Answered step by step

Verified Expert Solution

Question

1 Approved Answer

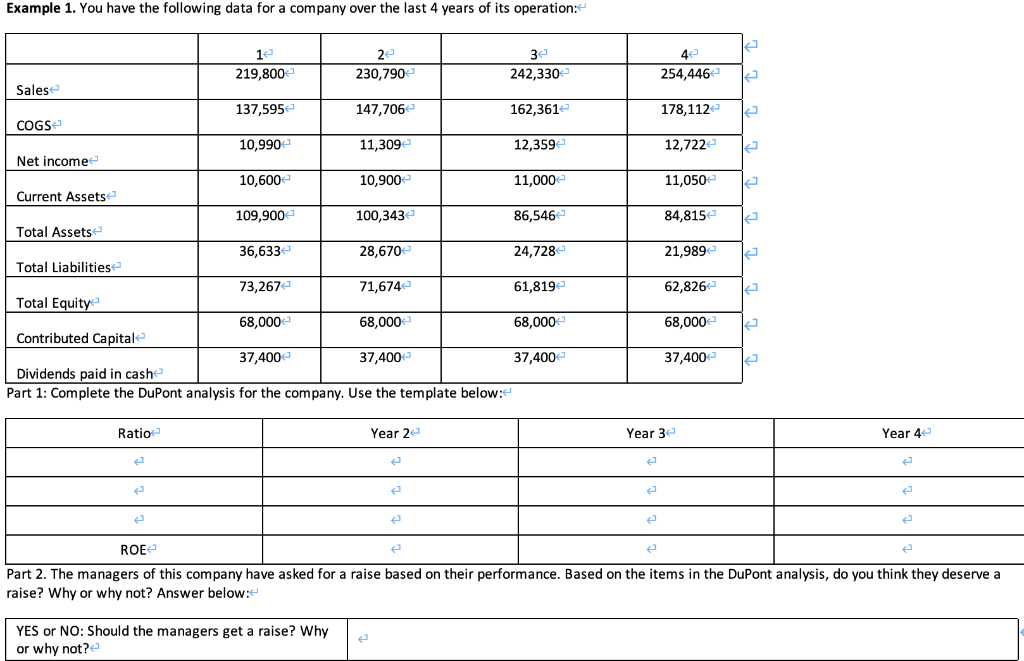

steps Example 1. You have the following data for a company over the last 4 years of its operation: 32 242,330 42 254,446 162,3612 178,112

steps

Example 1. You have the following data for a company over the last 4 years of its operation: 32 242,330 42 254,446 162,3612 178,112 12,359 12,722 ka 11,000 11,050 86,546 84,815 12 22 219,800 230,790 Sales 137,595 147,706 COGS 10,990 11,309 Net income 10,600 10,900 Current Assets 109,900 100,343 Total Assets 36,633 28,670 Total Liabilities 73,267 71,674 Total Equity 68,000 68,000 Contributed Capital 37,400 37,400 Dividends paid in cash Part 1: Complete the DuPont analysis for the company. Use the template below: 24,728 21,989 61,819 62,826 68,000 68,000 2 37,400 37,400 7 Ratio Year 2 Year 32 Year 4 e e e ROE Part 2. The managers of this company have asked for a raise based on their performance. Based on the items in the DuPont analysis, do you think they deserve a raise? Why or why not? Answer below: YES or NO: Should the managers get a raise? Why or why not? Example 1. You have the following data for a company over the last 4 years of its operation: 32 242,330 42 254,446 162,3612 178,112 12,359 12,722 ka 11,000 11,050 86,546 84,815 12 22 219,800 230,790 Sales 137,595 147,706 COGS 10,990 11,309 Net income 10,600 10,900 Current Assets 109,900 100,343 Total Assets 36,633 28,670 Total Liabilities 73,267 71,674 Total Equity 68,000 68,000 Contributed Capital 37,400 37,400 Dividends paid in cash Part 1: Complete the DuPont analysis for the company. Use the template below: 24,728 21,989 61,819 62,826 68,000 68,000 2 37,400 37,400 7 Ratio Year 2 Year 32 Year 4 e e e ROE Part 2. The managers of this company have asked for a raise based on their performance. Based on the items in the DuPont analysis, do you think they deserve a raise? Why or why not? Answer below: YES or NO: Should the managers get a raise? Why or why notStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started