Sticky Stack has been very profitable and now has time to upgrade some of their equipment. They are considering two projects to improve efficiency

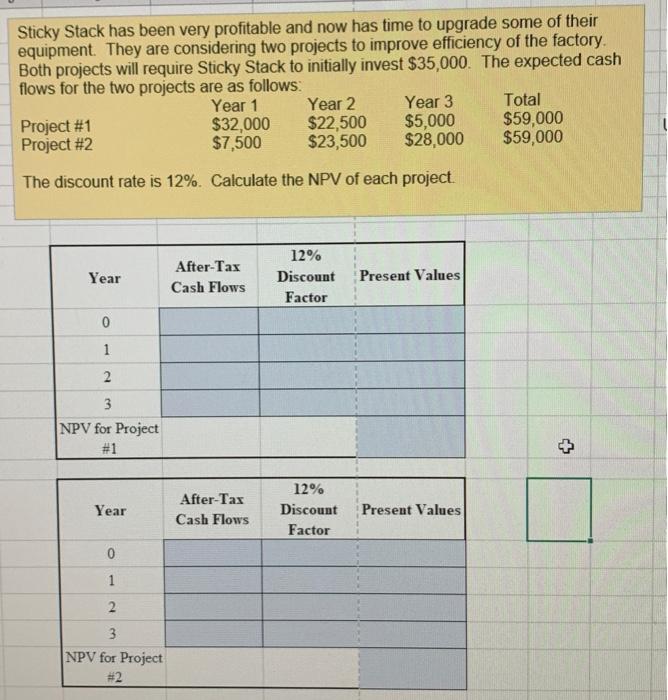

Sticky Stack has been very profitable and now has time to upgrade some of their equipment. They are considering two projects to improve efficiency of the factory. Both projects will require Sticky Stack to initially invest $35,000. The expected cash flows for the two projects are as follows: Year 1 Year $32,000 Project #1 Project #2 $7,500 The discount rate is 12%. Calculate the NPV of each project. 0 1 2 3 NPV for Project #1 Year 0 1 2 3 NPV for Project # 2 After-Tax Cash Flows Year 2 $22,500 $23,500 After-Tax Cash Flows Year 3 $5,000 $28,000 12% Discount Present Values Factor 12% Discount Factor Present Values Total $59,000 $59,000

Step by Step Solution

3.49 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Project 1 NPV 32000 2250...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started