Question

Steve needs to buy 6,000 kg of fine wool in November 2021.He has made forward sales of yarn based on today's spot price of $14.80

Steve needs to buy 6,000 kg of fine wool in November 2021.He has made forward sales of yarn based on today's spot price of $14.80 / kg, however, if this rises above $16.25 by November, Steve will make a loss.The following fine wool contracts are available on the futures market:

Delivery DateSettlement Price

June 2021$14.85 / kg

September 2021$15.25 / kg

December 2021$15.65 / kg

Today is June 5th, and Steve decides to hedge his position using futures.Assume that he can enter futures contracts at the settlement price.

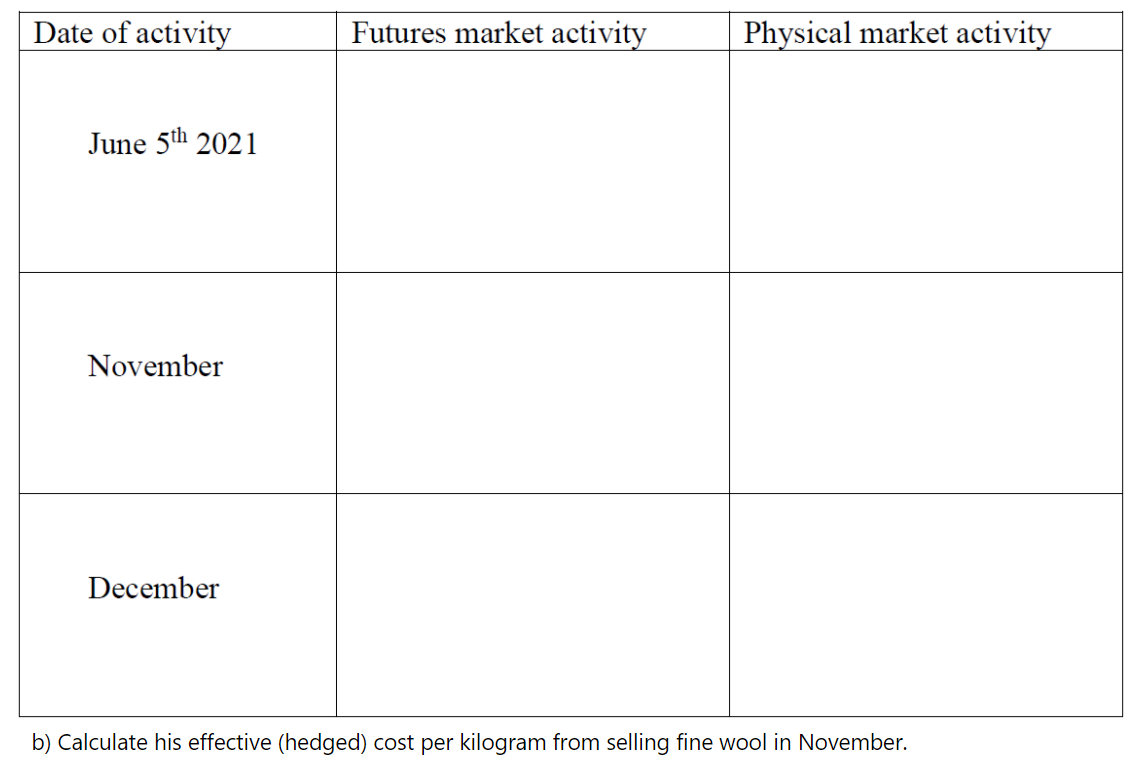

a)Use the grid below to clearly specify:

i)the action he should take today,

ii)the action he should take in November if spot and December futures prices are $16.00 and $16.20 respectively,

[Fine wool contract size is 2500 kg.]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started