Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Step by step solution needed for all parts of the question and each part with answers thanks An investor is considering purchasing a fixed interest

Step by step solution needed for all parts of the question and each part with answers thanks

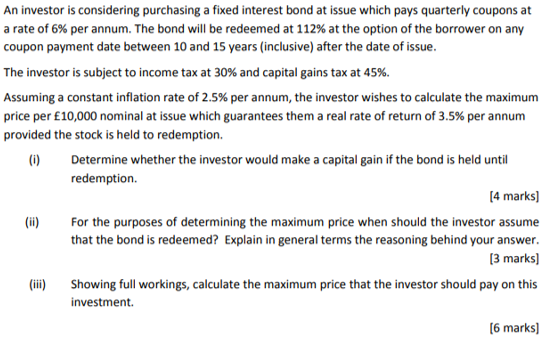

An investor is considering purchasing a fixed interest bond at issue which pays quarterly coupons at a rate of 6% per annum. The bond will be redeemed at 112 % at the option of the borrower on any coupon payment date between 10 and 15 years (inclusive) after the date of issue The investor is subject to income tax at 30% and capital gains tax at 45% Assuming a constant inflation rate of 2.5% per annum, the investor wishes to calculate the maximum price per 10,000 nom inal at issue which guarantees them a real rate of return of 3.5% per annum provided the stock is held to redemption Determine whether the investor would make a capital gain if the bond is held until redemption (i) (4 marks (i) For the purposes of determining the maximum price when should the investor assume that the bond is redeemed? Explain in general terms the reasoning behind your answer. [3 marks] (ii) Showing full workings, calculate the maximum price that the investor should pay on this investment [6 marksStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started