Answered step by step

Verified Expert Solution

Question

1 Approved Answer

step by step approach Question 1 A petroleum investor has to make the following payments for a joint venture petroleum project: A down payment of

step by step approach

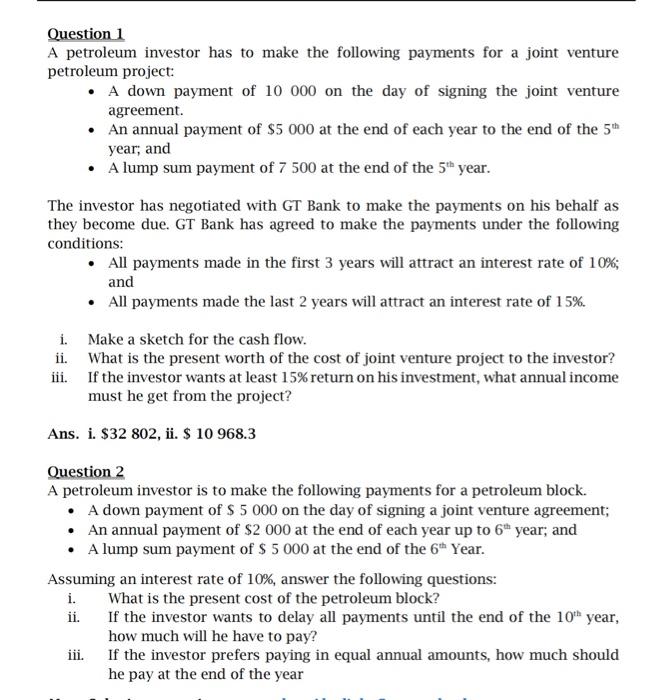

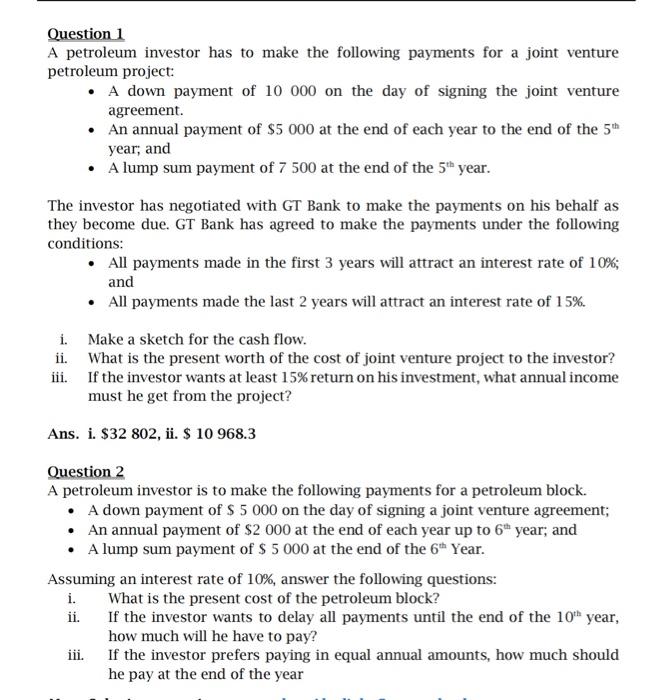

Question 1 A petroleum investor has to make the following payments for a joint venture petroleum project: A down payment of 10 000 on the day of signing the joint venture agreement. An annual payment of $5 000 at the end of each year to the end of the 55 year; and A lump sum payment of 7 500 at the end of the 5th year. The investor has negotiated with GT Bank to make the payments on his behalf as they become due. GT Bank has agreed to make the payments under the following conditions: All payments made in the first 3 years will attract an interest rate of 10%; and All payments made the last 2 years will attract an interest rate of 15%. i. Make a sketch for the cash flow. ii. What is the present worth of the cost of joint venture project to the investor? iii. If the investor wants at least 15% return on his investment, what annual income must he get from the project? Ans. i. $32 802, i. $ 10 968.3 Question 2 A petroleum investor is to make the following payments for a petroleum block. A down payment of $ 5 000 on the day of signing a joint venture agreement; An annual payment of $2 000 at the end of each year up to 6 year; and A lump sum payment of $ 5 000 at the end of the 6 Year. Assuming an interest rate of 10%, answer the following questions: i. What is the present cost of the petroleum block? ii. If the investor wants to delay all payments until the end of the 10th year, how much will he have to pay? iii. If the investor prefers paying in equal annual amounts, how much should he pay at the end of the year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started