.0% Assets Cash and cash equivalents Short-term marketable securities Accounts receivable, net Inventories.. Vendor non-trade receivables Other current assets. Total current assets Long-term marketable securities Property, plant and equipment, net Goodwill.... Acquired intangible assets, net Other non-current assets Total assets Llabilities Accounts payable Accrued expenses Deferred revenue. Commercial paper Current portion of long-term debt Total current liabilities. Deferred revenue-noncurrent Long-term debt. Other non-current liabilties Total Liabilities Stockholders' Equity Common stock Retained earnings Accumulated other comprehensive income Total stockholders' equity Total liabilities and stockholders' equity...... $ 49,049 25.744 7,548 11.977 6.496 100,814 2.836 97.207 40.415 241.272 "GOOD/EXCELLENT" ANALYSIS EXAMPLE $ 37,294 22,027 8,080 8,105 3,500 79,006 2,930 75,427 36,074 193,437 13.1% 6.9 2.0 3.2 1.7 26.9 11.6% 6.8 2.5 2.5 1.1 24.6 0.9 23.4 11.2 60.1 0.8 25.9 10.8 64.3 Cash decreased by $195 from 2018 to 2019 due to the company's increased investment in short-term marketable securities and their buildup of inventory. The buildup of inventory seemed necessary as Net Sales increased by 6.3%. Operating Income increased by only 2.2% as the company seemed to have trouble controlling its operating expenses which increased by 10.7%. Further expansion may not be advisable until the operating expenses can be controlled. Long-term Debt increased by 28.9% and Long-Term Marketable Securities increased by 14.2%. A favorable stock market and low interest rates on long-term debt may have the company adopting the strategy of borrowing capital and then investing that capital in stock. 35867 98.330 (150) 134047 $375,319 31,251 96,364 634 128,249 $321,686 9.6 26.2 0.0 35.7 100.0% 9.7 30.0 0.2 39.9 100.0% Percents are rounded to tenths and thus may not exactly sum to totals and subtotals