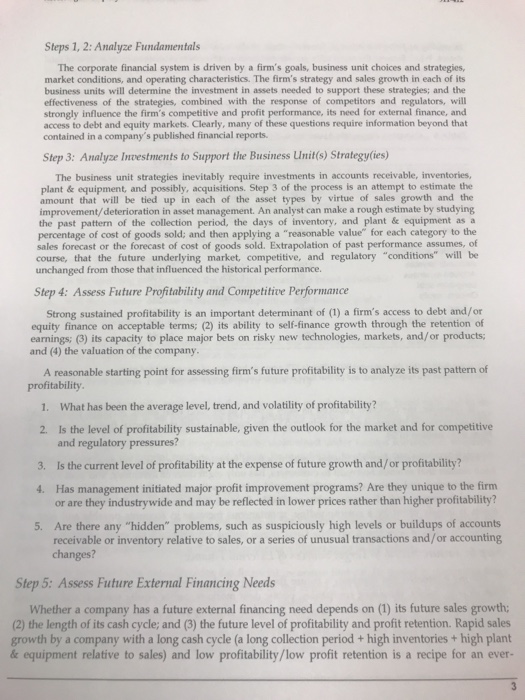

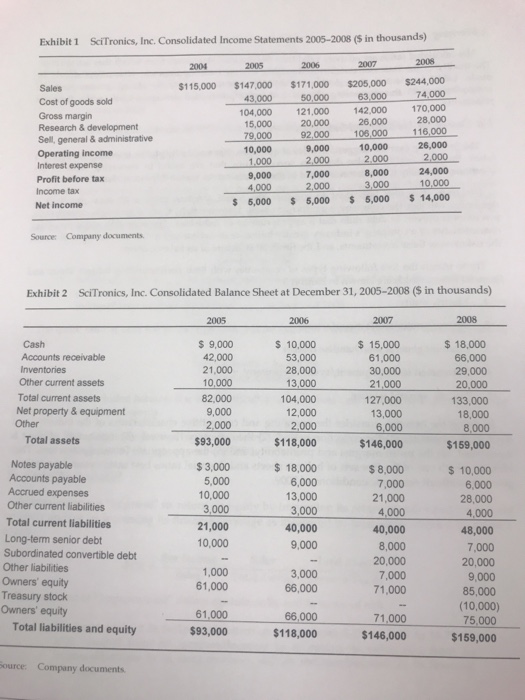

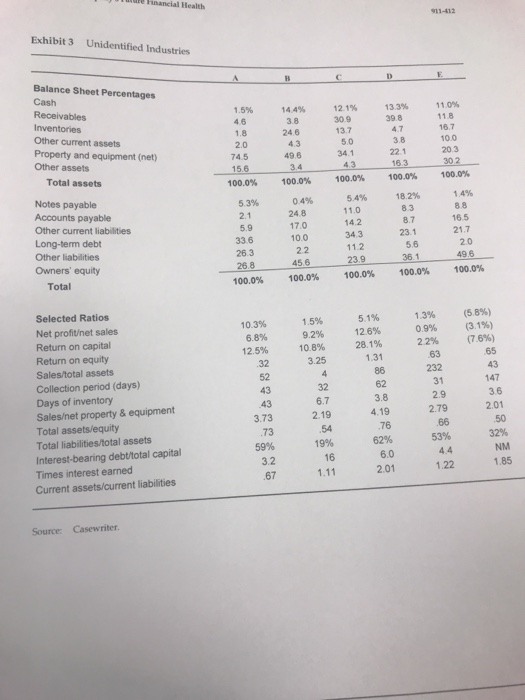

Steps 1, 2: Analyze Fundamentals The corporate financial system is driven by a firm's goals, business unit choices and strategies, market conditions, and operating characteristics. The firm's strategy and sales growth in each of its business units will determine the investment in assets needed to support these strategies; and the effectiveness of the strategies, combined with the response of competitors and regulators, will strongly influence the firm's competitive and profit performance, its need for external finance, and access to debt and equity markets. Clearly, many of these questions require information beyond that in a company's published financial reports. Step 3: Analyze Investments to Support the Business Unit(s) Strategy(ies) The business unit strategies inevitably require investments in accounts receivable, inventories, plant & equipment, and possibly, acquisitions. Step 3 of the process is an attempt to estimate the amount that will be tied up in each of the asset types by virtue of sales growth and the improvement/ deterioration in asset management. An analyst can make a rough estimate by studying the past pattern of the collection period, the days of inventory, and plant & equipment as a percentage of cost of goods sold; and then applying a "reasonable value" for each category to the sales forecast or the forecast of cost of goods sold. Extrapolation of past performance assumes, of course, that the future underlying market, competitive, and regulatory "conditions" will be unchanged from those that influenced the historical performance. Step 4: Assess Future Profitability and Competitive Performance Strong sustained profitability is an important determinant of (1) a firm's access to debt and/or equity finance on acceptable terms; (2) its ability to self-finance growth through the retention of earnings; (3) its capacity to place major bets on risky new technologies, markets, and/or products and (4) the valuation of the company A reasonable starting point for assessing firm's future profitability is to analyze its past pattern of profitability 1. What has been the average level, trend, and volatility of profitability? Is the level of profitability sustainable, given the outlook for the market and for competitive and regulatory pressures? 2. 3. Is the current level of profitability at the expense of future growth and/or profitability? 4. Has management initiated major profit improvement programs? Are they unique to the firm or are they industrywide and may be reflected in lower prices rather than higher profitability? 5. Are there any "hidden" problems, such as suspiciously high levels or buildups of accounts receivable or inventory relative to sales, or a series of unusual transactions and/or accounting changes? Step 5: Assess Future External Financing Needs Whether a company has a future external financing need depends on (1) its future sales growth: (2) the length of its cash cycle; and (3) the future level of profitability and profit retention. Rapid sales growth by a company with a long cash cycle (a long collection period+ high inventories+ high plant &e equipment relative to sales) and low profitability/low profit retention is a recipe for an ever- Steps 1, 2: Analyze Fundamentals The corporate financial system is driven by a firm's goals, business unit choices and strategies, market conditions, and operating characteristics. The firm's strategy and sales growth in each of its business units will determine the investment in assets needed to support these strategies; and the effectiveness of the strategies, combined with the response of competitors and regulators, will strongly influence the firm's competitive and profit performance, its need for external finance, and access to debt and equity markets. Clearly, many of these questions require information beyond that in a company's published financial reports. Step 3: Analyze Investments to Support the Business Unit(s) Strategy(ies) The business unit strategies inevitably require investments in accounts receivable, inventories, plant & equipment, and possibly, acquisitions. Step 3 of the process is an attempt to estimate the amount that will be tied up in each of the asset types by virtue of sales growth and the improvement/ deterioration in asset management. An analyst can make a rough estimate by studying the past pattern of the collection period, the days of inventory, and plant & equipment as a percentage of cost of goods sold; and then applying a "reasonable value" for each category to the sales forecast or the forecast of cost of goods sold. Extrapolation of past performance assumes, of course, that the future underlying market, competitive, and regulatory "conditions" will be unchanged from those that influenced the historical performance. Step 4: Assess Future Profitability and Competitive Performance Strong sustained profitability is an important determinant of (1) a firm's access to debt and/or equity finance on acceptable terms; (2) its ability to self-finance growth through the retention of earnings; (3) its capacity to place major bets on risky new technologies, markets, and/or products and (4) the valuation of the company A reasonable starting point for assessing firm's future profitability is to analyze its past pattern of profitability 1. What has been the average level, trend, and volatility of profitability? Is the level of profitability sustainable, given the outlook for the market and for competitive and regulatory pressures? 2. 3. Is the current level of profitability at the expense of future growth and/or profitability? 4. Has management initiated major profit improvement programs? Are they unique to the firm or are they industrywide and may be reflected in lower prices rather than higher profitability? 5. Are there any "hidden" problems, such as suspiciously high levels or buildups of accounts receivable or inventory relative to sales, or a series of unusual transactions and/or accounting changes? Step 5: Assess Future External Financing Needs Whether a company has a future external financing need depends on (1) its future sales growth: (2) the length of its cash cycle; and (3) the future level of profitability and profit retention. Rapid sales growth by a company with a long cash cycle (a long collection period+ high inventories+ high plant &e equipment relative to sales) and low profitability/low profit retention is a recipe for an ever