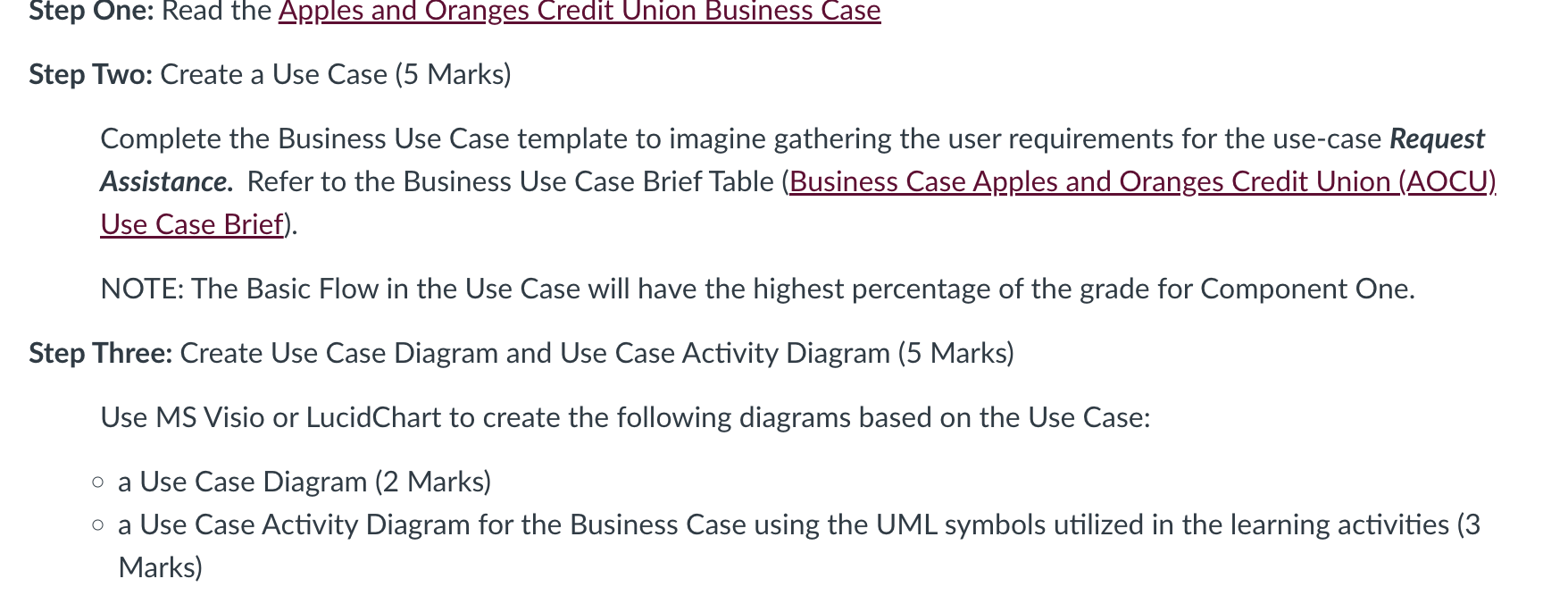

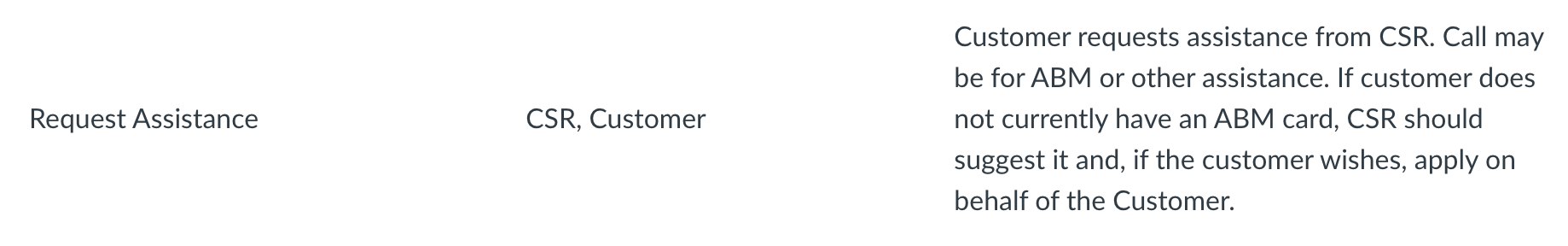

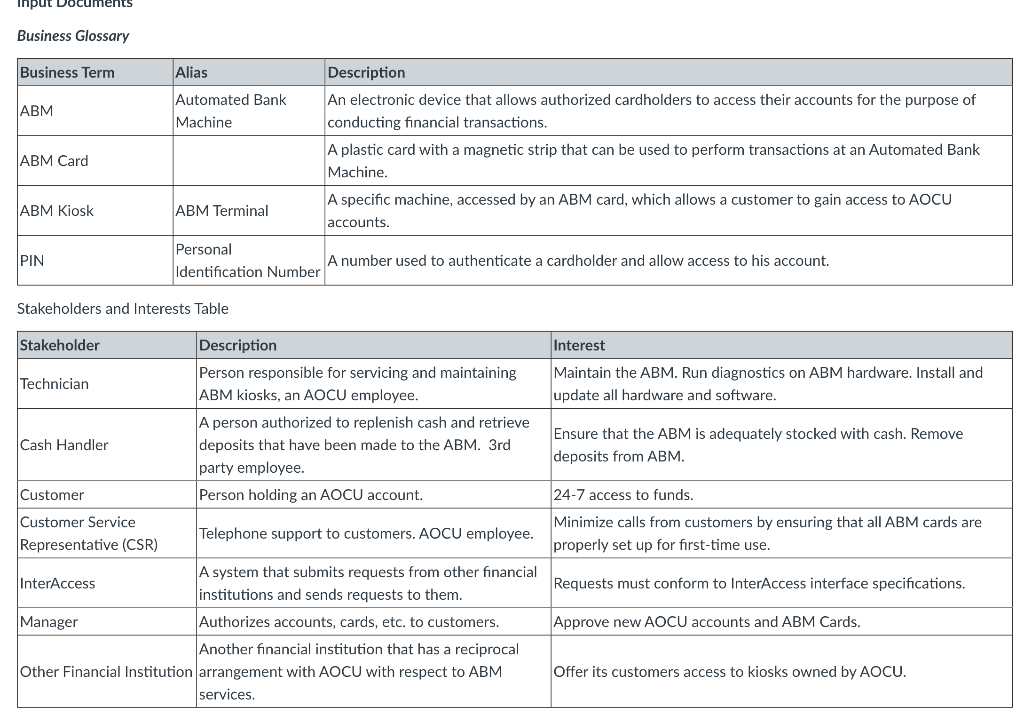

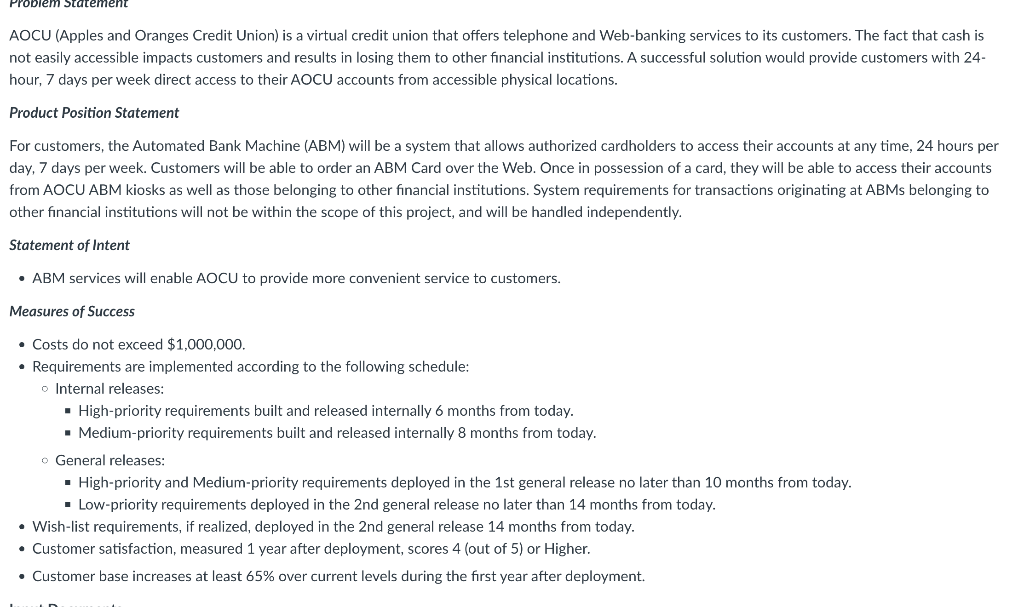

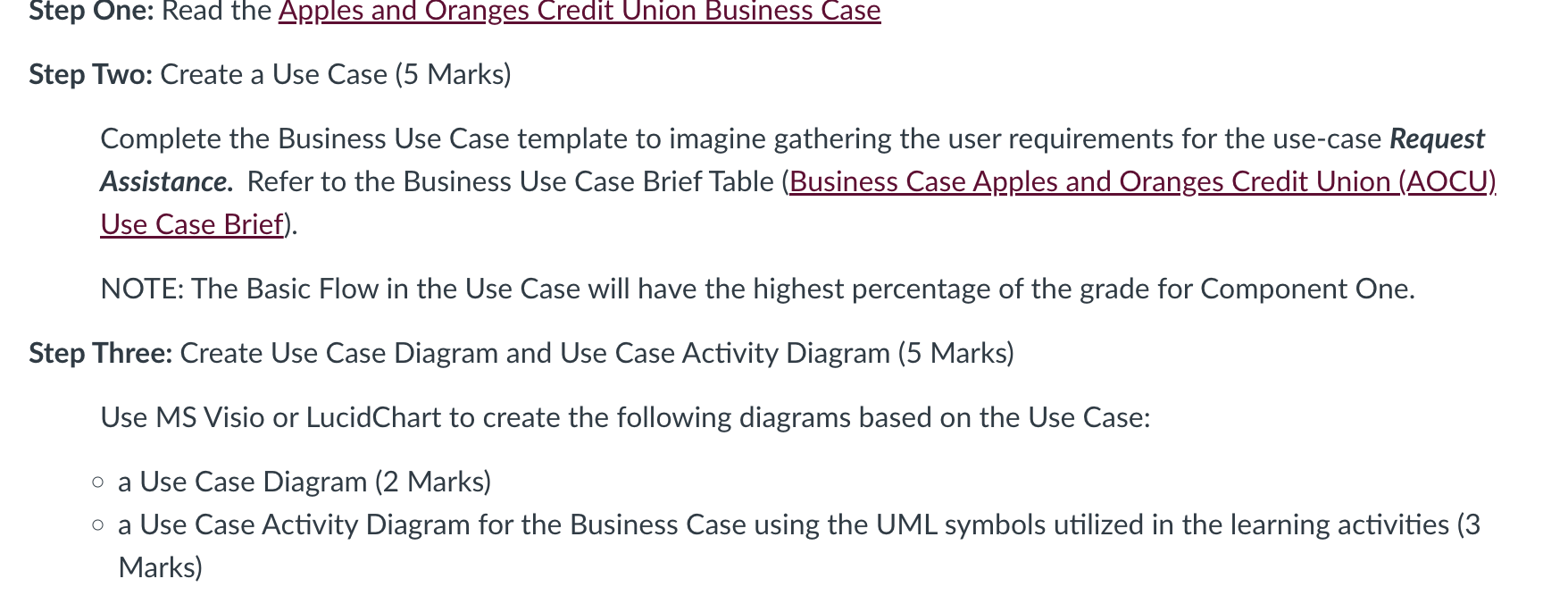

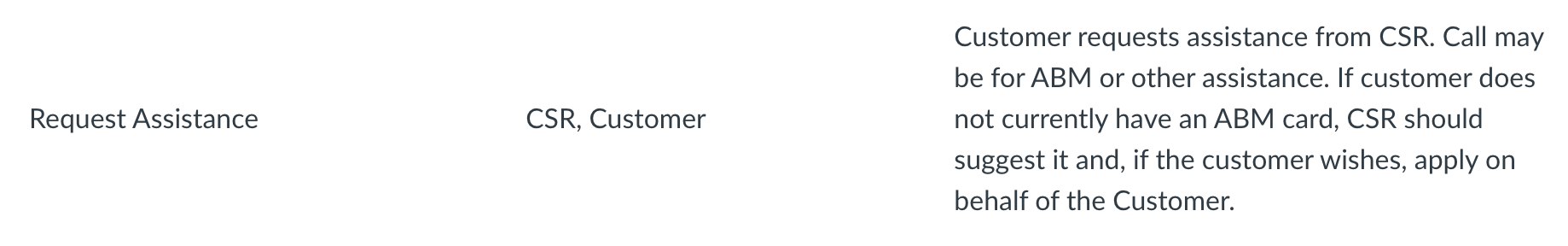

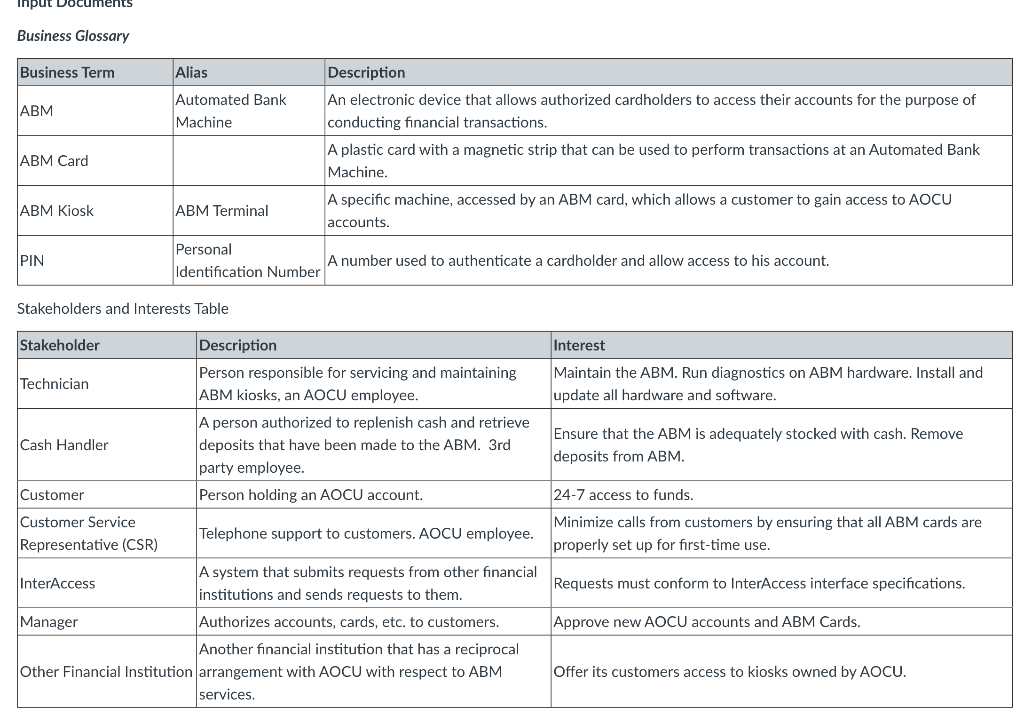

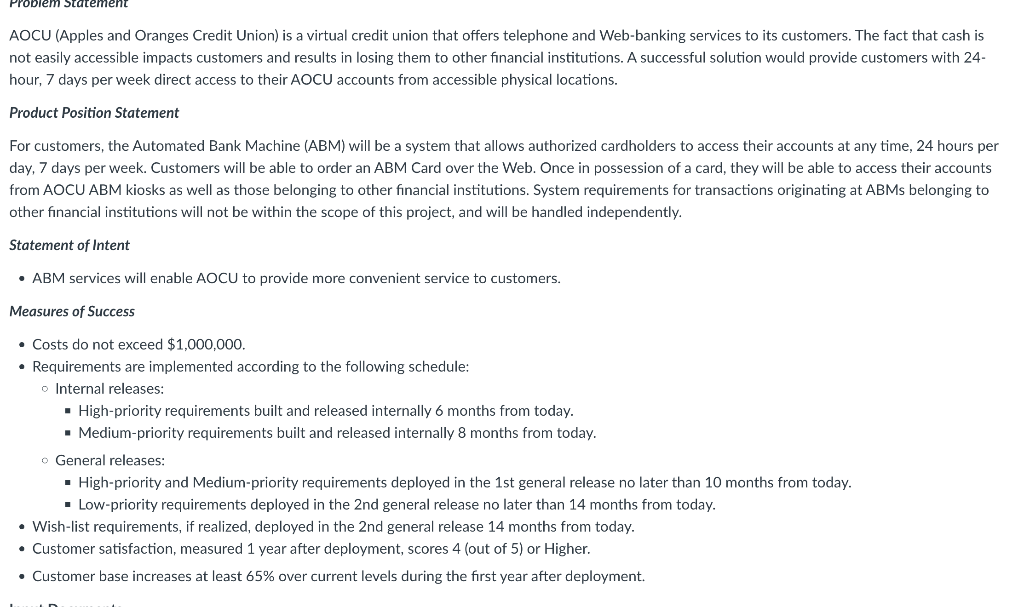

Step One: Read the A ppples and Oranges Credit Union Business Case Step Two: Create a Use Case (5 Marks) Complete the Business Use Case template to imagine gathering the user requirements for the use-case Request Assistance. Refer to the Business Use Case Brief Table (Business Case Apples and Oranges Credit Union (AOCU). Use Case Brief). NOTE: The Basic Flow in the Use Case will have the highest percentage of the grade for Component One. Step Three: Create Use Case Diagram and Use Case Activity Diagram (5 Marks) Use MS Visio or LucidChart to create the following diagrams based on the Use Case: - a Use Case Diagram (2 Marks) - a Use Case Activity Diagram for the Business Case using the UML symbols utilized in the learning activities (3 Marks) Customer requests assistance from CSR. Call may be for ABM or other assistance. If customer does not currently have an ABM card, CSR should suggest it and, if the customer wishes, apply on behalf of the Customer. Business Glossary AOCU (Apples and Oranges Credit Union) is a virtual credit union that offers telephone and Web-banking services to its customers. The fact that cash is not easily accessible impacts customers and results in losing them to other financial institutions. A successful solution would hour, 7 days per week direct access to their AOCU accounts from accessible physical locations. Product Position Statement day, 7 days per week. Customers will be able to order an ABM Card over the Web. Once in possession of a card, they will be able the accounts from AOCU ABM kiosks as well as those belonging to other financial institutions. System requirements for transactions originating at ABMs belonging to other financial institutions will not be within the scope of this project, and will be handled independently. Statement of Intent - ABM services will enable AOCU to provide more convenient service to customers. Measures of Success - Costs do not exceed $1,000,000. - Requirements are implemented according to the following schedule: Internal releases: - High-priority requirements built and released internally 6 months from today. - Medium-priority requirements built and released internally 8 months from today. General releases: - High-priority and Medium-priority requirements deployed in the 1st general release no later than 10 months from today. - Low-priority requirements deployed in the 2nd general release no later than 14 months from today. - Wish-list requirements, if realized, deployed in the 2 nd general release 14 months from today. - Customer satisfaction, measured 1 year after deployment, scores 4 (out of 5) or Higher. - Customer base increases at least 65% over current levels during the first year after deployment. Step One: Read the A ppples and Oranges Credit Union Business Case Step Two: Create a Use Case (5 Marks) Complete the Business Use Case template to imagine gathering the user requirements for the use-case Request Assistance. Refer to the Business Use Case Brief Table (Business Case Apples and Oranges Credit Union (AOCU). Use Case Brief). NOTE: The Basic Flow in the Use Case will have the highest percentage of the grade for Component One. Step Three: Create Use Case Diagram and Use Case Activity Diagram (5 Marks) Use MS Visio or LucidChart to create the following diagrams based on the Use Case: - a Use Case Diagram (2 Marks) - a Use Case Activity Diagram for the Business Case using the UML symbols utilized in the learning activities (3 Marks) Customer requests assistance from CSR. Call may be for ABM or other assistance. If customer does not currently have an ABM card, CSR should suggest it and, if the customer wishes, apply on behalf of the Customer. Business Glossary AOCU (Apples and Oranges Credit Union) is a virtual credit union that offers telephone and Web-banking services to its customers. The fact that cash is not easily accessible impacts customers and results in losing them to other financial institutions. A successful solution would hour, 7 days per week direct access to their AOCU accounts from accessible physical locations. Product Position Statement day, 7 days per week. Customers will be able to order an ABM Card over the Web. Once in possession of a card, they will be able the accounts from AOCU ABM kiosks as well as those belonging to other financial institutions. System requirements for transactions originating at ABMs belonging to other financial institutions will not be within the scope of this project, and will be handled independently. Statement of Intent - ABM services will enable AOCU to provide more convenient service to customers. Measures of Success - Costs do not exceed $1,000,000. - Requirements are implemented according to the following schedule: Internal releases: - High-priority requirements built and released internally 6 months from today. - Medium-priority requirements built and released internally 8 months from today. General releases: - High-priority and Medium-priority requirements deployed in the 1st general release no later than 10 months from today. - Low-priority requirements deployed in the 2nd general release no later than 14 months from today. - Wish-list requirements, if realized, deployed in the 2 nd general release 14 months from today. - Customer satisfaction, measured 1 year after deployment, scores 4 (out of 5) or Higher. - Customer base increases at least 65% over current levels during the first year after deployment