Answered step by step

Verified Expert Solution

Question

1 Approved Answer

step by step thanks! 15. You are in a job interview. The company is planning to raise additional capital, either through long-term debt or issuing

step by step

thanks!

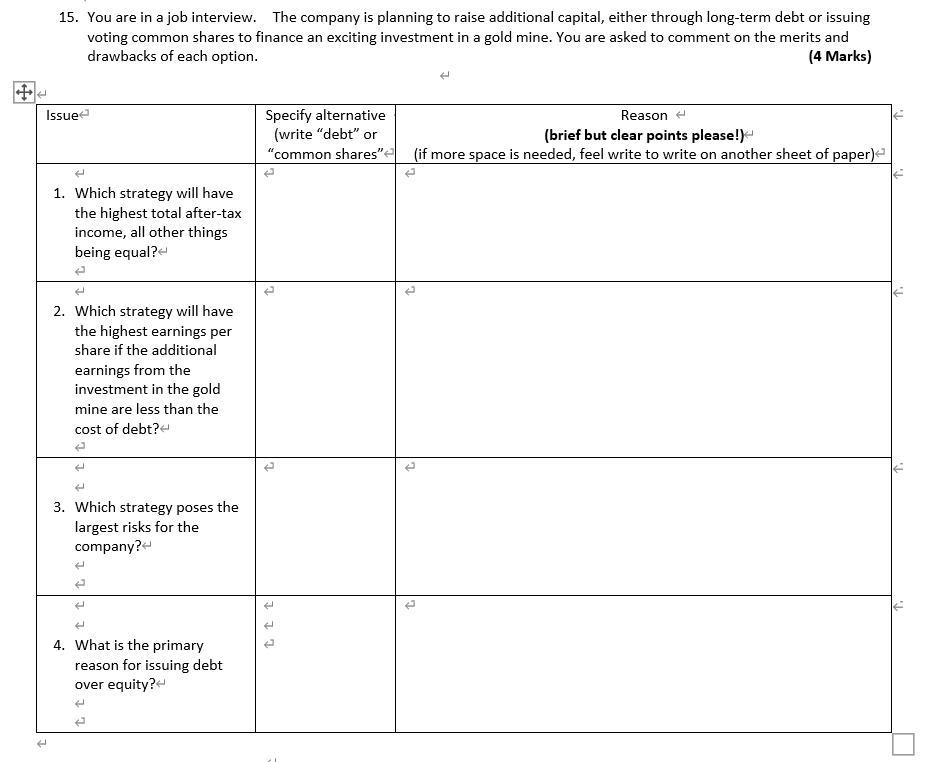

15. You are in a job interview. The company is planning to raise additional capital, either through long-term debt or issuing voting common shares to finance an exciting investment in a gold mine. You are asked to comment on the merits and drawbacks of each option. (4 Marks) Issue Specify alternative Reason (write "debt" or (brief but clear points please!) "common shares" (if more space is needed, feel write to write on another sheet of paper) 1. Which strategy will have the highest total after-tax income, all other things being equal? 2. Which strategy will have the highest earnings per share if the additional earnings from the investment in the gold mine are less than the cost of debt? 3. Which strategy poses the largest risks for the company? tt 4. What is the primary reason for issuing debt over equityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started