Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Steve Corporation is a US corporation, and Kispert Corporation is a Chinese Corporation. The two corporations are owned by the same individual, a US citizen,

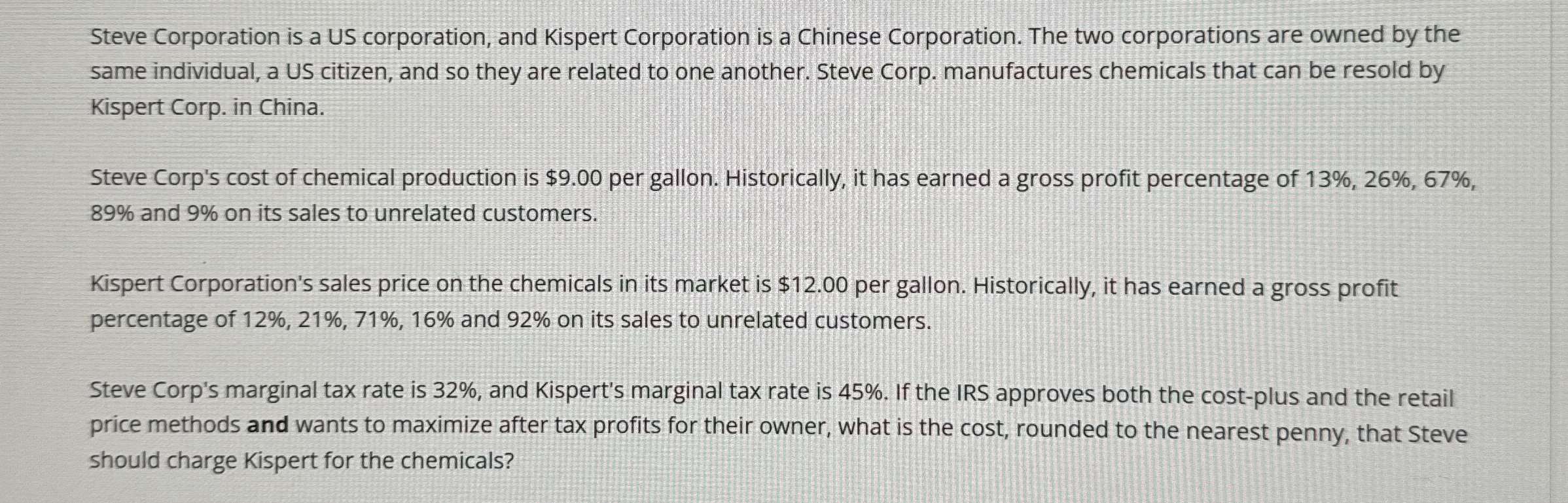

Steve Corporation is a US corporation, and Kispert Corporation is a Chinese Corporation. The two corporations are owned by the same individual, a US citizen, and so they are related to one another. Steve Corp. manufactures chemicals that can be resold by Kispert Corp. in China.

Steve Corp's cost of chemical production is $ per gallon. Historically, it has earned a gross profit percentage of and on its sales to unrelated customers.

Kispert Corporation's sales price on the chemicals in its market is $ per gallon. Historically, it has earned a gross profit percentage of and on its sales to unrelated customers.

Steve Corp's marginal tax rate is and Kispert's marginal tax rate is If the IRS approves both the costplus and the retail price methods and wants to maximize after tax profits for their owner, what is the cost, rounded to the nearest penny, that Steve should charge Kispert for the chemicals?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started