Question

Step by step please thanks On November 1, 2019, Dunn Company (a U.S.-based company) forecasts the purchase of goods from a foreign supplier for 200,000

Step by step please thanks

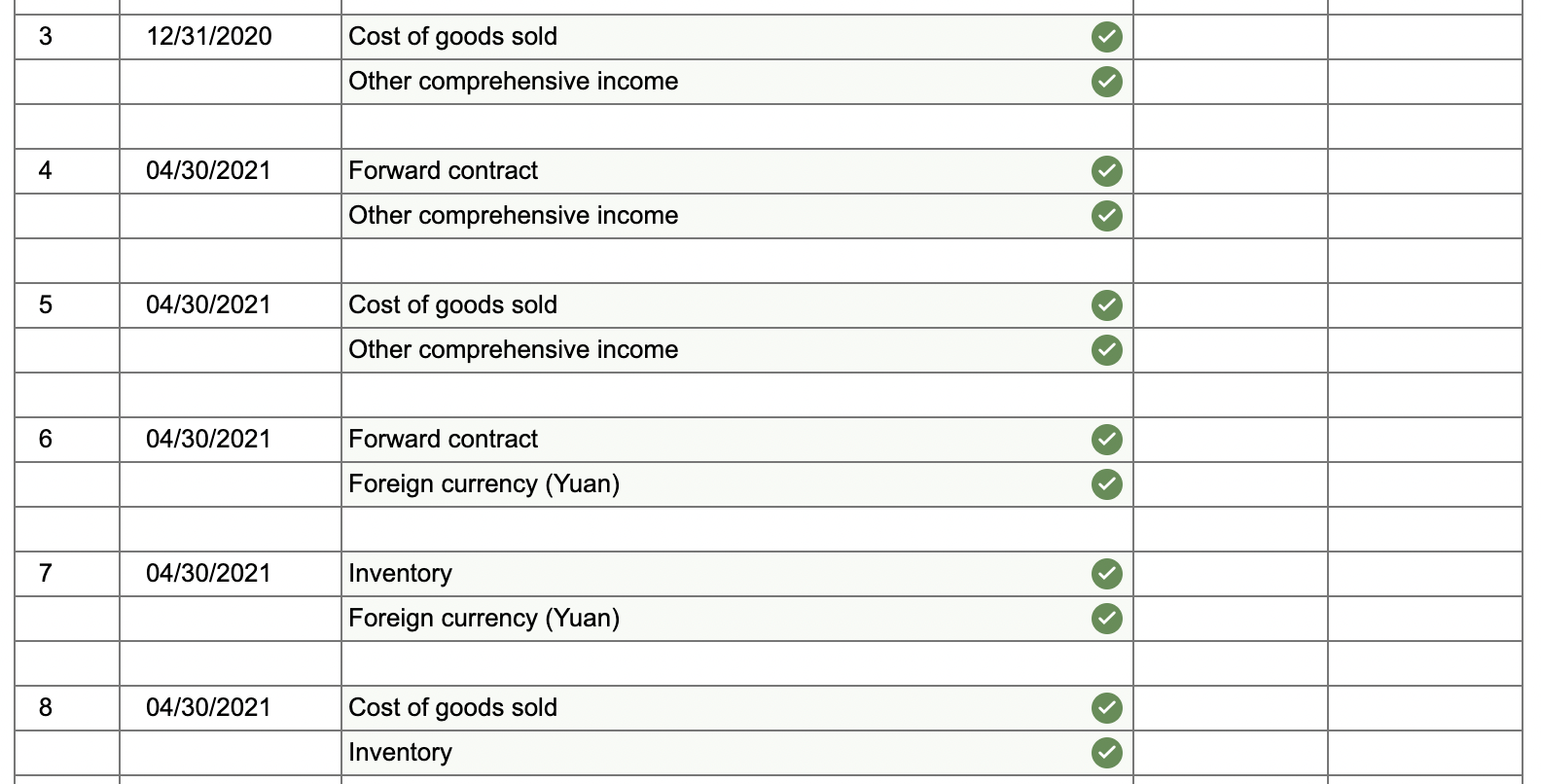

On November 1, 2019, Dunn Company (a U.S.-based company) forecasts the purchase of goods from a foreign supplier for 200,000 yuan. Cheng expects to receive the goods on April 30, 2020, and make immediate payment. On November 1, 2019, Dunn enters into a six-month forward contract to buy 200,000 yuan. The company properly designates the forward contract as a cash flow hedge of a forecasted foreign currency transaction. Forward points are excluded in assessing hedge effectiveness and are amortized to net income using a straight-line method on a monthly basis over the life of the contract. The following U.S. dollarYuan exchange rates apply:

| Date | Spot Rate | Forward Rate (to April 30, 2020) | ||||

| November 1, 2019 | $ | 0.25 | $ | 0.255 | ||

| December 31, 2019 | 0.21 | 0.230 | ||||

| April 30, 2021 | 0.24 | N/A | ||||

As expected, Dunn receives goods from the foreign supplier on April 30, 2020, and pays 200,000 yuan immediately. Dunn sells the imported goods in the local market in May 2020.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started