Question: Steven is considering allocating his funds between the Risky Portfolio of Stocks and the risk-free T-bills. The Risky Portfolio of Stocks has the following

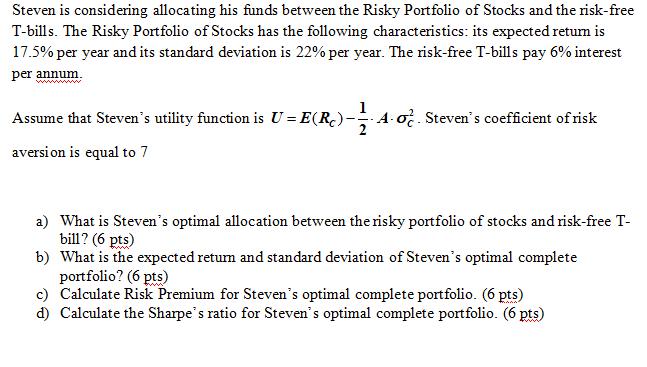

Steven is considering allocating his funds between the Risky Portfolio of Stocks and the risk-free T-bills. The Risky Portfolio of Stocks has the following characteristics: its expected return is 17.5% per year and its standard deviation is 22% per year. The risk-free T-bills pay 6% interest per annum Assume that Steven's utility function is U = E(Rc)-A o Steven's coefficient of risk aversi on is equal to 7 a) What is Steven's optimal allocation between the risky portfolio of stocks and risk-free T- bill? (6 pts) b) What is the expected retum and standard deviation of Steven's optimal complete portfolio? (6 pts) c) Calculate Risk Premium for Steven's optimal complete portfolio. (6 pts) d) Calculate the Sharpe's ratio for Steven's optimal complete portfolio. (6 pts)

Step by Step Solution

3.30 Rating (153 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts