Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Steven has deposited $6,646 in 13.0% p.a. simple interest rate for 4 months. How much is his outstanding balance at the end of 4

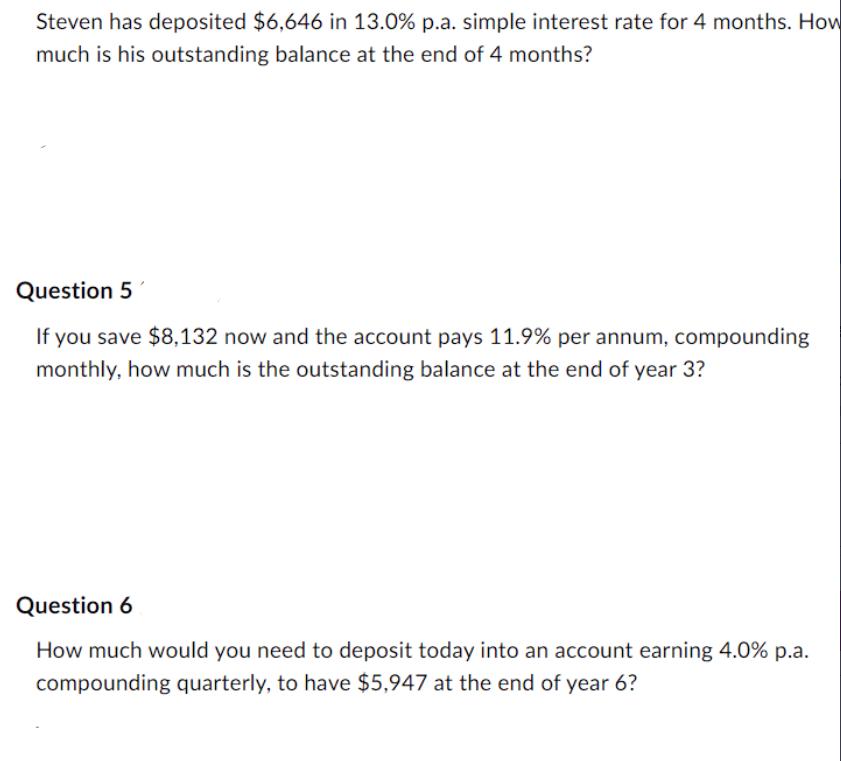

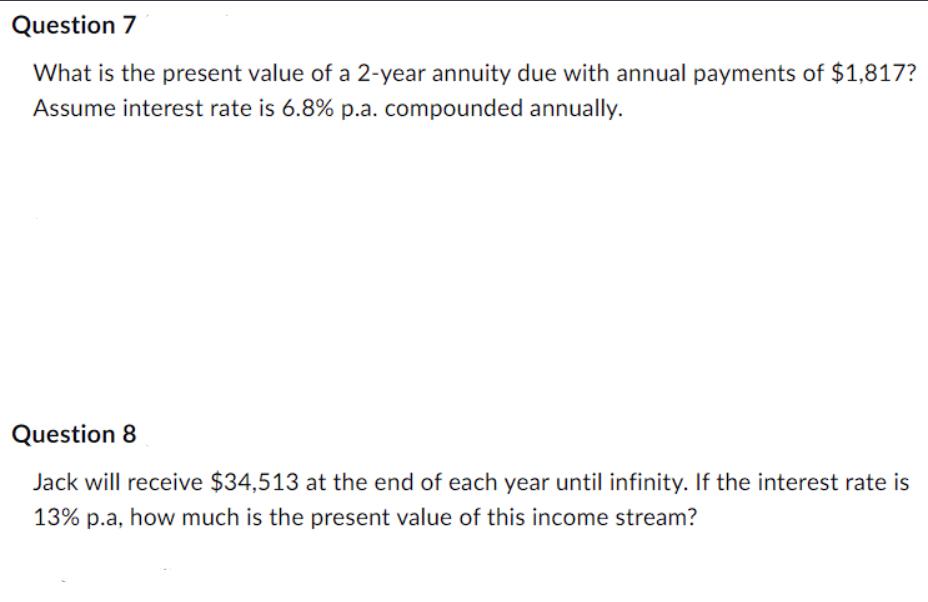

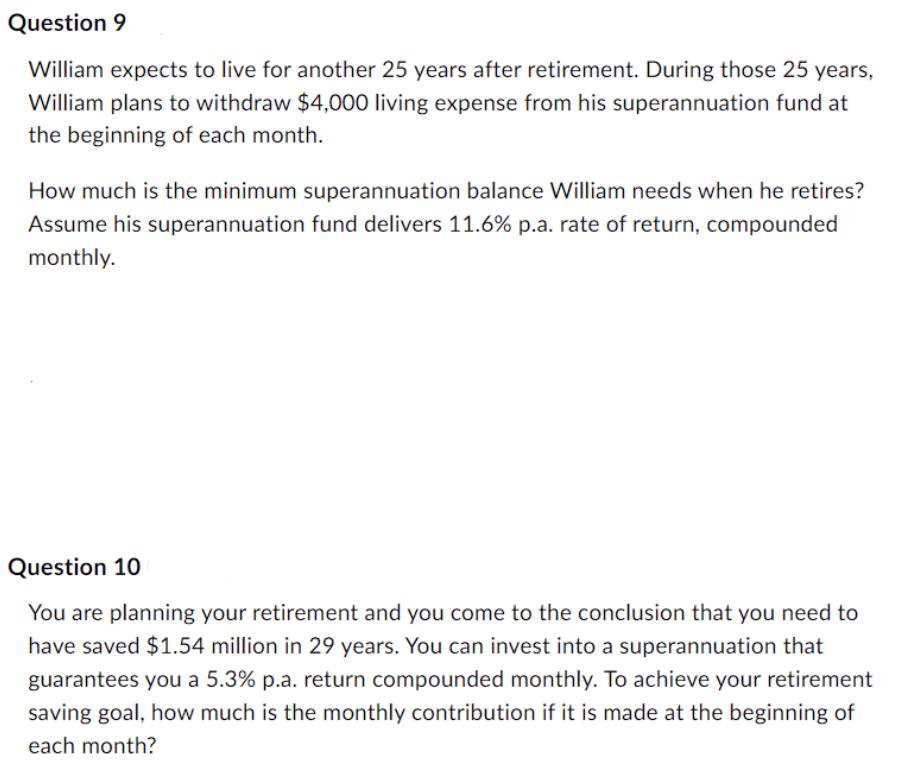

Steven has deposited $6,646 in 13.0% p.a. simple interest rate for 4 months. How much is his outstanding balance at the end of 4 months? Question 5 If you save $8,132 now and the account pays 11.9% per annum, compounding monthly, how much is the outstanding balance at the end of year 3? Question 6 How much would you need to deposit today into an account earning 4.0% p.a. compounding quarterly, to have $5,947 at the end of year 6? Question 7 What is the present value of a 2-year annuity due with annual payments of $1,817? Assume interest rate is 6.8% p.a. compounded annually. Question 8 Jack will receive $34,513 at the end of each year until infinity. If the interest rate is 13% p.a, how much is the present value of this income stream? Question 9 William expects to live for another 25 years after retirement. During those 25 years, William plans to withdraw $4,000 living expense from his superannuation fund at the beginning of each month. How much is the minimum superannuation balance William needs when he retires? Assume his superannuation fund delivers 11.6% p.a. rate of return, compounded monthly. Question 10 You are planning your retirement and you come to the conclusion that you need to have saved $1.54 million in 29 years. You can invest into a superannuation that guarantees you a 5.3% p.a. return compounded monthly. To achieve your retirement saving goal, how much is the monthly contribution if it is made at the beginning of each month?

Step by Step Solution

★★★★★

3.49 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION Question 4 Using the formula for simple interest we have Interest Principal x Rate x Time where Principal is the initial deposit Rate is the interest rate per year and Time is the time period ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started