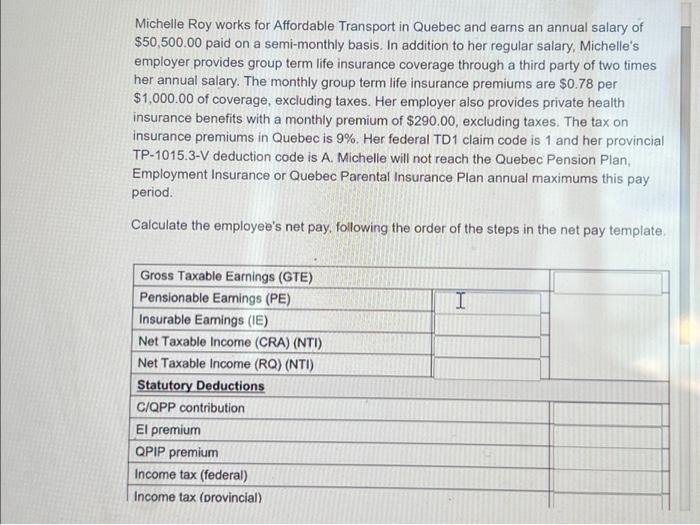

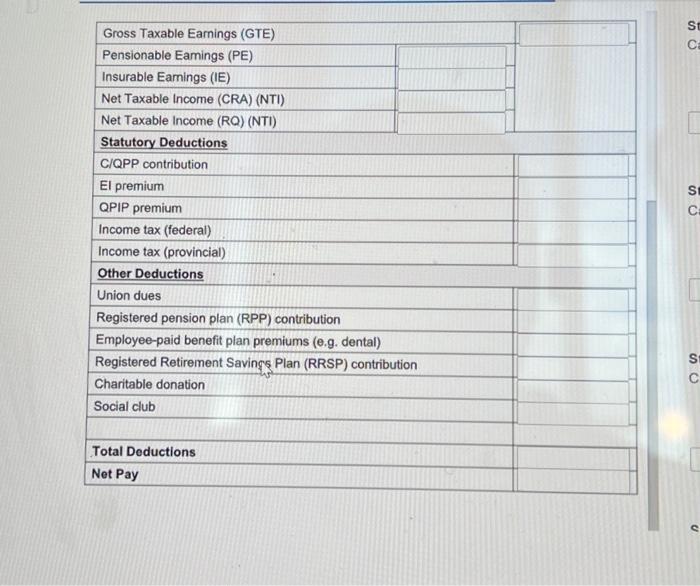

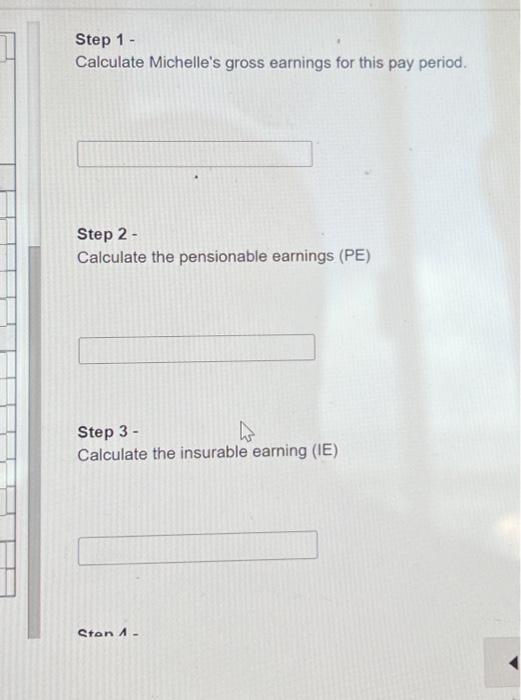

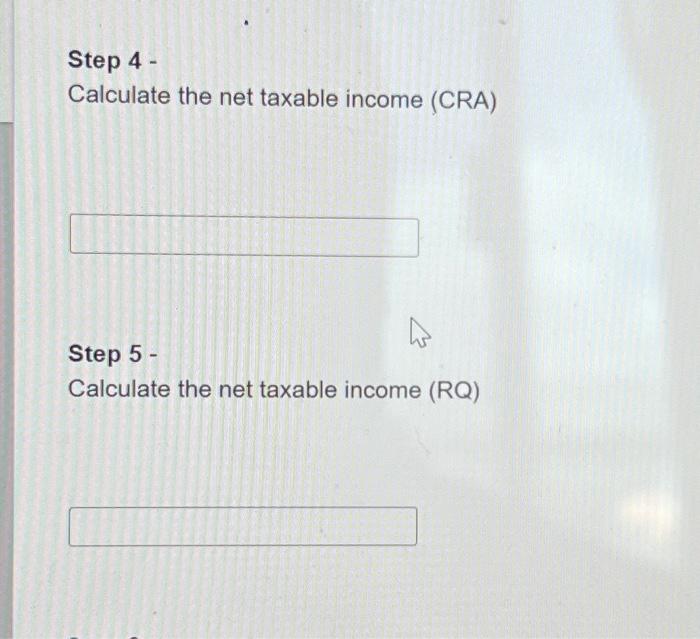

Step 6 - Calculate Michelle's Quebec Pension Plan contribution. Step 7 - Calculate Michelle's Estoployment Insurance premium. Step 8 - Calculate Michelle's Quebec Parental Insurance Plan premium. Step 12 - Calculate Michelle's net pay. Step 1 - Calculate Michelle's gross earnings for this pay period. Step 2 - Calculate the pensionable earnings (PE) Step 3 - Calculate the insurable earning (IE) Michelle Roy works for Affordable Transport in Quebec and earns an annual salary of $50,500,00 paid on a semi-monthly basis. In addition to her regular salary, Michelle's employer provides group term life insurance coverage through a third party of two times her annual salary. The monthly group term life insurance premiums are $0.78 per $1,000.00 of coverage, excluding taxes. Her employer also provides private health insurance benefits with a monthly premium of $290.00, excluding taxes. The tax on insurance premiums in Quebec is 9%. Her federal TD1 claim code is 1 and her provincial TP-1015.3-V deduction code is A. Michelle will not reach the Quebec Pension Plan, Employment Insurance or Quebec Parental Insurance Plan annual maximums this pay period. Calculate the employee's net pay, following the order of the steps in the net pay template. Step 9 - Determine Michelle's federal income tax. Step 10 - Determine Michelle's Quebec provincial income tax. Step 11 - Calculate Michelle's total deductions. Step 4 - Calculate the net taxable income (CRA) Step 5 - Calculate the net taxable income (RQ) Step 6 - Calculate Michelle's Quebec Pension Plan contribution. Step 7 - Calculate Michelle's Estoployment Insurance premium. Step 8 - Calculate Michelle's Quebec Parental Insurance Plan premium. Step 12 - Calculate Michelle's net pay. Step 1 - Calculate Michelle's gross earnings for this pay period. Step 2 - Calculate the pensionable earnings (PE) Step 3 - Calculate the insurable earning (IE) Michelle Roy works for Affordable Transport in Quebec and earns an annual salary of $50,500,00 paid on a semi-monthly basis. In addition to her regular salary, Michelle's employer provides group term life insurance coverage through a third party of two times her annual salary. The monthly group term life insurance premiums are $0.78 per $1,000.00 of coverage, excluding taxes. Her employer also provides private health insurance benefits with a monthly premium of $290.00, excluding taxes. The tax on insurance premiums in Quebec is 9%. Her federal TD1 claim code is 1 and her provincial TP-1015.3-V deduction code is A. Michelle will not reach the Quebec Pension Plan, Employment Insurance or Quebec Parental Insurance Plan annual maximums this pay period. Calculate the employee's net pay, following the order of the steps in the net pay template. Step 9 - Determine Michelle's federal income tax. Step 10 - Determine Michelle's Quebec provincial income tax. Step 11 - Calculate Michelle's total deductions. Step 4 - Calculate the net taxable income (CRA) Step 5 - Calculate the net taxable income (RQ)