Answered step by step

Verified Expert Solution

Question

1 Approved Answer

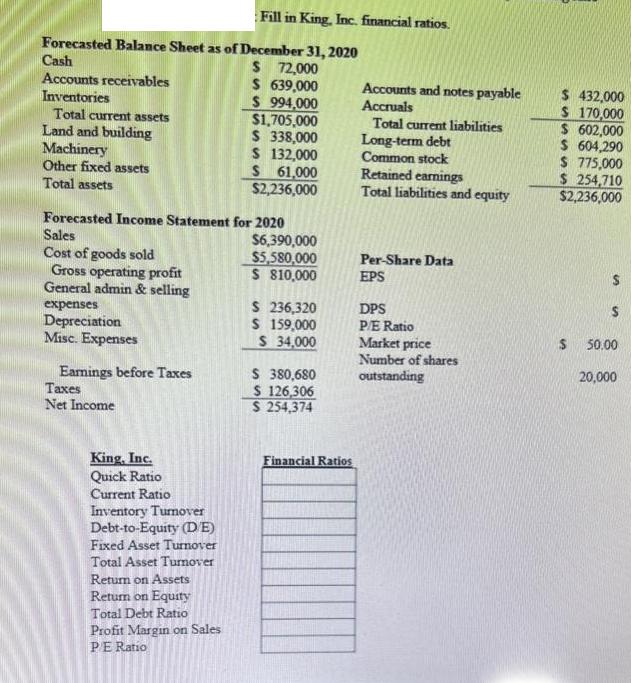

Forecasted Balance Sheet as of December 31, 2020 $ 72,000 $ 639,000 $ 994,000 Cash Accounts receivables Inventories Total current assets Land and building

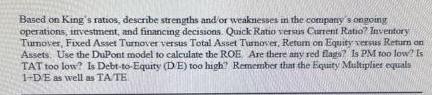

Forecasted Balance Sheet as of December 31, 2020 $ 72,000 $ 639,000 $ 994,000 Cash Accounts receivables Inventories Total current assets Land and building Machinery Other fixed assets Total assets Earnings before Taxes Forecasted Income Statement for 2020 Sales Cost of goods sold Gross operating profit General admin & selling expenses Depreciation Misc. Expenses Taxes Net Income King, Inc. Quick Ratio Current Ratio Inventory Turnover Fill in King, Inc. financial ratios. Debt-to-Equity (DE) Fixed Asset Turnover Total Asset Turnover Return on Assets Return on Equity Total Debt Ratio Profit Margin on Sales PE Ratio $1,705,000 $ 338,000 $ 132,000 $ 61,000 $2,236,000 $6,390,000 $5,580,000 $ 810,000 $ 236,320 $ 159,000 $ 34,000 $ 380,680 $ 126,306 $ 254,374 Financial Ratios Accounts and notes payable Accruals Total current liabilities Long-term debt Common stock Retained earnings Total liabilities and equity Per-Share Data EPS DPS P/E Ratio Market price Number of shares outstanding $ 432,000 $ 170,000 $ 602,000 $ 604,290 $ 775,000 $ 254,710 $2,236,000 $ S 50.00 20,000 Based on King's ratios, describe strengths and/or weaknesses in the company's ongoing operations, investment, and financing decisions. Quick Ratio versus Current Ratio? Inventory Tumover, Fixed Asset Turnover versus Total Asset Turnover, Return on Equity versus Return on Assets. Use the DuPont model to calculate the ROE. Are there any red flags? Is PM too low? Is TAT too low? Is Debt-to-Equity (DE) too high? Remember that the Equity Multiplier equals 1-DE as well as TA/TE

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer Lets calculate the financial ratios for King Inc based on the provided information Quick Ratio Quick Ratio Cash Accounts Receivable Current Liabilities Quick Ratio 72000 639000 602000 Quick Rat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started