Answered step by step

Verified Expert Solution

Question

1 Approved Answer

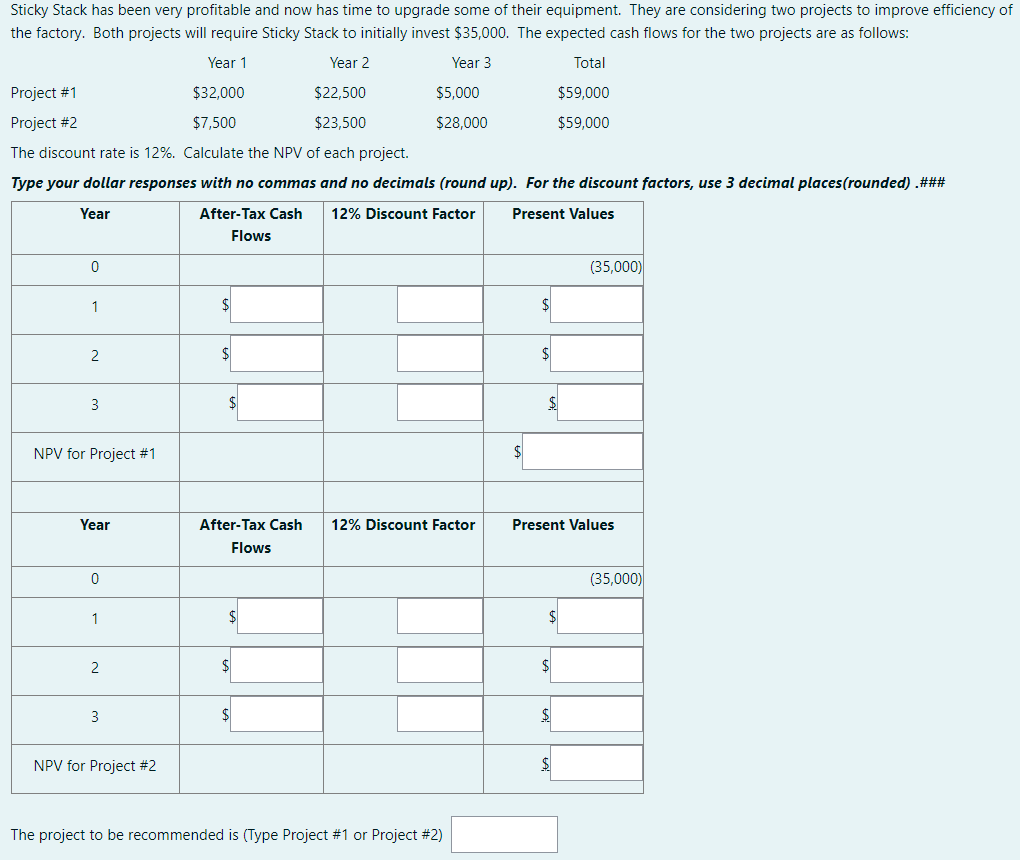

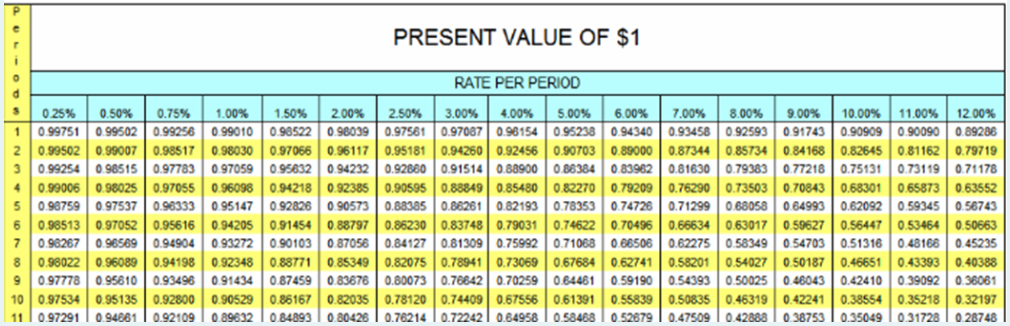

Sticky Stack has been very profitable and now has time to upgrade some of their equipment. They are considering two projects to improve efficiency o

Sticky Stack has been very profitable and now has time to upgrade some of their equipment. They are considering two projects to improve efficiency o the factory. Both projects will require Sticky Stack to initially invest $35,000. The expected cash flows for the two projects are as follows: The discount rate is 12%. Calculate the NPV of each project. Type your dollar responses with no commas and no decimals (round up). For the discount factors, use 3 decimal places(rounded).\#\#\# The project to be recommended is (Type Project \#1 or Project \#2) \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline e & & & & & & & & E & V & = & & & & & & & \\ \hline d & & & & & & & & RATE & DER PE & RIOD & & & & & & & \\ \hline 3 & 0.25% & 0.50% & 0.75% & 1.00% & 1.50% & 200% & 2.50% & 3.00% & 4.00% & 5.00% & 6.00% & 7.00% & 8.00% & 9.00% & 10.00% & 11.00% & 1200% \\ \hline 1 & 0.99751 & 0.99502 & 0.99256 & 0.99010 & 0.90522 & 0.98039 & 0.97561 & 0.97067 & 0.96154 & 0.95238 & 0.94340 & 0.93458 & 0.92593 & 0.91743 & 0.90909 & 0.90090 & 0.89286 \\ \hline 2 & 0.99502 & 0.99007 & 0.98517 & 0.98030 & 0.97066 & 0.96117 & 0.95181 & 0.94260 & 0.92456 & 0.90703 & 0.89000 & 0.87344 & 0.85734 & 0.84168 & 0.82645 & 0.81162 & 0.79719 \\ \hline 3 & 0.99254 & 0.98515 & 0.97783 & 0.97059 & 0.95632 & 0.94232 & 0.92860 & 0.91514 & 0.88900 & 0.86384 & 0.83962 & 0.81630 & 0.79363 & 0.77218 & 0.75131 & 0.73119 & 0.71178 \\ \hline 4 & 0.99006 & 0.98025 & 0.97055 & 0.96098 & 0.94218 & 0.92385 & 0.90595 & 0.88%9 & 0.85480 & 0.82270 & 0.79209 & 0.76290 & 0.73503 & 0.70843 & 0.68301 & 0.65873 & 0.63552 \\ \hline 5 & 0.96759 & 0.97537 & 0.96333 & 0.95147 & 0.92828 & 0.90573 & 0.88305 & 0.86261 & 0.82193 & 0.76353 & 0.74726 & 0.71299 & 0.68058 & 0.64993 & 0.62092 & 0.59345 & 0.5674 \\ \hline 6 & 0.98513 & 0.97052 & 0.95616 & 0.94205 & 0.91454 & 0.88797 & 0.86230 & 0.83748 & 0.79031 & 0.74622 & 0.70496 & 0.66634 & 0.63017 & 0.59627 & 0.56447 & 0.53464 & 0.50663 \\ \hline 7 & 0.96267 & 0.96569 & 0.94904 & 0.93272 & 0.90103 & 0.87058 & 0.84127 & 0.81309 & 0.75992 & 0.71068 & 0.06506 & 0.62275 & 0.58349 & 0.54703 & 0.51316 & 0.48168 & 0.45235 \\ \hline 8 & 0.98022 & 0.96089 & 0.94198 & 0.92348 & 0.88771 & 0.85349 & 0.82075 & 0.78941 & 0.73069 & 0.67684 & 0.62741 & 0.58201 & 0.54027 & 0.50187 & 0.46651 & 0.43393 & 0.4038: \\ \hline 9 & 0.97778 & 0.95610 & 0.93496 & 0.91434 & 0.87459 & 0.83676 & 0.80073 & 0.76042 & 0.70259 & 0.84461 & 0.59190 & 0.54393 & 0.50025 & 0.46043 & 0.42410 & 0.39092 & 0.3606 \\ \hline 10 & 0.97534 & 0.95135 & 0.92800 & 0.90529 & 0.80167 & & & & 0.67556 & & & 0.50835 & 0.46319 & 0.42241 & 0.38554 & 0.35218 & 0.32197 \\ \hline 11 & 0.97291 & 0.94861 & 0.92109 & 0.89632 & 0.84893 & 0.80426 & 0.76214 & 0.72242 & 0.64958 & 0.58468 & 0.52679 & 0.47509 & 0.42888 & 038753 & 0.35049 & 0.31726 & 0.2874 \\ \hline \end{tabular} Sticky Stack has been very profitable and now has time to upgrade some of their equipment. They are considering two projects to improve efficiency o the factory. Both projects will require Sticky Stack to initially invest $35,000. The expected cash flows for the two projects are as follows: The discount rate is 12%. Calculate the NPV of each project. Type your dollar responses with no commas and no decimals (round up). For the discount factors, use 3 decimal places(rounded).\#\#\# The project to be recommended is (Type Project \#1 or Project \#2) \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline e & & & & & & & & E & V & = & & & & & & & \\ \hline d & & & & & & & & RATE & DER PE & RIOD & & & & & & & \\ \hline 3 & 0.25% & 0.50% & 0.75% & 1.00% & 1.50% & 200% & 2.50% & 3.00% & 4.00% & 5.00% & 6.00% & 7.00% & 8.00% & 9.00% & 10.00% & 11.00% & 1200% \\ \hline 1 & 0.99751 & 0.99502 & 0.99256 & 0.99010 & 0.90522 & 0.98039 & 0.97561 & 0.97067 & 0.96154 & 0.95238 & 0.94340 & 0.93458 & 0.92593 & 0.91743 & 0.90909 & 0.90090 & 0.89286 \\ \hline 2 & 0.99502 & 0.99007 & 0.98517 & 0.98030 & 0.97066 & 0.96117 & 0.95181 & 0.94260 & 0.92456 & 0.90703 & 0.89000 & 0.87344 & 0.85734 & 0.84168 & 0.82645 & 0.81162 & 0.79719 \\ \hline 3 & 0.99254 & 0.98515 & 0.97783 & 0.97059 & 0.95632 & 0.94232 & 0.92860 & 0.91514 & 0.88900 & 0.86384 & 0.83962 & 0.81630 & 0.79363 & 0.77218 & 0.75131 & 0.73119 & 0.71178 \\ \hline 4 & 0.99006 & 0.98025 & 0.97055 & 0.96098 & 0.94218 & 0.92385 & 0.90595 & 0.88%9 & 0.85480 & 0.82270 & 0.79209 & 0.76290 & 0.73503 & 0.70843 & 0.68301 & 0.65873 & 0.63552 \\ \hline 5 & 0.96759 & 0.97537 & 0.96333 & 0.95147 & 0.92828 & 0.90573 & 0.88305 & 0.86261 & 0.82193 & 0.76353 & 0.74726 & 0.71299 & 0.68058 & 0.64993 & 0.62092 & 0.59345 & 0.5674 \\ \hline 6 & 0.98513 & 0.97052 & 0.95616 & 0.94205 & 0.91454 & 0.88797 & 0.86230 & 0.83748 & 0.79031 & 0.74622 & 0.70496 & 0.66634 & 0.63017 & 0.59627 & 0.56447 & 0.53464 & 0.50663 \\ \hline 7 & 0.96267 & 0.96569 & 0.94904 & 0.93272 & 0.90103 & 0.87058 & 0.84127 & 0.81309 & 0.75992 & 0.71068 & 0.06506 & 0.62275 & 0.58349 & 0.54703 & 0.51316 & 0.48168 & 0.45235 \\ \hline 8 & 0.98022 & 0.96089 & 0.94198 & 0.92348 & 0.88771 & 0.85349 & 0.82075 & 0.78941 & 0.73069 & 0.67684 & 0.62741 & 0.58201 & 0.54027 & 0.50187 & 0.46651 & 0.43393 & 0.4038: \\ \hline 9 & 0.97778 & 0.95610 & 0.93496 & 0.91434 & 0.87459 & 0.83676 & 0.80073 & 0.76042 & 0.70259 & 0.84461 & 0.59190 & 0.54393 & 0.50025 & 0.46043 & 0.42410 & 0.39092 & 0.3606 \\ \hline 10 & 0.97534 & 0.95135 & 0.92800 & 0.90529 & 0.80167 & & & & 0.67556 & & & 0.50835 & 0.46319 & 0.42241 & 0.38554 & 0.35218 & 0.32197 \\ \hline 11 & 0.97291 & 0.94861 & 0.92109 & 0.89632 & 0.84893 & 0.80426 & 0.76214 & 0.72242 & 0.64958 & 0.58468 & 0.52679 & 0.47509 & 0.42888 & 038753 & 0.35049 & 0.31726 & 0.2874 \\ \hline \end{tabular}

Sticky Stack has been very profitable and now has time to upgrade some of their equipment. They are considering two projects to improve efficiency o the factory. Both projects will require Sticky Stack to initially invest $35,000. The expected cash flows for the two projects are as follows: The discount rate is 12%. Calculate the NPV of each project. Type your dollar responses with no commas and no decimals (round up). For the discount factors, use 3 decimal places(rounded).\#\#\# The project to be recommended is (Type Project \#1 or Project \#2) \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline e & & & & & & & & E & V & = & & & & & & & \\ \hline d & & & & & & & & RATE & DER PE & RIOD & & & & & & & \\ \hline 3 & 0.25% & 0.50% & 0.75% & 1.00% & 1.50% & 200% & 2.50% & 3.00% & 4.00% & 5.00% & 6.00% & 7.00% & 8.00% & 9.00% & 10.00% & 11.00% & 1200% \\ \hline 1 & 0.99751 & 0.99502 & 0.99256 & 0.99010 & 0.90522 & 0.98039 & 0.97561 & 0.97067 & 0.96154 & 0.95238 & 0.94340 & 0.93458 & 0.92593 & 0.91743 & 0.90909 & 0.90090 & 0.89286 \\ \hline 2 & 0.99502 & 0.99007 & 0.98517 & 0.98030 & 0.97066 & 0.96117 & 0.95181 & 0.94260 & 0.92456 & 0.90703 & 0.89000 & 0.87344 & 0.85734 & 0.84168 & 0.82645 & 0.81162 & 0.79719 \\ \hline 3 & 0.99254 & 0.98515 & 0.97783 & 0.97059 & 0.95632 & 0.94232 & 0.92860 & 0.91514 & 0.88900 & 0.86384 & 0.83962 & 0.81630 & 0.79363 & 0.77218 & 0.75131 & 0.73119 & 0.71178 \\ \hline 4 & 0.99006 & 0.98025 & 0.97055 & 0.96098 & 0.94218 & 0.92385 & 0.90595 & 0.88%9 & 0.85480 & 0.82270 & 0.79209 & 0.76290 & 0.73503 & 0.70843 & 0.68301 & 0.65873 & 0.63552 \\ \hline 5 & 0.96759 & 0.97537 & 0.96333 & 0.95147 & 0.92828 & 0.90573 & 0.88305 & 0.86261 & 0.82193 & 0.76353 & 0.74726 & 0.71299 & 0.68058 & 0.64993 & 0.62092 & 0.59345 & 0.5674 \\ \hline 6 & 0.98513 & 0.97052 & 0.95616 & 0.94205 & 0.91454 & 0.88797 & 0.86230 & 0.83748 & 0.79031 & 0.74622 & 0.70496 & 0.66634 & 0.63017 & 0.59627 & 0.56447 & 0.53464 & 0.50663 \\ \hline 7 & 0.96267 & 0.96569 & 0.94904 & 0.93272 & 0.90103 & 0.87058 & 0.84127 & 0.81309 & 0.75992 & 0.71068 & 0.06506 & 0.62275 & 0.58349 & 0.54703 & 0.51316 & 0.48168 & 0.45235 \\ \hline 8 & 0.98022 & 0.96089 & 0.94198 & 0.92348 & 0.88771 & 0.85349 & 0.82075 & 0.78941 & 0.73069 & 0.67684 & 0.62741 & 0.58201 & 0.54027 & 0.50187 & 0.46651 & 0.43393 & 0.4038: \\ \hline 9 & 0.97778 & 0.95610 & 0.93496 & 0.91434 & 0.87459 & 0.83676 & 0.80073 & 0.76042 & 0.70259 & 0.84461 & 0.59190 & 0.54393 & 0.50025 & 0.46043 & 0.42410 & 0.39092 & 0.3606 \\ \hline 10 & 0.97534 & 0.95135 & 0.92800 & 0.90529 & 0.80167 & & & & 0.67556 & & & 0.50835 & 0.46319 & 0.42241 & 0.38554 & 0.35218 & 0.32197 \\ \hline 11 & 0.97291 & 0.94861 & 0.92109 & 0.89632 & 0.84893 & 0.80426 & 0.76214 & 0.72242 & 0.64958 & 0.58468 & 0.52679 & 0.47509 & 0.42888 & 038753 & 0.35049 & 0.31726 & 0.2874 \\ \hline \end{tabular} Sticky Stack has been very profitable and now has time to upgrade some of their equipment. They are considering two projects to improve efficiency o the factory. Both projects will require Sticky Stack to initially invest $35,000. The expected cash flows for the two projects are as follows: The discount rate is 12%. Calculate the NPV of each project. Type your dollar responses with no commas and no decimals (round up). For the discount factors, use 3 decimal places(rounded).\#\#\# The project to be recommended is (Type Project \#1 or Project \#2) \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline e & & & & & & & & E & V & = & & & & & & & \\ \hline d & & & & & & & & RATE & DER PE & RIOD & & & & & & & \\ \hline 3 & 0.25% & 0.50% & 0.75% & 1.00% & 1.50% & 200% & 2.50% & 3.00% & 4.00% & 5.00% & 6.00% & 7.00% & 8.00% & 9.00% & 10.00% & 11.00% & 1200% \\ \hline 1 & 0.99751 & 0.99502 & 0.99256 & 0.99010 & 0.90522 & 0.98039 & 0.97561 & 0.97067 & 0.96154 & 0.95238 & 0.94340 & 0.93458 & 0.92593 & 0.91743 & 0.90909 & 0.90090 & 0.89286 \\ \hline 2 & 0.99502 & 0.99007 & 0.98517 & 0.98030 & 0.97066 & 0.96117 & 0.95181 & 0.94260 & 0.92456 & 0.90703 & 0.89000 & 0.87344 & 0.85734 & 0.84168 & 0.82645 & 0.81162 & 0.79719 \\ \hline 3 & 0.99254 & 0.98515 & 0.97783 & 0.97059 & 0.95632 & 0.94232 & 0.92860 & 0.91514 & 0.88900 & 0.86384 & 0.83962 & 0.81630 & 0.79363 & 0.77218 & 0.75131 & 0.73119 & 0.71178 \\ \hline 4 & 0.99006 & 0.98025 & 0.97055 & 0.96098 & 0.94218 & 0.92385 & 0.90595 & 0.88%9 & 0.85480 & 0.82270 & 0.79209 & 0.76290 & 0.73503 & 0.70843 & 0.68301 & 0.65873 & 0.63552 \\ \hline 5 & 0.96759 & 0.97537 & 0.96333 & 0.95147 & 0.92828 & 0.90573 & 0.88305 & 0.86261 & 0.82193 & 0.76353 & 0.74726 & 0.71299 & 0.68058 & 0.64993 & 0.62092 & 0.59345 & 0.5674 \\ \hline 6 & 0.98513 & 0.97052 & 0.95616 & 0.94205 & 0.91454 & 0.88797 & 0.86230 & 0.83748 & 0.79031 & 0.74622 & 0.70496 & 0.66634 & 0.63017 & 0.59627 & 0.56447 & 0.53464 & 0.50663 \\ \hline 7 & 0.96267 & 0.96569 & 0.94904 & 0.93272 & 0.90103 & 0.87058 & 0.84127 & 0.81309 & 0.75992 & 0.71068 & 0.06506 & 0.62275 & 0.58349 & 0.54703 & 0.51316 & 0.48168 & 0.45235 \\ \hline 8 & 0.98022 & 0.96089 & 0.94198 & 0.92348 & 0.88771 & 0.85349 & 0.82075 & 0.78941 & 0.73069 & 0.67684 & 0.62741 & 0.58201 & 0.54027 & 0.50187 & 0.46651 & 0.43393 & 0.4038: \\ \hline 9 & 0.97778 & 0.95610 & 0.93496 & 0.91434 & 0.87459 & 0.83676 & 0.80073 & 0.76042 & 0.70259 & 0.84461 & 0.59190 & 0.54393 & 0.50025 & 0.46043 & 0.42410 & 0.39092 & 0.3606 \\ \hline 10 & 0.97534 & 0.95135 & 0.92800 & 0.90529 & 0.80167 & & & & 0.67556 & & & 0.50835 & 0.46319 & 0.42241 & 0.38554 & 0.35218 & 0.32197 \\ \hline 11 & 0.97291 & 0.94861 & 0.92109 & 0.89632 & 0.84893 & 0.80426 & 0.76214 & 0.72242 & 0.64958 & 0.58468 & 0.52679 & 0.47509 & 0.42888 & 038753 & 0.35049 & 0.31726 & 0.2874 \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started