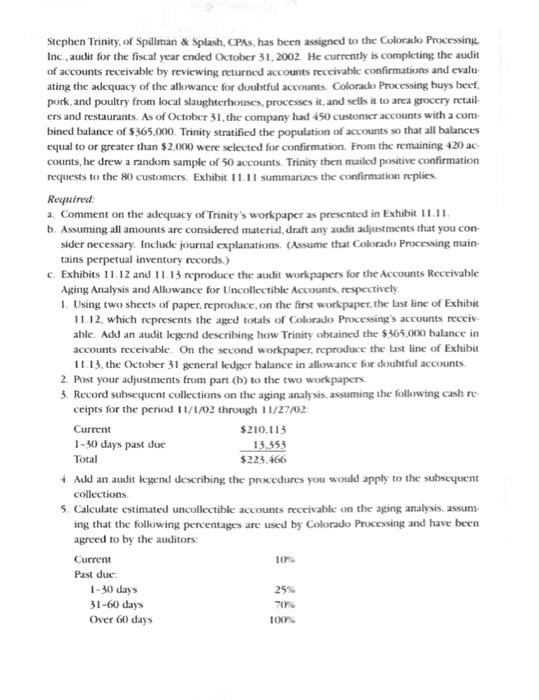

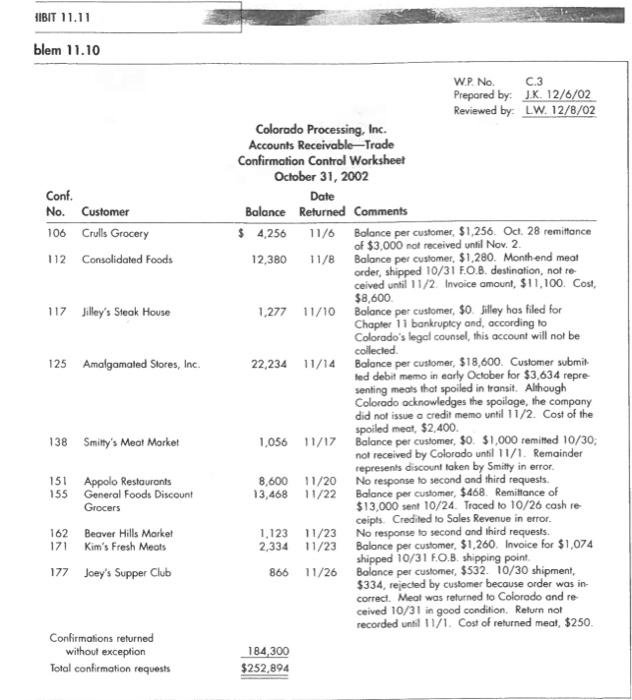

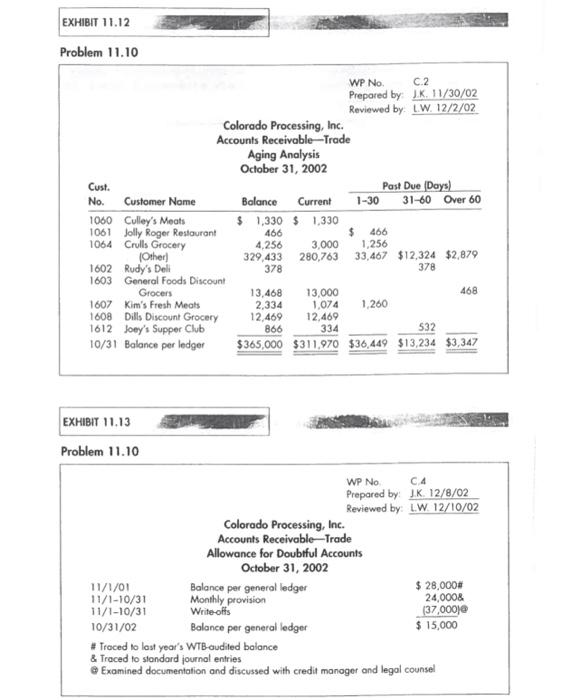

Stephen Trinity, of Spillman \& Splash, CPAs, has been assigned to the Colorado Processing. Inc, audit for the fiscal year ended October 31, 2002. He currently is completing the audit of accounts receivable by reviewing returned accounts reccivable confirmations and evaluating the adequacy of the allewance for doubtful accounts. Colorado Processing huys beef, pork, and poultry from local slaughterhouses, processes it, and sells it to area grocery retail ers and restaurants. As of October 31 , the company had 450 customer accounes with a combined balance of $365,000. Trinity stratified the population of accounts so that all balances equal to or greater than $2,000 were selected for confirmation. From the remaining 420 ac. counts, he drew a random sample of 50 accounts. Trinity then mailed positive confirmation requests to the 80 customers. Exhibit 11.11 summarizs the confirmation replies. Required: a. Comment on the adequacy of Trinity's workpaper as presented in Exhibit 11.11. b. Assuming all amounts are considered material, dratt any audit adjustments that you consider necessary. Include journal explanations. (Assume that Colorado Processing maintains perpetual inventory records.) c. Exhibits 11.12 and 11.13 reproduce the atdit workpapers for the Accounts Receivable Aging Analysis and Allowance for Uncollectible Accounts, respectively. 1. Using two sheets of paper. repeoduce, on the first workpaper, the last line of Exhibit 11.12, which represents the aged totals of Colorado Processing's accounts receiv. able. Add an audit legend deseribing how Trinity obtained the $365,000 balance in accounts receivable. On the second workpaper, reproduce the tast line of Exlibit 11.13, the October 31 general kedger balance in allowance for doubtful accounts. 2. Post your adjustments from part (b) to the two workpapers 3. Record subsequent collections on the aging analysis, assuming the following cash receipts for the period 11/1/02 through 11/27/02 : f. Add an atdit legend describing the procedures you would apply to the subsequent collections. 5. Calculate cstimated uncollectible accounts receivable on the aging analysis, assun: ing that the following percentages are used by Colorado Processing and have been agreed to by the auditors: en Problem 11.10 EXHIBIT 11.13 Problem 11.10 Stephen Trinity, of Spillman \& Splash, CPAs, has been assigned to the Colorado Processing. Inc, audit for the fiscal year ended October 31, 2002. He currently is completing the audit of accounts receivable by reviewing returned accounts reccivable confirmations and evaluating the adequacy of the allewance for doubtful accounts. Colorado Processing huys beef, pork, and poultry from local slaughterhouses, processes it, and sells it to area grocery retail ers and restaurants. As of October 31 , the company had 450 customer accounes with a combined balance of $365,000. Trinity stratified the population of accounts so that all balances equal to or greater than $2,000 were selected for confirmation. From the remaining 420 ac. counts, he drew a random sample of 50 accounts. Trinity then mailed positive confirmation requests to the 80 customers. Exhibit 11.11 summarizs the confirmation replies. Required: a. Comment on the adequacy of Trinity's workpaper as presented in Exhibit 11.11. b. Assuming all amounts are considered material, dratt any audit adjustments that you consider necessary. Include journal explanations. (Assume that Colorado Processing maintains perpetual inventory records.) c. Exhibits 11.12 and 11.13 reproduce the atdit workpapers for the Accounts Receivable Aging Analysis and Allowance for Uncollectible Accounts, respectively. 1. Using two sheets of paper. repeoduce, on the first workpaper, the last line of Exhibit 11.12, which represents the aged totals of Colorado Processing's accounts receiv. able. Add an audit legend deseribing how Trinity obtained the $365,000 balance in accounts receivable. On the second workpaper, reproduce the tast line of Exlibit 11.13, the October 31 general kedger balance in allowance for doubtful accounts. 2. Post your adjustments from part (b) to the two workpapers 3. Record subsequent collections on the aging analysis, assuming the following cash receipts for the period 11/1/02 through 11/27/02 : f. Add an atdit legend describing the procedures you would apply to the subsequent collections. 5. Calculate cstimated uncollectible accounts receivable on the aging analysis, assun: ing that the following percentages are used by Colorado Processing and have been agreed to by the auditors: en Problem 11.10 EXHIBIT 11.13 Problem 11.10