Refer to the data in A5-6. Data from A5-6 The financial statements for Linked Ltd. are shown

Question:

Refer to the data in A5-6.

Data from A5-6

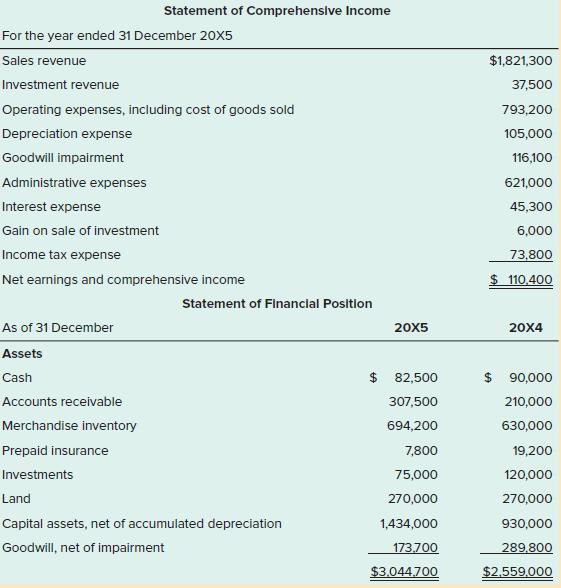

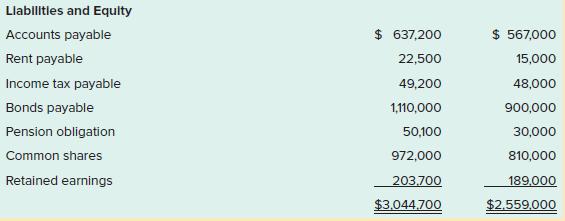

The financial statements for Linked Ltd. are shown below:

During the year, the company purchased a capital asset valued at $30,000; payment was made by issuing common shares. Additional capital assets were acquired for cash. Changes in other accounts were typical transactions.

Required:

Prepare the complete SCF, in good form, using the direct method in the operating activities section. Include required note disclosure of non-cash transactions. Omit the separate disclosure of cash flow for interest, investment income, and income tax.

Statement of Comprehenslve Income For the year ended 31 December 20X5 Sales revenue $1,821,300 Investment revenue 37,500 Operating expenses, including cost of goods sold 793,200 Depreciation expense 105,000 Goodwill impairment 116,100 Administrative expenses 621,000 Interest expense 45,300 Gain on sale of investment 6,000 Income tax expense 73,800 Net earnings and comprehensive income $ 110.400 Statement of Financlal Position As of 31 December 20X5 20X4 Assets $ 82,500 $ 90,000 Cash Accounts receivable 307,500 210,000 Merchandise inventory 694,200 630,000 Prepaid insurance 7,800 19,200 Investments 75,000 120,000 Land 270,000 270,000 Capital assets, net of accumulated depreciation 1,434,000 930,000 Goodwill, net of impairment 173,700 289,800 $3.044.700 $2,559,000

Step by Step Answer:

Linked Limited Statement of Cash Flows Year ended 31 December 20x5 Operating activities Cash from cu...View the full answer

Intermediate Accounting Volume 1

ISBN: 9781260306743

7th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod Dick

Related Video

Depreciation of non-current assets is the process of allocating the cost of the asset over its useful life. The cost of the asset includes the purchase price, any additional costs incurred to bring the asset to its current condition and location, and any other costs that are directly attributable to the asset. The useful life of the asset is the period over which the asset is expected to be used by the company. To calculate the depreciation, companies use different methods such as straight-line, declining-balance, sum-of-the-years\'-digits, units-of-production, and group depreciation. The chosen method will depend on the type of asset, the company\'s accounting policies, and the accounting standards that are applicable. The straight-line method allocates an equal amount of the asset\'s cost over its useful life, while the declining-balance method calculates depreciation at a fixed rate, typically double the straight-line rate, but the amount of depreciation decreases over time. The sum-of-the-years\'-digits method is similar to the declining-balance method, but the rate of depreciation is calculated using a fraction that is based on the useful life of the asset. It\'s important to note that the depreciation expense will be recorded on the company\'s income statement and the accumulated depreciation will be recorded on the company\'s balance sheet. This will decrease the value of the asset on the balance sheet over time.

Students also viewed these Business questions

-

The financial statements for Linked Ltd. are shown below: During the year, the company purchased a capital asset valued at $30,000; payment was made by issuing common shares. Additional capital...

-

The financial statements for Fardy Limited are shown below: During the year, the company purchased a capital asset valued at $ 10,000; payment was made by issuing common shares. Additional capital...

-

Refer to the data in A5- 6. Required: Prepare the SCF, in good form, using the direct method in the operating activities section.

-

Listed below are the genders of the younger winner in the categories of Best Actor and Best Actress for recent and consecutive years. Do the genders of the younger winners appear to occur randomly? F...

-

A solution containing 50.0 mL of 0.100 M EDTA buffered to pH 10.00 was titrated with 50.0 mL of 0.020 0 M Hg(ClO 4 ) 2 in the cell shown in Exercise 14-B: S.C.E. 7 titration solution | Hg(l) From the...

-

As an employee, what does it mean to be told that the share of employees with higher degrees has gone up and line manager satisfaction rating has gone down?

-

Beyond simply increasing revenue, what advantages might a new business benefit from thanks to early international exposure and growth? L01

-

Lobster Trap Company is considering automating its manufacturing facility. Company information before and after the proposed automation follows: Required: 1. Calculate Lobster Traps break-even sales...

-

10. A laundry detergent manufacturer would most likely use: A) Process costing. B) Job-order costing. C) Hybrid costing. D) Batch-order costing

-

For two spin-1/2 particles you can construct symmetric and antisymmetric spin states (the triplet and singlet combinations, respectively). For three spin-1/2 parti- cles you can construct symmetric...

-

Grand Corp.s 20X2 financial statements showed the following: Additional information: During the year, equipment with an original cost of $82,000 was sold for cash. Required: 1. Prepare the SCF, in...

-

The following financial information is available for Chipmunk Inc. for the 20X3 fiscal year: Additional information: 1. Marketable securities were sold at their carrying value. The marketable...

-

Last year the Bulls Business Bureau (BBB) retained $400,000 of the $1 million net income it generated. This year BBB generated net income equal to $1.2 million. If BBB follows the constant dividend...

-

The following table contains the monthly operating costs of a company. Salary is not included. Determine the variance and standard deviation of the costs. Enero Febrero Marzo Abril Mayo Junio Julio...

-

Becker & Smith, CPAs, performs a financial statement review for BAM Markets ( BAM ) . Caroline, the manager on the job, learns that Don, a member of the review team, violated the independence rules....

-

Presented here are selected transactions for Sheridan Inc. during August of the current year. Sheridan uses a perpetual inventory system. It estimates a return rate of 10%, based on past experience....

-

. Complete both parts (a) and (b) below. ). In1 (a) Let X11, X12, ..., X be a random sample of size n from a population with mean and variance . Let X21, X22,..., X2n2 be a random sample of size n...

-

41. Let S be the cone z = x + y, z 2, oriented with outward unit normal. Use Stokes' theorem to evaluate the flux integral for the vector field SJ (V x F). ndS F(x, y, z) = (x y)i + 2zj + xk. -

-

The weekly time tickets indicate the following distribution of labor hours for three direct labor employees: The direct labor rate earned per hour by the three employees is as follows: Tom Couro...

-

Find the APR in each of the following cases: NUMBER OF TIMES COMPOUNDED Semiannually Monthly Weekly Infinite EAR APR 10.4% 8.9 11.6 15.4

-

On January 1, 2020, the accounting records of Sasseville Lte included a debit balance of $15 million in the building account and of $12 million in the related accumulated depreciation account. The...

-

On January 1, 2020, Algo Ltd. acquires a building at a cost of $230,000. The building is expected to have a 20-year life and no residual value. The asset is accounted for under the revaluation model,...

-

A partial statement of financial position of Bluewater Ltd. on December 31, 2019, showed the following property, plant, and equipment assets accounted for under the cost model (accumulated...

-

Berbice Inc. has a new project, and you were recruitment to perform their sensitivity analysis based on the estimates of done by their engineering department (there are no taxes): Pessimistic Most...

-

#3) Seven years ago, Crane Corporation issued 20-year bonds that had a $1,000 face value, paid interest annually, and had a coupon rate of 8 percent. If the market rate of interest is 4.0 percent...

-

I have a portfolio of two stocks. The weights are 60% and 40% respectively, the volatilities are both 20%, while the correlation of returns is 100%. The volatility of my portfolio is A. 4% B. 14.4%...

Study smarter with the SolutionInn App