Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Steve and Jane Ibarra have been married for over two years. They have been trying to save for a down payment on a house, but

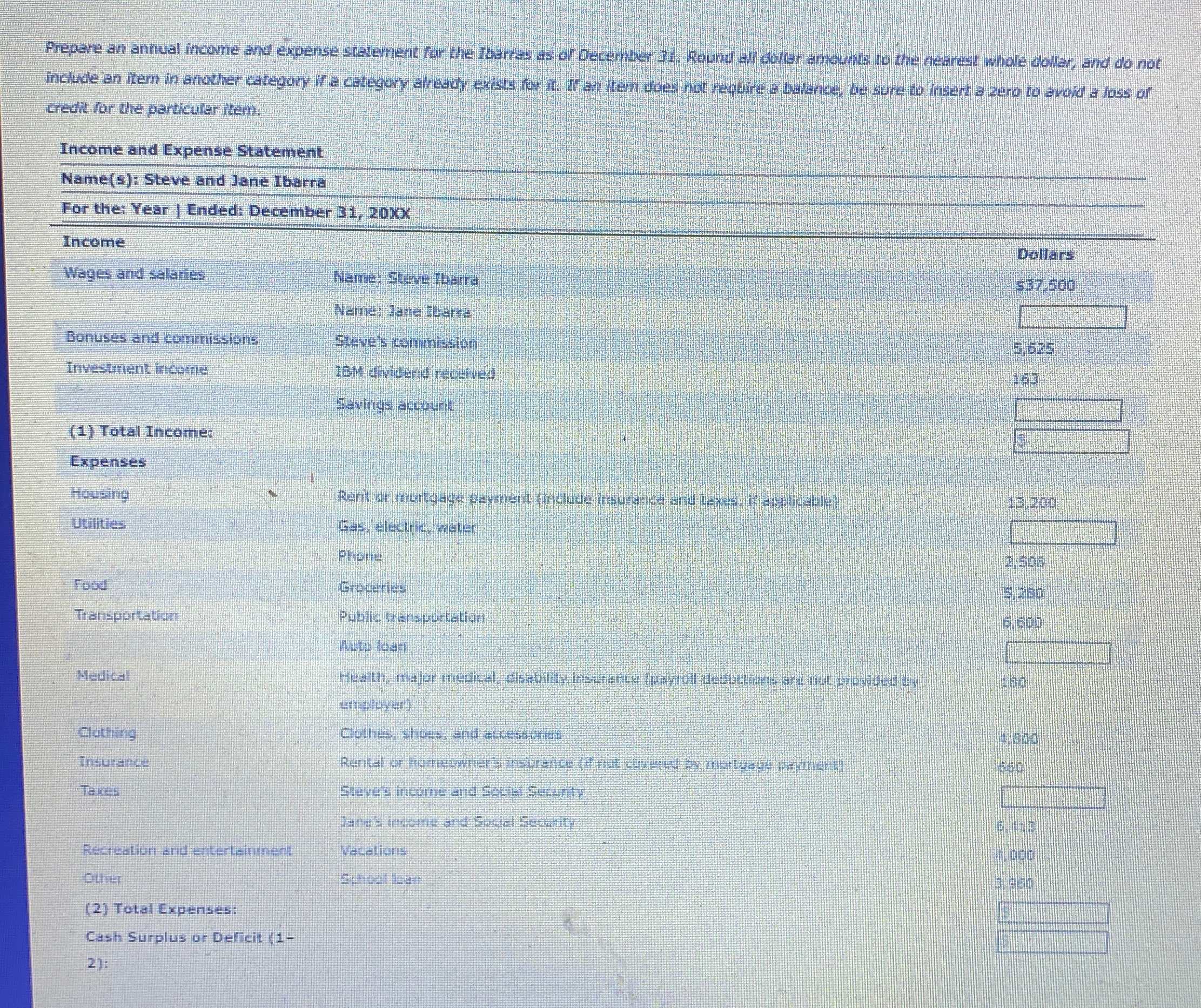

Steve and Jane Ibarra have been married for over two years. They have been trying to save for a down payment on a house, but they feel that there is never anything left over to save. They talked with their parents who suggested that they prepare an incame and expense statement.

Steve and Jane put together the following worksheet:

tableCar payment,Worksheet,$Savings account interestSteves commission,Schoolloan,Commuter train pass yearTaxes,IBM dividend,steve,Renter: Insurance yearJane,Central Maine Power bill,Wages & salaries,TMobile bill,seve,Renttane

The following is some additional information.

For income items, they knew yearly amounts. For expenses, in some ca:es they knew the annua amcunt for evamole tanes commuter train pass They listed those amounts and noted them such.

Unfortunatel, for other expenses, thev provided as: month: szeynert: stating that the amount didn: change nuch fiom month to month. combined S tintes during the vear

Jane estimated trat she spends abcut a monzh or cothing an s a month on gracerisa,

credit for the particufler kamet:

Income and Expense Statement:

Name S: Steve and Jane Ibarna

For thei Year I Ended: December

Total Expenses:

Cash Surplus or Deficit $

:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started