Answered step by step

Verified Expert Solution

Question

1 Approved Answer

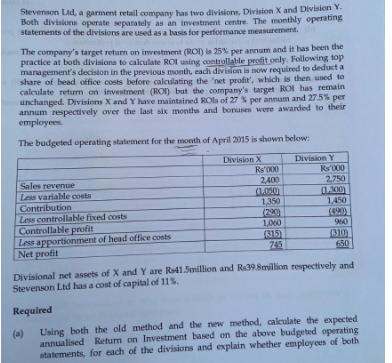

Stevenson Lad, a garment retail company has two divisions, Division X and Division Y. Both divisions operate separately as an investment centre. The monthly

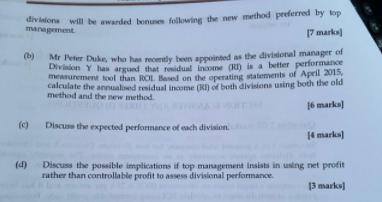

Stevenson Lad, a garment retail company has two divisions, Division X and Division Y. Both divisions operate separately as an investment centre. The monthly operating statements of the divisions are used as a basis for performance measurement. The company's target return on investment (ROI) is 25% per annum and it has been the practice at both divisiona to calculate ROI using controllable profit only. Following top management's decision in the previous month, each division is now required to deduct a share of head office costs before caleulating the 'net profit, which is then uned to calculate returm on investment (RO) but the company's target ROI has remain unchanged. Divisions Xand Y have maintained ROls of 27% per annum and 27.5% per annum respectively over the last six monthe and bonusen were awarded to their employees The budgeted operating statement for the month of April 2015 is shown below: Division X Rs'O00 2400 Division Y Rs000 Sales revenue Les varialle costs Contribution Less controllable fixed costs Controllable profit Less apportionment of head office costs Net profit 1,350 (290) 1000 (315) 745 2.750 L200) 1,450 (490) 960 (310) 650 Divisional net assets of X and Y are Ro41.Smillion and R398million respectively and Stevenson Ltd has a cost of capital of 115. Required Using both the old method and the new method, caleulate the expected (a) annualised Return on Investment based on the above budgeted operating statements, for each of the divisions and explain whether employees of both ona will be awarded bonunn following the new method preferred by top management 7 marks Air Peer Duke, who has reomtly been appointed as the divisional manager of Divinon Y has argund that rosidual income (RI) is a better performance meurement tool than ROL Based on the operating statements of April 2015, calculate the annualied residual income (K) of both divisions using both the old (b) method and the new method 16 marka) Discuse the expected performance of each division. 4 marks) (d) Discuss the possible implications if top management Insists in using net profit rather than controllable profit to assess divisional performance. 13 marks)

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

A Calculation of Return on Investment Under Old Method Division X Return on Investment Controllable ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started