Question: X Corporation, which uses a normal job costing system and dispose the over/under applied manufacturing overhead using write-off method, had two jobs in process

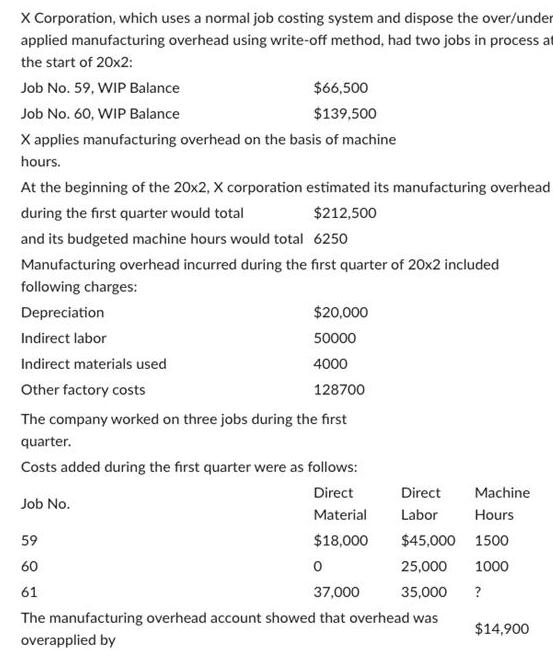

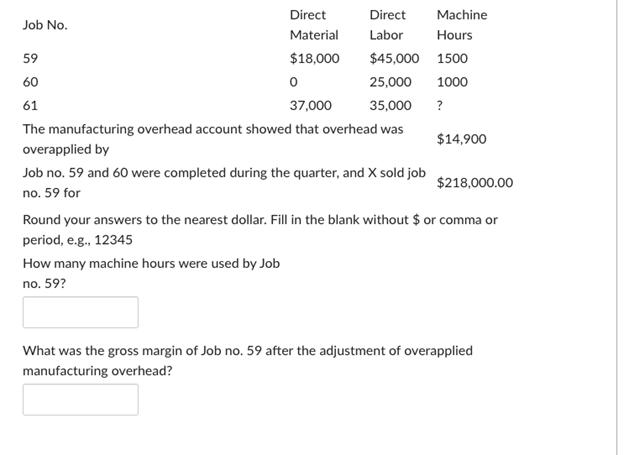

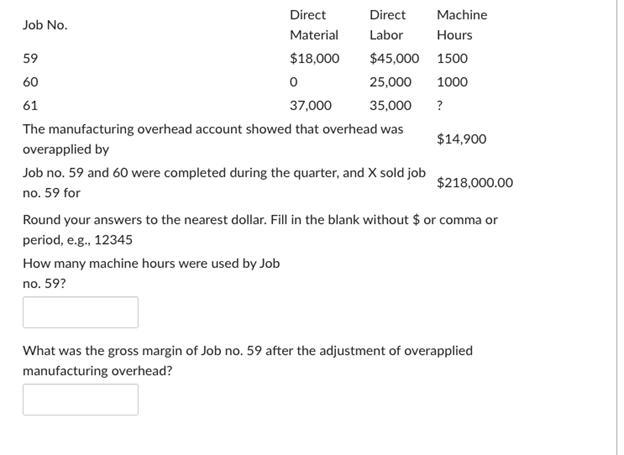

X Corporation, which uses a normal job costing system and dispose the over/under applied manufacturing overhead using write-off method, had two jobs in process at the start of 20x2: Job No. 59, WIP Balance $66,500 Job No. 60, WIP Balance $139,500 X applies manufacturing overhead on the basis of machine hours. At the beginning of the 20x2, X corporation estimated its manufacturing overhead during the first quarter would total $212,500 and its budgeted machine hours would total 6250 Manufacturing overhead incurred during the first quarter of 20x2 included following charges: Depreciation $20,000 Indirect labor 50000 Indirect materials used 4000 Other factory costs 128700 The company worked on three jobs during the first quarter. Costs added during the first quarter were as follows: Direct Direct Machine Job No. Material Labor Hours 59 $18,000 $45,000 1500 60 25,000 1000 61 37,000 35,000 ? The manufacturing overhead account showed that overhead was $14,900 overapplied by Direct Direct Machine Job No. Material Labor Hours 59 $18,000 $45,000 1500 60 25,000 1000 61 37,000 35,000 ? The manufacturing overhead account showed that overhead was $14,900 overapplied by Job no. 59 and 60 were completed during the quarter, and X sold job $218,000.00 no. 59 for Round your answers to the nearest dollar. Fill in the blank without $ or comma or period, e.g., 12345 How many machine hours were used by Job no. 59? What was the gross margin of Job no. 59 after the adjustment of overapplied manufacturing overhead? Direct Direct Machine Job No. Material Labor Hours 59 $18,000 $45,000 1500 60 25,000 1000 61 37,000 35,000 ? The manufacturing overhead account showed that overhead was $14,900 overapplied by Job no. 59 and 60 were completed during the quarter, and X sold job $218,000.00 no. 59 for Round your answers to the nearest dollar. Fill in the blank without $ or comma or period, e.g., 12345 How many machine hours were used by Job no. 59? What was the gross margin of Job no. 59 after the adjustment of overapplied manufacturing overhead?

Step by Step Solution

3.35 Rating (164 Votes )

There are 3 Steps involved in it

Answer Note How many machine hours were used by Job No 59 Machine hours used by Job No 59 is given in the question ... View full answer

Get step-by-step solutions from verified subject matter experts