Answered step by step

Verified Expert Solution

Question

1 Approved Answer

stock 1 - HP Inc. (HPQ) Current Price -$ 30.00 Bought 6Months ago - $31.53 Stock 2 - Logitech International (LOGI) Current Price - $54.84

stock 1 - HP Inc. (HPQ)

Current Price -$ 30.00

Bought 6Months ago - $31.53

Stock 2 - Logitech International (LOGI)

Current Price - $54.84

Bought 6 months ago - 51.14

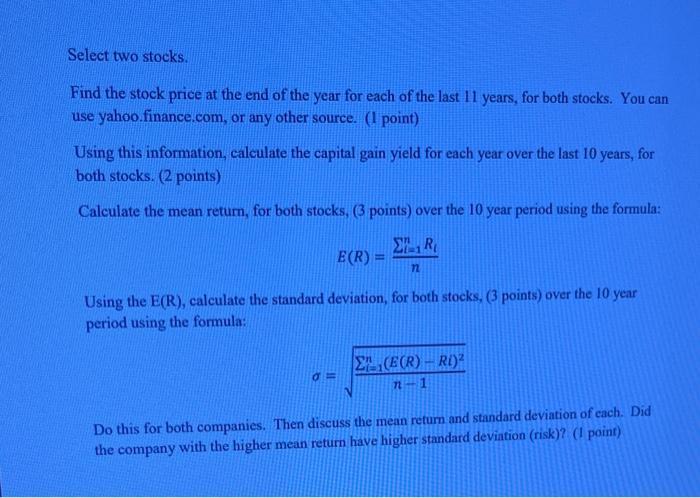

Select two stocks. Find the stock price at the end of the year for each of the last 11 years, for both stocks. You can use yahoo.finance.com, or any other source. (1 point) Using this information, calculate the capital gain yield for each year over the last 10 years, for both stocks. (2 points) Calculate the mean return, for both stocks, (3 points) over the 10 year period using the formula: 1 R 72 E(R)= Using the E(R), calculate the standard deviation, for both stocks, (3 points) over the 10 year period using the formula: d= (E(R)-RI) 7-1 Do this for both companies. Then discuss the mean return and standard deviation of each. Did the company with the higher mean return have higher standard deviation (risk)? (1 point)

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

To solve this problem well follow these steps 1 Find the stock price at the end of the year for each ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started