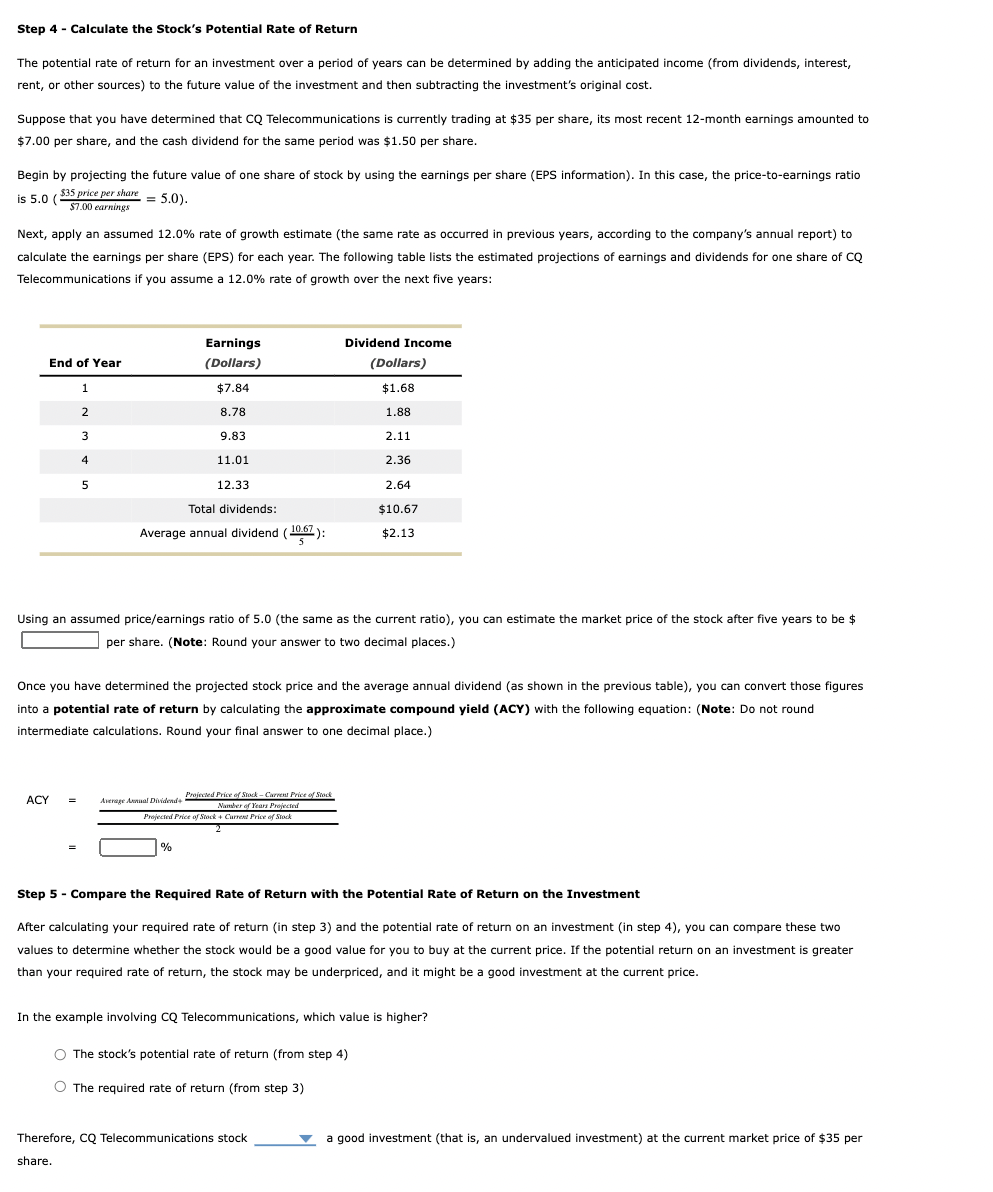

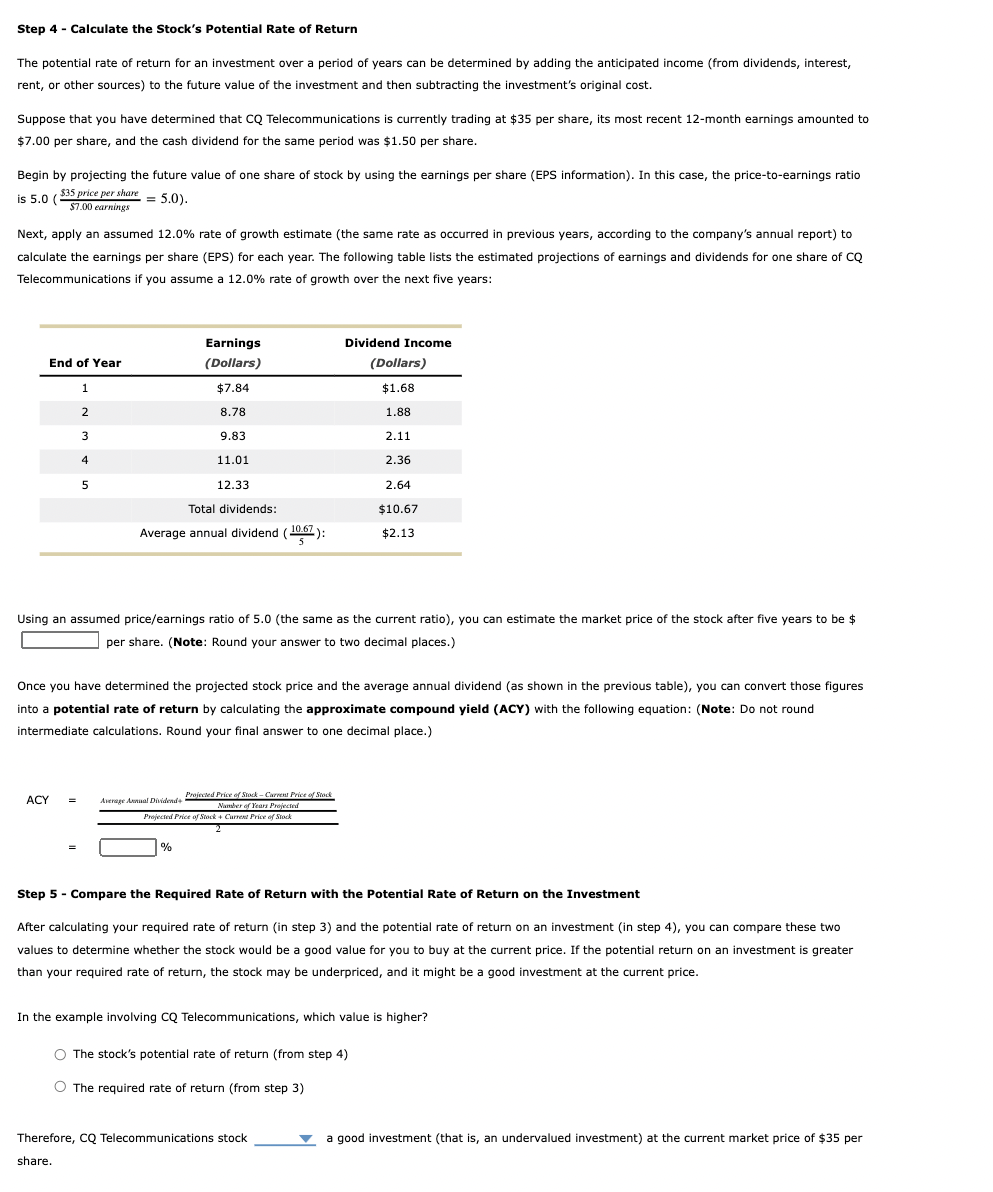

Step 4 - Calculate the Stock's Potential Rate of Return The potential rate of return for an investment over a period of years can be determined by adding the anticipated income (from dividends, interest, rent, or other sources) to the future value of the investment and then subtracting the investment's original cost. Suppose that you have determined that CQ Telecommunications is currently trading at $35 per share, its most recent 12-month earnings amounted to $7.00 per share, and the cash dividend for the same period was $1.50 per share. Begin by projecting the future value of one share of stock by using the earnings per share (EPS information). In this case, the price-to-earnings ratio is 5.0 535 price per share = 5,0). $7.00 earnings ( Next, apply an assumed 12.0% rate of growth estimate the same rate as occurred in previous years, according to the company's annual report) to calculate the earnings per share (EPS) for each year. The following table lists the estimated projections of earnings and dividends for one share of CQ Telecommunications if you assume a 12.0% rate of growth over the next five years: Dividend Income Earnings (Dollars) End of Year (Dollars) 1 $7.84 $1.68 2 8.78 1.88 3 9.83 2.11 4 11.01 2.36 5 12.33 2.64 $10.67 Total dividends: Average annual dividend (1967): ( $2.13 Using an assumed price/earnings ratio of 5.0 (the same as the current ratio), you can estimate the market price of the stock after five years to be $ per share. (Note: Round your answer to two decimal places.) Once you have determined the projected stock price and the average annual dividend (as shown in the previous table), you can convert those figures into a potential rate of return by calculating the approximate compound yield (ACY) with the following equation: (Note: Do not round intermediate calculations. Round your final answer to one decimal place.) ACY = Atrage Animal Divided. Prowed Price of Stock - Current Price of Sock Nanser of Years Projected Projected Price of Stack + Current Price of Stack = % Step 5 - Compare the required Rate of Return with the potential Rate of Return on the Investment After calculating your required rate of return (in step 3) and the potential rate of return on an investment in step 4), you can compare these two values to determine whether the stock would be a good value for you to buy at the current price. If the potential return on an investment is greater than your required rate of return, the stock may be underpriced, and it might be a good investment at the current price. In the example involving CQ Telecommunications, which value is higher? O The stock's potential rate of return (from step 4) The required rate of return (from step 3) Therefore, CO Telecommunications stock a good investment (that is, an undervalued investment) at the current market price of $35 per share