step by step solution needed for each part, would appreciate it

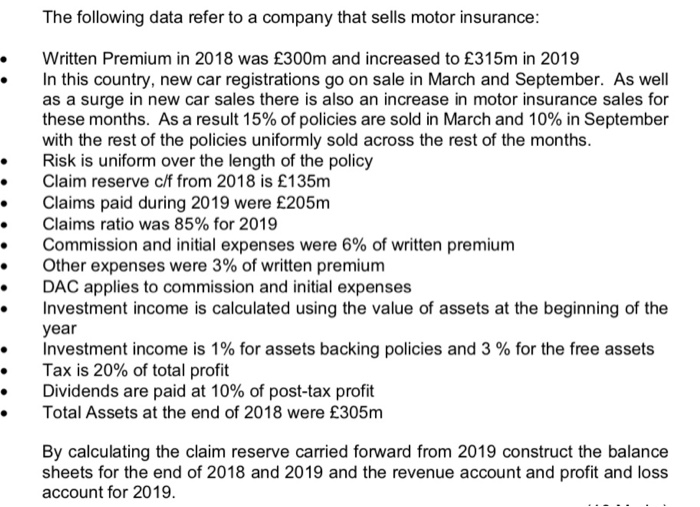

The following data refer to a company that sells motor insurance: Written Premium in 2018 was 300m and increased to 315m in 2019 In this country, new car registrations go on sale in March and September. As well as a surge in new car sales there is also an increase in motor insurance sales for these months. As a result 15% of policies are sold in March and 10% in September with the rest of the policies uniformly sold across the rest of the months. Risk is uniform over the length of the policy Claim reserve c/f from 2018 is 135m Claims paid during 2019 were 205m Claims ratio was 85% for 2019 Commission and initial expenses were 6% of written premium Other expenses were 3% of written premium DAC applies to commission and initial expenses Investment income is calculated using the value of assets at the beginning of the year Investment income is 1% for assets backing policies and 3 % for the free assets Tax is 20% of total profit Dividends are paid at 10% of post-tax profit Total Assets at the end of 2018 were 305m By calculating the claim reserve carried forward from 2019 construct the balance sheets for the end of 2018 and 2019 and the revenue account and profit and loss account for 2019. The following data refer to a company that sells motor insurance: Written Premium in 2018 was 300m and increased to 315m in 2019 In this country, new car registrations go on sale in March and September. As well as a surge in new car sales there is also an increase in motor insurance sales for these months. As a result 15% of policies are sold in March and 10% in September with the rest of the policies uniformly sold across the rest of the months. Risk is uniform over the length of the policy Claim reserve c/f from 2018 is 135m Claims paid during 2019 were 205m Claims ratio was 85% for 2019 Commission and initial expenses were 6% of written premium Other expenses were 3% of written premium DAC applies to commission and initial expenses Investment income is calculated using the value of assets at the beginning of the year Investment income is 1% for assets backing policies and 3 % for the free assets Tax is 20% of total profit Dividends are paid at 10% of post-tax profit Total Assets at the end of 2018 were 305m By calculating the claim reserve carried forward from 2019 construct the balance sheets for the end of 2018 and 2019 and the revenue account and profit and loss account for 2019