Question

Stip Inc.'s real assets are expected to generate earnings before interest and taxes (EBIT) of $102,000 at the end of every year in perpetuity.

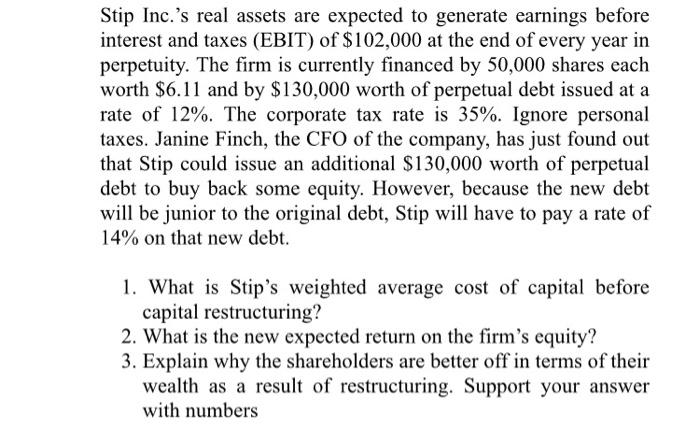

Stip Inc.'s real assets are expected to generate earnings before interest and taxes (EBIT) of $102,000 at the end of every year in perpetuity. The firm is currently financed by 50,000 shares each worth $6.11 and by $130,000 worth of perpetual debt issued at a rate of 12%. The corporate tax rate is 35%. Ignore personal taxes. Janine Finch, the CFO of the company, has just found out that Stip could issue an additional $130,000 worth of perpetual debt to buy back some equity. However, because the new debt will be junior to the original debt, Stip will have to pay a rate of 14% on that new debt. 1. What is Stip's weighted average cost of capital before capital restructuring? 2. What is the new expected return on the firm's equity? 3. Explain why the shareholders are better off in terms of their wealth as a result of restructuring. Support your answer with numbers

Step by Step Solution

3.26 Rating (129 Votes )

There are 3 Steps involved in it

Step: 1

1To calculate Stip Incs weighted average cost of capital WACC before capital restructuring we need to determine the cost of equity and the cost of deb...

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started