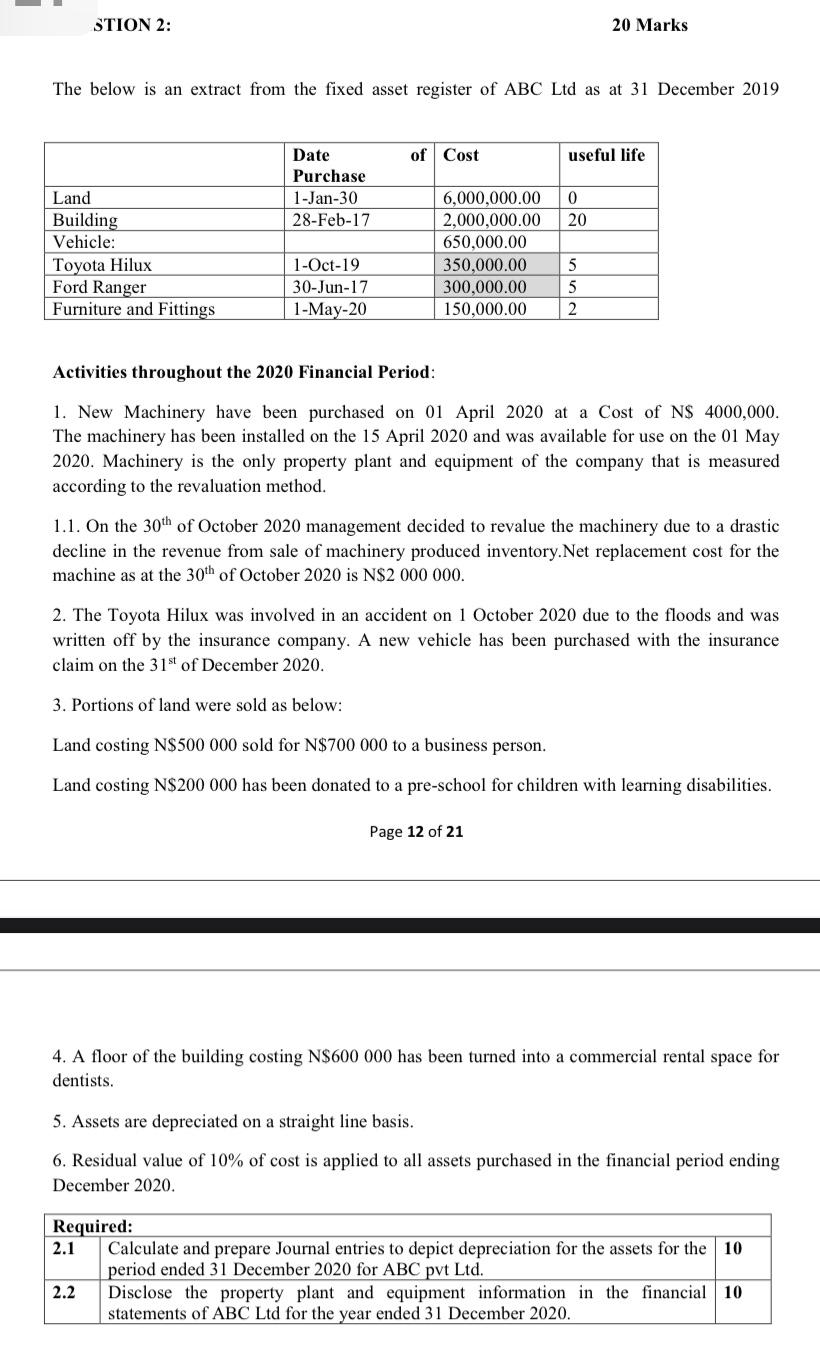

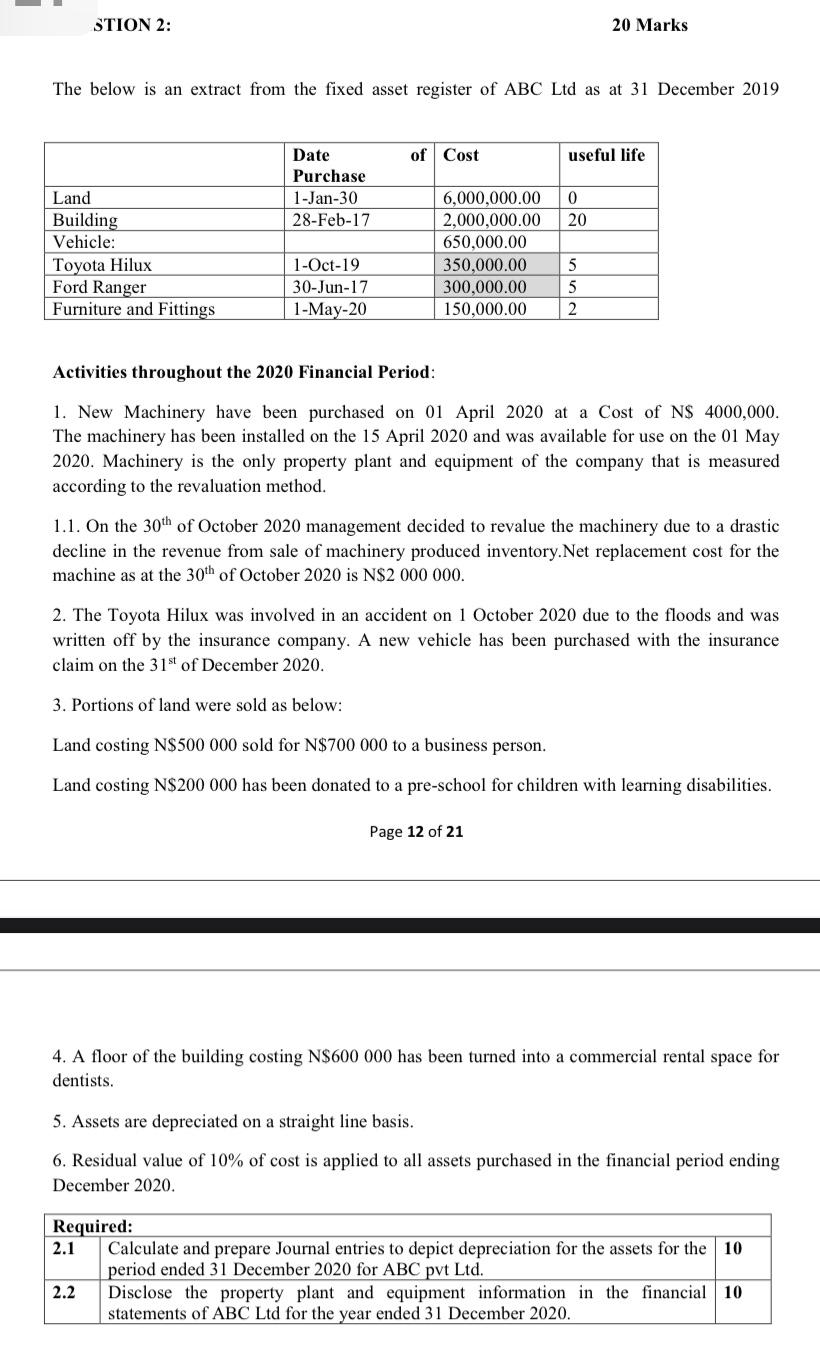

STION 2: 20 Marks The below is an extract from the fixed asset register of ABC Ltd as at 31 December 2019 of Cost useful life Date Purchase 1-Jan-30 28-Feb-17 0 20 Land Building Vehicle: Toyota Hilux Ford Ranger Furniture and Fittings 6,000,000.00 2,000,000.00 650,000.00 350,000.00 300,000.00 150,000.00 1-Oct-19 30-Jun-17 1-May-20 5 5 2 Activities throughout the 2020 Financial Period: 1. New Machinery have been purchased on 01 April 2020 at a cost of N$ 4000,000. The machinery has been installed on the 15 April 2020 and was available for use on the 01 May 2020. Machinery is the only property plant and equipment of the company that is measured according to the revaluation method. 1.1. On the 30th of October 2020 management decided to revalue the machinery due to a drastic decline in the revenue from sale of machinery produced inventory.Net replacement cost for the machine as at the 30th of October 2020 is N$2 000 000. 2. The Toyota Hilux was involved in an accident on 1 October 2020 due to the floods and was written off by the insurance company. A new vehicle has been purchased with the insurance claim on the 31st of December 2020. 3. Portions of land were sold as below: Land costing N$500 000 sold for N$700 000 to a business person. Land costing N$200 000 has been donated to a pre-school for children with learning disabilities. Page 12 of 21 4. A floor of the building costing N$600 000 has been turned into a commercial rental space for dentists. 5. Assets are depreciated on a straight line basis. 6. Residual value of 10% of cost is applied to all assets purchased in the financial period ending December 2020. Required: 2.1 Calculate and prepare Journal entries to depict depreciation for the assets for the 10 period ended 31 December 2020 for ABC pvt Ltd. 2.2 Disclose the property plant and equipment information in the financial 10 statements of ABC Ltd for the year ended 31 December 2020. STION 2: 20 Marks The below is an extract from the fixed asset register of ABC Ltd as at 31 December 2019 of Cost useful life Date Purchase 1-Jan-30 28-Feb-17 0 20 Land Building Vehicle: Toyota Hilux Ford Ranger Furniture and Fittings 6,000,000.00 2,000,000.00 650,000.00 350,000.00 300,000.00 150,000.00 1-Oct-19 30-Jun-17 1-May-20 5 5 2 Activities throughout the 2020 Financial Period: 1. New Machinery have been purchased on 01 April 2020 at a cost of N$ 4000,000. The machinery has been installed on the 15 April 2020 and was available for use on the 01 May 2020. Machinery is the only property plant and equipment of the company that is measured according to the revaluation method. 1.1. On the 30th of October 2020 management decided to revalue the machinery due to a drastic decline in the revenue from sale of machinery produced inventory.Net replacement cost for the machine as at the 30th of October 2020 is N$2 000 000. 2. The Toyota Hilux was involved in an accident on 1 October 2020 due to the floods and was written off by the insurance company. A new vehicle has been purchased with the insurance claim on the 31st of December 2020. 3. Portions of land were sold as below: Land costing N$500 000 sold for N$700 000 to a business person. Land costing N$200 000 has been donated to a pre-school for children with learning disabilities. Page 12 of 21 4. A floor of the building costing N$600 000 has been turned into a commercial rental space for dentists. 5. Assets are depreciated on a straight line basis. 6. Residual value of 10% of cost is applied to all assets purchased in the financial period ending December 2020. Required: 2.1 Calculate and prepare Journal entries to depict depreciation for the assets for the 10 period ended 31 December 2020 for ABC pvt Ltd. 2.2 Disclose the property plant and equipment information in the financial 10 statements of ABC Ltd for the year ended 31 December 2020