Answered step by step

Verified Expert Solution

Question

1 Approved Answer

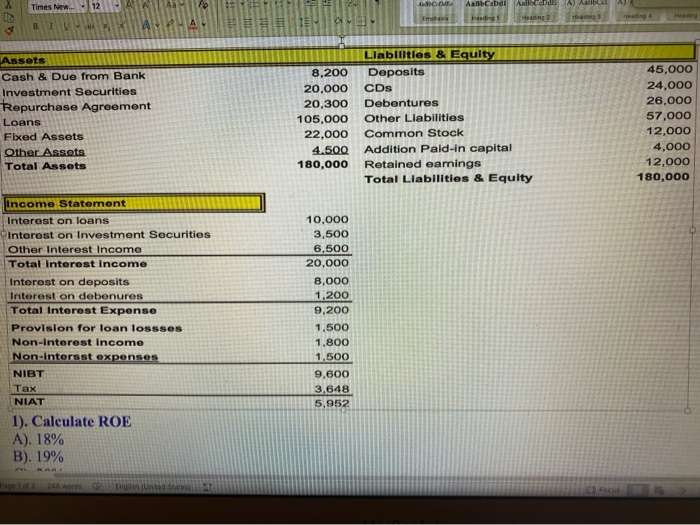

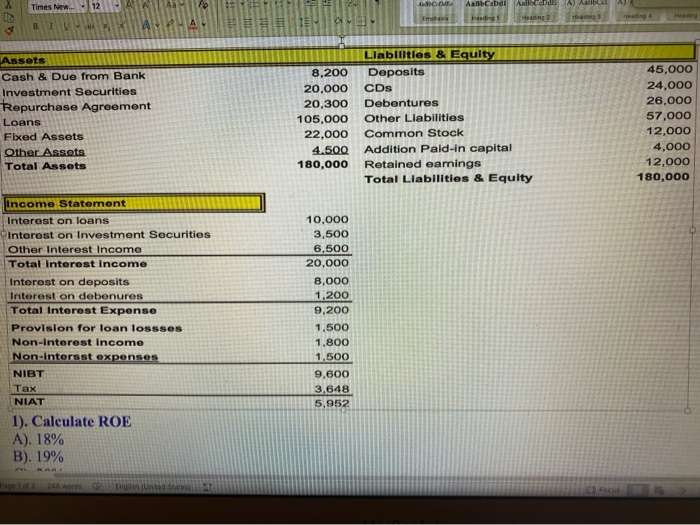

step by step Times New... 12 C.DE AalbCebdi Ascend A) ABC Heading Emos Heading Heading BTW XIX AMMA Assets Cash & Due from Bank Investment

step by step

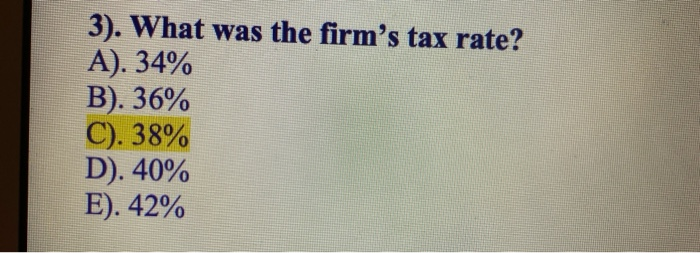

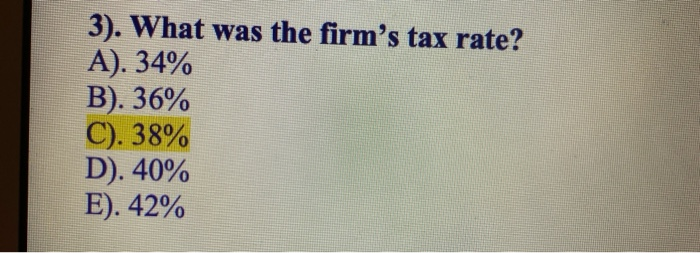

Times New... 12 C.DE AalbCebdi Ascend A) ABC Heading Emos Heading Heading BTW XIX AMMA Assets Cash & Due from Bank Investment Securities Repurchase Agreement Loans Fixed Assets Other Assets Total Assets 8,200 20,000 20,300 105,000 22,000 4.500 180,000 Liabilities & Equity Deposits CDs Debentures Other Llabilities Common Stock Addition Paid-in capital Retained earnings Total Liabilities & Equity 45,000 24,000 26.000 57,000 12,000 4,000 12,000 180,000 Income Statement Interest on loans Interest on Investment Securities Other interest income Total interest income Interest on deposits Interest on debenures Total Interest Expense Provision for loan lossses Non-interest income Non-intorsst expenses NIBT Tax NIAT 1). Calculate ROE A). 18% B). 19% 10,000 3,500 6,500 20,000 8,000 1,200 9,200 1.500 1.800 1,500 9,600 3,648 5,952 W 3). What was the firm's tax rate? A). 34% B). 36% C). 38% D). 40% E). 42%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started