Answered step by step

Verified Expert Solution

Question

1 Approved Answer

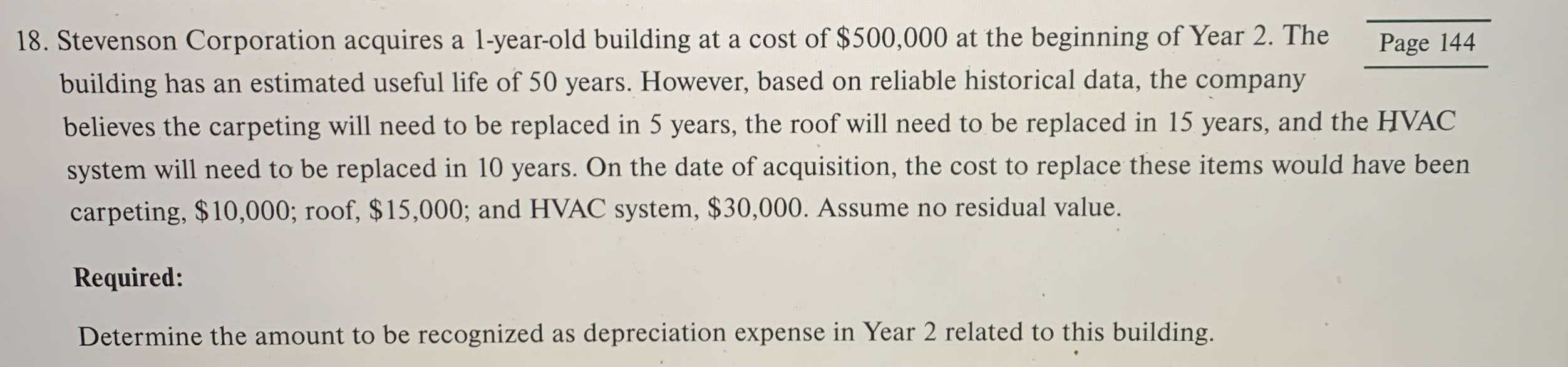

Stevenson Corporation acquires a 1 - year - old building at a cost of $ 5 0 0 , 0 0 0 at the beginning

Stevenson Corporation acquires a yearold building at a cost of $ at the beginning of Year The

Page

building has an estimated useful life of years. However, based on reliable historical data, the company believes the carpeting will need to be replaced in years, the roof will need to be replaced in years, and the HVAC system will need to be replaced in years. On the date of acquisition, the cost to replace these items would have been carpeting, $; roof, $; and HVAC system, $ Assume no residual value.

Required:

Determine the amount to be recognized as depreciation expense in Year related to this building.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started