Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Steps for... A payment of P 3 , 0 0 0 . 0 0 at the end of each year was made for a period

Steps for...

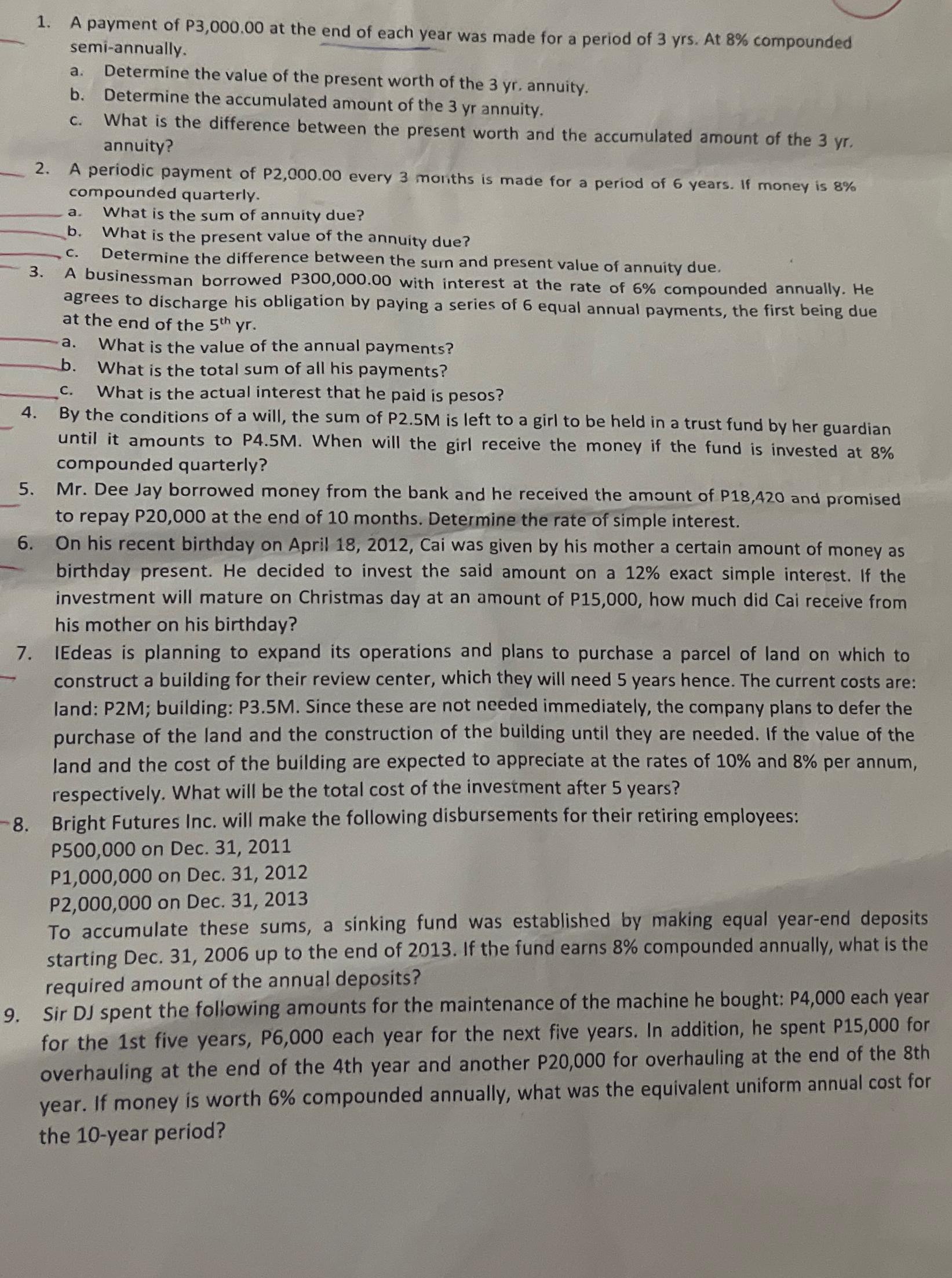

A payment of at the end of each year was made for a period of At compounded semiannually.

a Determine the value of the present worth of the annuity.

b Determine the accumulated amount of the annuity.

c What is the difference between the present worth and the accumulated amount of the annuity?

A periodic payment of every moliths is made for a period of years. If money is compounded quarterly.

a What is the sum of annuity due?

b What is the present value of the annuity due?

c Determine the difference between the sum and present value of annuity due.

A businessman borrowed with interest at the rate of compounded annually. He agrees to discharge his obligation by paying a series of equal annual payments, the first being due at the end of the

a What is the value of the annual payments?

b What is the total sum of all his payments?

c What is the actual interest that he paid is pesos?

By the conditions of a will, the sum of PM is left to a girl to be held in a trust fund by her guardian until it amounts to PM When will the girl receive the money if the fund is invested at compounded quarterly?

Mr Dee Jay borrowed money from the bank and he received the amount of and promised to repay at the end of months. Determine the rate of simple interest.

On his recent birthday on April Cai was given by his mother a certain amount of money as birthday present. He decided to invest the said amount on a exact simple interest. If the investment will mature on Christmas day at an amount of how much did Cai receive from his mother on his birthday?

IEdeas is planning to expand its operations and plans to purchase a parcel of land on which to construct a building for their review center, which they will need years hence. The current costs are: land: PM; building: PM Since these are not needed immediately, the company plans to defer the purchase of the land and the construction of the building until they are needed. If the value of the land and the cost of the building are expected to appreciate at the rates of and per annum, respectively. What will be the total cost of the investment after years?

Bright Futures Inc. will make the following disbursements for their retiring employees:

P on Dec.

P on Dec.

P on Dec.

To accumulate these sums, a sinking fund was established by making equal yearend deposits starting Dec. up to the end of If the fund earns compounded annually, what is the required amount of the annual deposits?

Sir DJ spent the following amounts for the maintenance of the machine he bought: each year for the st five years, P each year for the next five years. In addition, he spent for overhauling at the end of the th year and another P for overhauling at the end of the th year. If money is worth compounded annually, what was the equivalent uniform annual cost for the year period?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started